Nationwide Insurance Review 2026

A deep dive into Nationwide auto insurance

Get quotes from providers in your area

Questions? Call us: 844-966-4864

Nationwide has been offering car insurance to Americans for nearly 100 years. It serves millions of customers and is the nation’s 13th-largest auto insurance provider.1

Drivers with bad credit, low-mileage drivers, and people with good driving habits may save more with Nationwide than they would with other providers. And if you value working directly with an agent and being able to speak with another human about your insurance needs, Nationwide’s free insurance assessments may appeal to you.

Nationwide is a large provider, offering all the standard coverages, a solid but familiar set of discounts, and excellent third-party customer service and financial strength scores. However, even as a large-scale provider with standard insurance options to meet the needs of the average customer, Nationwide offers unique perks, add-ons, and affordable rates that appeal to specific drivers.

As a senior staff writer and editor at AutoInsurance.com and a State Farm customer, I’m always eager to discover what makes particular brands different, more competitive, or more compatible with specific driver types. For some specialized providers, like USAA (military insurance) or Direct Auto (high-risk insurance), it’s easy to see those distinctions. Those differences are less clear for other brands, especially some of the larger providers that offer standard coverages, similar sets of car insurance discounts, and solid third-party customer service/financial strength scores.

Below, I’ll dive deep into Nationwide’s auto insurance offerings, highlighting features, rates, and discounts that stand out to me as better, different, or more compatible for specific driver types.

At a Glance: Nationwide Pros and Cons

Pros

Affordable for drivers with clean records, as well as bad credit

Attractive loyalty perks

Pay-per-mile option

Free one-on-one insurance reviews and consultations

Cons

Slightly higher average rates than competitors

No rideshare coverage

Who Is Nationwide Auto Insurance Best For?

Nationwide is best for safe drivers, individuals with a low credit score, and drivers seeking affordable insurance.

Nationwide Is Best for Those Who:

- Want to work one-on-one with an agent

- Need commercial auto insurance (especially fleet owners)

- Have bad credit

- Drive safely and are eligible for Nationwide’s many safe driver discounts

Nationwide Is Not Best for Those Who:

- Work for a rideshare service and need rideshare insurance

- Live in one of the four states Nationwide does not serve

- Alaska

- Hawaii

- Louisiana

- Massachusetts

Why I Would Consider Nationwide

Although I’m a State Farm customer, there are a few reasons I would consider switching to Nationwide. If, for example, my credit score took an unexpected plummet — let’s hope that doesn’t happen — I would consider Nationwide, as its prices are among the lowest for drivers with bad credit. With an average rate of $2,810 for drivers with bad credit, Nationwide ranks lowest on several data sets, often right behind or just in front of GEICO, depending on the study.

Here’s how Nationwide’s averages compare to the nation by credit score:

| Credit rating | Nationwide average annual rate for full coverage | National average annual rate for full coverage |

|---|---|---|

| Good driver with good credit | $1,987 | $2,356 |

| Driver with bad credit | $2,810 | $4,126 |

Nationwide’s average rate of $2,810 is over $1,000 cheaper than the national average, making it one of the most competitive providers for individuals with a poor credit score.

PRO TIP:

Part of why I’m a State Farm customer has to do with my family’s State Farm policy. Because I share a policy with multiple people, I benefit from multi-vehicle discounts, bundling discounts, loyalty discounts, and more. Being able to combine policies with family members completely changes the way I shop for car insurance, incentivizing bundling and loyalty discounts over my individual driving profile.

I would also consider Nationwide if I were a business owner who owned a fleet, as it offers a lot of perks. Below, I’ll walk you through coverages and discounts for this profile.

How Much Does Nationwide Car Insurance Cost?

On average, Nationwide charges $1,987 for full coverage, which is almost $400 less than the national average. Its premiums are on the cheaper end compared to competitors, and you can evaluate your needs and driver profile alongside Nationwide’s discounts and offerings.

Nationwide’s rates are lower than average for people with bad credit, safe drivers, and low-mileage drivers. If you don’t fit into one of these categories, your rates might be higher than the average we presented. Since I drive often and have a good credit score, Nationwide likely won’t be able to beat all the perks I get with my State Farm family plan.

