State Farm Auto Insurance Review 2025

An inside look at your friendly neighborhood auto insurance provider.

Compare quotes from top providers

State Farm is known for its catchy marketing campaigns, such as “Like a good neighbor, State Farm is there.” Brand recognition is just one of the reasons 87 million people carry State Farm insurance.

I’m a senior editor and analyst at AutoInsurance.com, and our industry research shows that State Farm offers cheaper-than-average rates and good bundling discounts.

In addition, as a State Farm auto and renters insurance policyholder, I can vouch for its excellent rates and “good neighbor” ethos. State Farm caters to individuals like me with a good driving record, families with multiple drivers, and homeowners interested in bundling services.

While the company provides a few extra coverages, like rideshare insurance, it is best for customers looking for standard coverage. Individuals searching for extras like gap insurance and accident forgiveness may find better options elsewhere.

Below, I’ll walk you through whether State Farm is the right choice for you, based on our team’s in-depth research and my own experience as a State Farm customer.

At a Glance: State Farm’s Pros and Cons

Pros

Exceptional customer service

Affordable rates

Good bundling discount

Easy claims process

Cons

Must complete quote and purchase by phone

No accident forgiveness

Who Is State Farm Auto Insurance Best For?

Overall, State Farm is best for families and customers looking for help navigating the insurance process.

State Farm Is Best for Those Who:

- Want to work with a local agent, rather than navigating the often-complicated ins and outs of insurance by yourself

- Have a family and are also looking for home and life insurance

- Need only standard coverages, with no additional bells and whistles

- Are rideshare drivers

State Farm Is Not Best for Those Who:

- Have a credit score below 580, as State Farm tends to be on the pricey side for drivers with bad credit

- Need gap coverage and don’t have or plan to have a loan through State Farm Bank

Why I Chose State Farm

I chose State Farm because its prices were about 15 percent cheaper than the other quotes I received (sorry, GEICO!). That said, at my six-month renewal my rates increased by about 20 percent. My agent told me these increases are happening across the board, including with other carriers, as auto insurance becomes more expensive overall.

The good news: By working with my agent, I managed to lower my rates at renewal so that they increased by only 5 percent. More on how I did that below.

Here’s a breakdown of State Farm’s average prices based on the driver profile. As you can see, State Farm’s prices tend to be below average for drivers with a good record and good credit, as well as for drivers with a speeding ticket.

| Driver profile | State Farm average annual rate for full coverage | National average annual rate for full coverage |

|---|---|---|

| Good driver with good credit | $2,167 | $2,399 |

| Driver with a DUI | $3,151 | $3,305 |

| Driver with an at-fault accident | $2,917 | $2,812 |

| Driver with bad credit | $6,814 | $3,377 |

| Drivers with a speeding ticket | $2,345 | $2,511 |

| Senior drivers | $2,188 | $1,666 |

How Much Does State Farm Car Insurance Cost?

On average, State Farm charges $2,167 annually for full coverage ($181 monthly) and $674 annually for minimum coverage ($56 monthly). State Farm’s prices are about 11 percent lower than the national average.

Keep in mind that rates can vary a lot depending on factors like your age, vehicle, and where you live. For example, I pay more than the State Farm average because I live in a major city, where there is a higher likelihood of getting into an accident.

Check out the table below to see how State Farm stacks up with other major national insurers.

| Company | Average annual premium for full coverage | Average annual premium for minimum coverage |

|---|---|---|

| Allstate | $2,605 | $840 |

| American Family | $1,936 | $604 |

| Farmers | $2,979 | $1,002 |

| GEICO | $1,731 | $517 |

| Nationwide | $1,808 | $718 |

| Progressive | $1,960 | $638 |

| State Farm | $2,167 | $674 |

| Travelers | $1,597 | $576 |

| USAA | $1,407 | $417 |

| National Average | $2,399 | $635 |

How I Saved on My State Farm Policy With Discounts

Like I mentioned, at my six-month renewal, my premium increased by about 20 percent. However, my agent and I were able to adjust my policy so that my premium increased by less than 5 percent. This involved two main steps:

- Looking for additional discounts, including how I could get the most out of my Drive Safe & Save Discount

- Adjusting my coverages and deductible, specifically increasing my collision deductible

Highlighted Discount: Drive Safe & Save