Check out the table below to see how Nationwide stacks up with other major national insurers.

| Company | Average annual premium for full coverage | Average monthly premium for full coverage |

|---|---|---|

| USAA | $1,533 | $128 |

| Travelers | $1,837 | $153 |

| Erie | $1,833 | $153 |

| GEICO | $1,867 | $156 |

| Nationwide | $1,987 | $166 |

| American Family | $2,181 | $182 |

| Progressive | $2,060 | $172 |

| State Farm | $2,030 | $169 |

| Allstate | $2,915 | $243 |

| Farmers | $3,023 | $252 |

| AAA | $3,009 | $251 |

| National Average | $2,356 | $196 |

Insights from Real Nationwide Policyholders

In addition to sharing our experiences with Nationwide, we analyzed real-life customer feedback and review patterns to understand what other drivers think. By analyzing over 1,000 customer reviews from major platforms like Reddit, BBB, and more, we identified common themes in customer satisfaction, complaints, and overall experience. Here’s what we found:

| Category | Details |

|---|---|

| Total Reviews Analyzed | 1,000+ (BBB , Trustpilot , Reddit, and other consumer portals) |

| Top 3 Positives |

|

| Top 3 Negatives |

|

| Key Takeaway | Nationwide offers solid products for the price, and customers appreciate the assistance they receive from local agents. The most common complaints pertain to recurring billing/cancellation issues. |

The Best Ways to Save With Nationwide

In this section, we will look at Nationwide’s discounts and average rates, with special attention to its safety discounts. You should consider Nationwide if you qualify for some or most of these discounts or if you fit the ideal driver type (safe drivers, bad credit, low mileage).

Here’s a brief view of all of Nationwide’s advertised discounts:

- Multi-policy/bundling discount: An average savings of $1,032 when bundling car and home insurance2

- SmartRide: Up to 40 percent off when you drive safely with Nationwide’s tracking plug-in

- SmartMiles: Up to 10 percent off and additional per-mile earnings if you drive less each month

- Vehicle safety: For having anti-theft devices installed in your car

- Accident-free: For maintaining an accident-free driving record

- Good student: For maintaining a B average or better

- Automatic payments: For setting up automatic payments

- Safe driver: For five years of safe driving (no at-fault accidents or major violations)

- Defensive driving: For completing a state-approved defensive driving course

Highlighted Savings: SmartRide and SmartMiles

Nationwide has two usage-based insurance programs: SmartRide and SmartMiles. SmartRide rewards you for safe driving, while SmartMiles is a pay-per-mile insurance plan.

If I were to sign up for these programs, I’d have to download an app (SmartRide) and receive a plug-in device so Nationwide can track my driving (SmartMiles). The safer I drive and the fewer miles I drive each month, the less I’d pay for car insurance.

I currently don’t have any safety tracking programs because my insurance is already relatively low. However, if my premiums were higher and I was looking for savvy ways to save, I would look into signing up for either a safe-driver tracking program or pay-per-mile program.

Below I’ll show you how to sign up for each of these programs.

How Does SmartRide Work?

You get a 5 percent discount for signing up for SmartRide, and up to 15 percent off depending on your driving behaviors. Like most programs, you’ll need to wait until your next renewal for your safe driving discount.

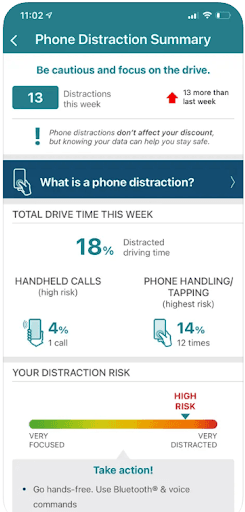

After you sign up for SmartRide, you’ll download the app so Nationwide can track your driving habits through your phone. If you also participate in SmartMiles, you’ll use a plug-in device instead. The app/device will track your driving habits, score you based on those habits, and reward you for safer driving.

Nationwide tracks four key metrics via SmartRide:

- Miles driven: The less you drive, the more you save. Although this is a feature of SmartRide, it differs from SmartMiles, which we’ll look at below.

- Hard braking and acceleration: Sudden increases in speed or hard braking could hurt your score.

- Night-time driving: Driving between midnight and 5 a.m. could decrease your score.

- Idle time: Nationwide considers idle time — an indicator of being stuck in traffic — a higher driving risk and will penalize you for it.

If you score well for each of the four metrics, you can save up to 15 percent on your premium. Even better, you only need to use SmartRide to track your driving habits for four to six months. At the next policy period, you’ll get a discount — which will continuously apply to your premium as long as you insure the same vehicle with Nationwide.

How Does SmartMiles Work?

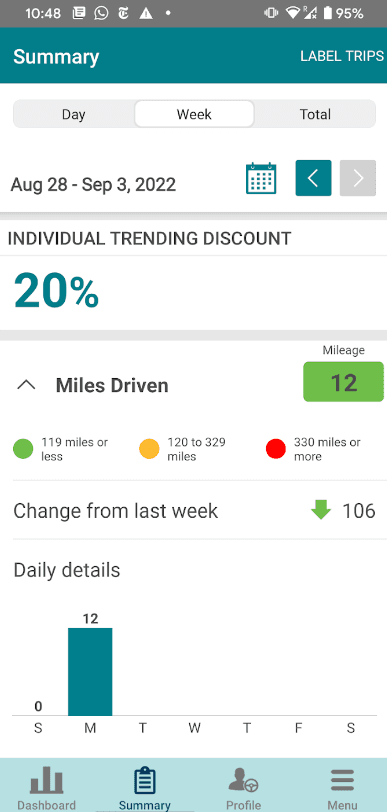

SmartMiles is a separate pay-per-mile auto insurance program that tracks how many miles you drive each month.

SmartMiles calculates your premium based on two numbers: your flat-based rate, which stays the same each month, and your per-mile rate, which fluctuates based on how many miles you drive each month.

In the example above, the base rate is $60, which stays $60 for each month within a renewal period, and the driver gets charged $0.07 per mile per month. A charge of $35 for their pay-per-mile means the driver logged 500 miles that month. Assuming similar mileage throughout the month, they pay only $1,140 per year, or nearly half the national average. Those are huge savings, making pay-per-mile insurance a very attractive alternative to standard insurance for those who don’t drive often. Nationwide also has a road trip exception, meaning it won’t charge for more than 250 miles per day. In addition, at your renewal, you can save up to 10 percent for safe driving.

NOTE:

You can access SmartMiles within the Nationwide SmartRide App. SmartRide has a 4.7-star rating (out of 5) in the Apple App Store and a 4.5-star rating on Google Play.

At the moment, pay-per-mile insurance isn’t a viable option for me because I drive around 1,000 miles per month. If I had the same flat rate and pay-per-mile rate in the image above, I’d have to pay $130 each month, or $1,560 per year, which is more than I currently pay for car insurance. While SmartMiles is a great option for people who drive around 500 to 750 miles per month, you have to consider your personal driving needs and whether or not pay-per-mile insurance makes sense for you.

Both SmartMiles and SmartRide come with a host of other neat features, like trip summaries and safe-driver tips. If you find it difficult to qualify for some of Nationwide’s other discounts, these usage-based insurance options offer great ways to save and improve your driving.

FYI:

Worried about getting penalized for having apps on while you’re driving or allowing your friends to use your phone while you’re behind the wheel? Don’t fret. Phone distraction time will not affect your discount with SmartRide. Nationwide simply offers that data to help you stay on top of your driving habits.

Cheap Rates for Drivers With Bad Credit

Discounts aside, I would also request a Nationwide quote if I had bad credit. Nationwide’s average rates are one of the lowest on average compared to those of other large providers.

Here’s how Nationwide’s full coverage rate for drivers with bad credit compares to competitors’:

| Company | Average annual premium for drivers with bad credit | Average monthly premium for drivers with bad credit |

|---|---|---|

| Erie | $4,003 | $334 |

| GEICO | $2,912 | $243 |

| USAA | $2,669 | $222 |

| Nationwide | $2,810 | $234 |

| American Family | $4,281 | $357 |

| Travelers | $3,016 | $251 |

| Progressive | $3,524 | $294 |

| Allstate | $4,560 | $380 |

As you can see, credit score has a huge impact on car insurance premiums, and can double the average rate in some cases.

Bad credit scores lead to higher premiums for a couple of reasons. First, individuals with a bad credit score are less likely to make on-time payments, which insurers see as a financial risk. Second, the Federal Trade Commission released a report that found a correlation between low credit scores and a higher frequency of claims.3 This also leads insurers to associate a low credit score with greater risk.

What Types of Auto Insurance Coverage Does Nationwide Offer?

Nationwide offers all of the basic coverage types you’d find in a major provider: liability, personal injury protection, collision, comprehensive, medical payments, and uninsured/underinsured motorist.

On top of that, it also offers some add-ons that you may want to consider as a Nationwide customer. Here are a few of those add-ons:

| Coverage type | Coverage details |

|---|---|

| Rental car reimbursement | Provides you with access to a rental car or other transportation while your vehicle is in the shop after a covered accident; great for individuals who need transportation for day-to-day needs |

| Gap insurance | If you finance or lease a vehicle that is totaled in an accident, this coverage will help pay the difference between the current cash value of the vehicle and what you owe on the lease or loan. |

| Roadside assistance | 24/7 roadside assistance if you need help with fuel, a jump-start, towing, or other emergencies |

| Accident forgiveness | No premium increase after your first at-fault accident or minor violation on your plan |

FYI:

Because most cars depreciate in value over time, you may owe more on your auto loan than what it’s worth, especially in the first few years of paying off a loan. Gap insurance provides the peace of mind that your loan/lease will be fulfilled if your vehicle is totaled.

Here’s my take on these coverage options:

- Gap Insurance: If I financed or leased a vehicle, I would definitely sign up for gap insurance. For example, I definitely wouldn’t want to be in a position where my car depreciated to a value of, say, $15,000, but I still owed $19,000 on my loan. If my vehicle were totaled in that situation, I’d be reimbursed only for the $15,000 and have to pay $4,000 out of pocket (unless I had gap insurance; then, my insurance company would pay the difference, after any deductible).

- Roadside assistance and rental car reimbursement: Both roadside assistance and rental car reimbursement are great options to help you in a pinch. While I do have roadside assistance, I am not signed up for rental car reimbursement. Because other people in my household own cars and I have other ways of getting around, it’s not a huge priority for me personally. However, if you don’t have alternatives and have urgent daily needs, like picking the kids up from school or commuting to work each day, rental car coverage will ensure you have your transportation needs met in emergency situations.

- Accident forgiveness: And finally, you can’t really go wrong with accident forgiveness. You never know when the unthinkable may happen, and one at-fault claim, especially from a severe accident, can mean significant increases for years to come. This is something I would consider more for new drivers, young drivers, and drivers with a rocky driving history.

Coverage Highlight: Nationwide Commercial Car Insurance

I want to highlight Nationwide’s commercial car insurance, which earned a spot as the best provider for fleet owners in our commercial auto insurance review.

READ MORE:

For more on the best policies for businesses, fleet owners, delivery services, and employers, check out our guide on the best commercial auto insurance companies in the country.

Since I don’t own a business or a fleet, I can’t speak to the merits of this insurance; however, from my research, I can say it has a lot of great features that you may want to know if you’re a business owner.

Among Nationwide’s many coverages for delivery services, business owners, and fleet owners, you can benefit from its free telematics program, Vantage 360 Fleet.

Vantage 360 Fleet offers:

- A 10 percent discount when you sign up with Vantage 360 Fleet

- The ability to track driver routes and alter their schedules based on where they are, traffic in the area, or upcoming weather changes

- Safety tracking features so that you can keep tabs on the habits of your drivers on the road

- A point reward system for drivers who exhibit safe habits on the road — points redeemable via gift cards

- A 50 percent decrease in claims and accidents for nearly three-quarters of the drivers who were driving with vantage 360 Fleet

As this is an entirely free service, I can’t think of any reasons why a business owner wouldn’t take advantage of the discount and safety perks.

Nationwide: Customer Satisfaction

With no firsthand experience with Nationwide’s customer service, I’ve analyzed third-party customer reviews to see what customers have to say about working with Nationwide.

- The AM Best Financial Strength Rating assesses insurance companies on their financial strength and creditworthiness, which is important to demonstrate providers’ abilities to fulfill claims and financial obligations. Nationwide’s A rating indicates excellent financial strength, meaning Nationwide demonstrates a good ability to meet its ongoing financial needs and can reliably pay out claims.

- The CRASH Network surveys collision repair shops and assesses how easy a company is to work with. Nationwide’s C score is just under the national average of C+; however, it scored third highest among the 10 largest providers.

- Finally, J.D. Power’s annual customer service surveys score companies based on customers’ experiences with claims or customer service interactions. They consider how long it takes for a claim to be paid out, how long repairs take, ease of digital interactions, and more. Nationwide scored above average for both claims satisfaction and shopping — suggesting that customers are happy with Nationwide’s quote process and pricing, as well as with the service they receive when they need to file a claim.

Here’s a succinct summary of those scores.

| Third-party rating source | Nationwide rating/score |

|---|---|

| AM Best Financial Strength Rating4 | A (Excellent) |

| CRASH Network 2025 Insurer Report Card5 | C — Ranked 73 out of 97, No. 3 among largest providers |

| J.D. Power 2025 Claims Satisfaction Study6 | 729 out of 1,000 — No. 4 overall |

| J.D. Power 2025 Insurance Shopping Study7 | 671 out of 1,000 |

On a regional level, Nationwide made strides between 2024 and 2025 on J.D. Power’s Auto Insurance Study. It scored above average in:

- New York – #2

- North Central region – #2

- Southeast region – #3

- Southwest region – #2

- Texas – #1

The company scored below average in California and the Central, Mid-Atlantic, and Northwest regions. By comparison, in 2024, Nationwide scored below average in every region except two.

Nationwide also placed first for usage-based insurance. Nationwide’s pay-per-mile insurance is one of the most widely available in the U.S.

| Region | Nationwide | Average |

|---|---|---|

| California | 586 | 631 |

| Central | 632 | 649 |

| Florida | Not rated | Not rated |

| Mid-Atlantic | 636 | 656 |

| New England | Not rated | Not rated |

| New York | 647 | 636 |

| North Central | 674 | 643 |

| Northwest | 625 | 629 |

| Southeast | 691 | 667 |

| Southwest | 661 | 636 |

| Texas | 657 | 640 |

| Usage-based insurance | 698 | 643 |

Note that in some cases, USAA may have scored higher, but is ineligible to rank due to its availability restrictions.

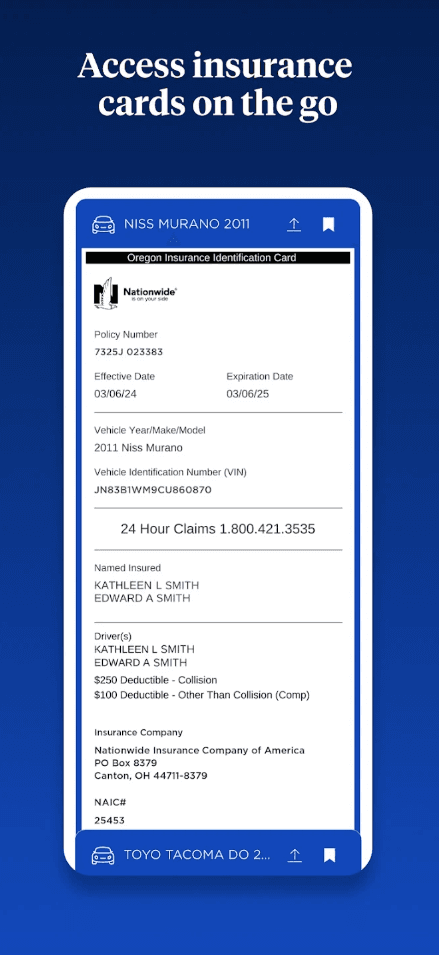

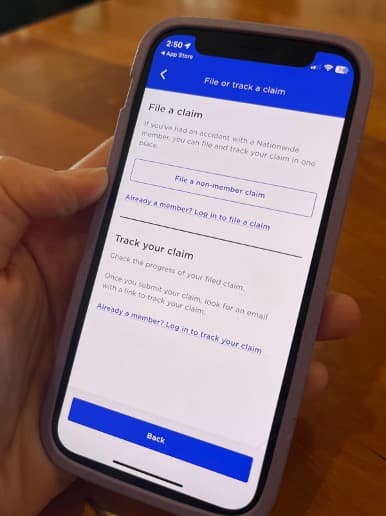

Digital Tools

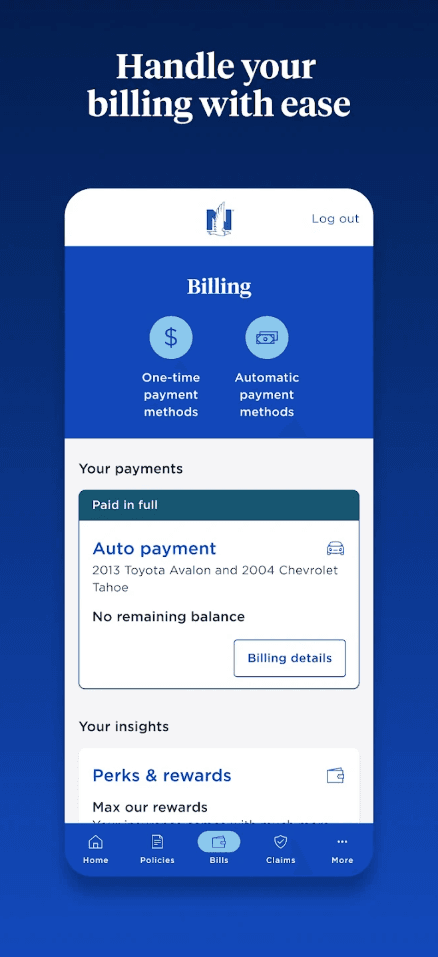

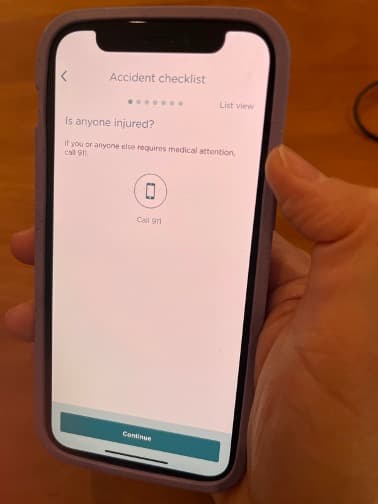

On top of the SmartRide app, Nationwide has an end-to-end auto insurance app to take care of your everyday insurance needs. As someone who uses State Farm’s app for my own needs, it’s important for me to sign up with a company that offers robust digital features, like a seamless mobile app and website experience.

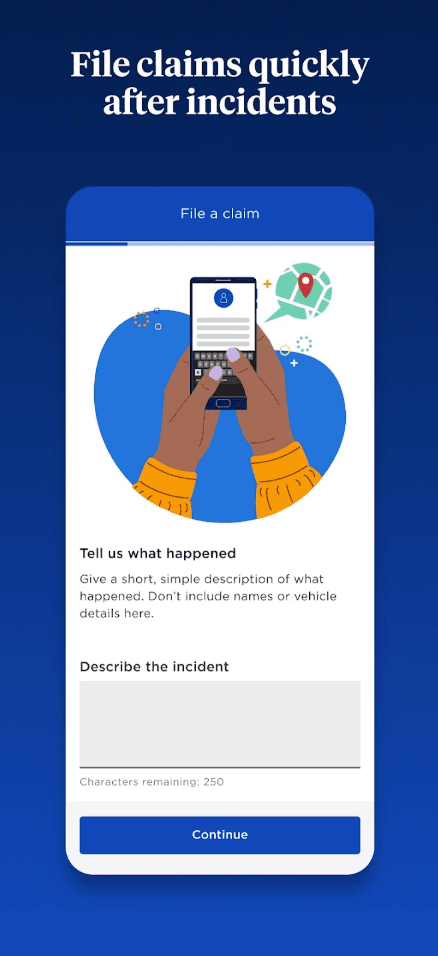

I downloaded the app to get a feel for it. Even without logging in, you can file a claim as a non-member (i.e., if you’re involved in an accident with a Nationwide customer), call Nationwide, review an accident checklist, and more. Some of these activities bring you to a browser, rather than taking place in the app itself. You’ll need to log in for other features.

Nationwide’s website and mobile app include features that you’d find with any other leading auto insurance app. Some of those features include:

- Digital ID cards

- Billing and payment services for your auto insurance premium

- Auto pay options

- Adding/replacing vehicle options

- Adding/editing driver options

- Coverage overview and changes

- Claims processing and tracking

The Nationwide mobile app has a 4.5-star rating (out of 5) for Android and a 4.7-star rating for iOS users, which are great scores, especially considering that the app has tens of thousands of downloads on both platforms.

Methodology: How We Review Insurance Companies

At AutoInsurance.com, we review auto insurance providers on four factors:

- Price (40%): We assess average premiums for full and minimum coverage for good drivers with good credit, as well as various driver profiles, including those with DUIs, accidents, minimal experience (like teens), or low credit scores. Available discounts are also considered. Our full coverage averages are based on the following limits:

- Bodily injury liability: $100,000 per person/$300,000 per accident

- Property damage liability: $50,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person/$100,000 per accident

- Comprehensive and collision: $500 deductible

- Claims Handling (25%): A strong claims process should be prompt, transparent, and efficient. We evaluate insurers based on clear communication, fair damage assessment, and timely resolution or payment. We use sources like the CRASH Network Insurer Report Card, J.D. Power’s Claims Satisfaction Report, and financial strength ratings from AM Best and S&P. Real-life customer experiences are included where available.

- Customer Experience (25%): The ease of the customer journey is key, from obtaining a quote and purchasing a policy to making changes or accessing documents. We get quotes from providers ourselves. We assess both online and agent interactions, as well as the functionality of the insurer’s website and mobile app. Our sources include J.D. Power studies, the NAIC complaint index, BBB ratings, and app store reviews.

- Coverage Options (10%): We examine each company’s coverage offerings, giving value to those that provide options beyond the state-required minimums, such as accident forgiveness, gap coverage, rideshare coverage, and more.

Read more about our ratings and methodology.

Frequently Asked Questions

Yes. Nationwide has an “A” rating for financial strength from AM Best, and it ranked fourth overall in J.D. Power’s Claims Satisfaction Study. When it comes to covering claims, Nationwide has excellent third-party ratings.

To receive a quote through Nationwide’s website, you’ll need the following pieces of information:

- Date of birth

- Name

- Marital status

- Sex

- Email address

- Driver’s license number

- Street address

- Whom you live with

- What vehicles you drive

To get a quote for Nationwide’s pay-per-mile insurance, SmartMiles, you will need to speak with an agent on the phone.

Yes, Nationwide does offer SR-22 certificates for high-risk drivers.

An SR-22 certificate is required for drivers who have a DUI or other serious violations on their record. The SR-22 proves that these individuals have the minimum insurance required to drive in their state, and their insurance provider must agree to file an SR-22 with that state.

You can file a claim with Nationwide in the following ways:

- Through the online portal or mobile app

- By calling Nationwide’s claims phone number: 1-800-421-3535

- By contacting your agent

On average, Nationwide is significantly cheaper than the national average. It is also considerably cheaper for individuals with bad credit.

Citations

NAIC Releases 2024 Market Share Data. National Association of Insurance Commissioners (NAIC).

https://content.naic.org/article/naic-releases-2024-market-share-dataAuto Insurance Discounts. Nationwide.

https://www.nationwide.com/personal/insurance/auto/discounts/Credit-Based Insurance Scores: Impacts on Consumers of Automobile Insurance – A Report to Congress. Federal Trade Commission. (2007, July).

https://www.ftc.gov/sites/default/files/documents/reports/credit-based-insurance-scores-impacts-consumers-automobile-insurance-report-congress-federal-trade/p044804facta_report_credit-based_insurance_scores.pdfAM Best Affirms Credit Ratings of Nationwide Mutual Insurance Company and Its Key Operating Subsidiaries. AM Best. (2024, Nov 7).

https://news.ambest.com/newscontent.aspx?refnum=261986&altsrc=23Insurer Report Card. CRASH Network.

https://www.crashnetwork.com/irc/Satisfaction with Auto Insurance Claims Strained by Higher Deductibles, More Total Losses, J.D. Power Finds. J.D. Power. (2025, October 28).

https://www.jdpower.com/business/press-releases/2025-us-auto-claims-satisfaction-studyDespite Slowing Rate of Increase in Auto Insurance Pricing, Most Customers Still Shopping, J.D. Power Finds. J.D. Power. (2025, April 29).

https://www.jdpower.com/business/press-releases/2025-us-insurance-shopping-studyIt’s Now a Buyer’s Market for Auto Insurance, J.D. Power Finds. J.D. Power. (2025, June 10).

https://www.jdpower.com/business/press-releases/2025-us-auto-insurance-study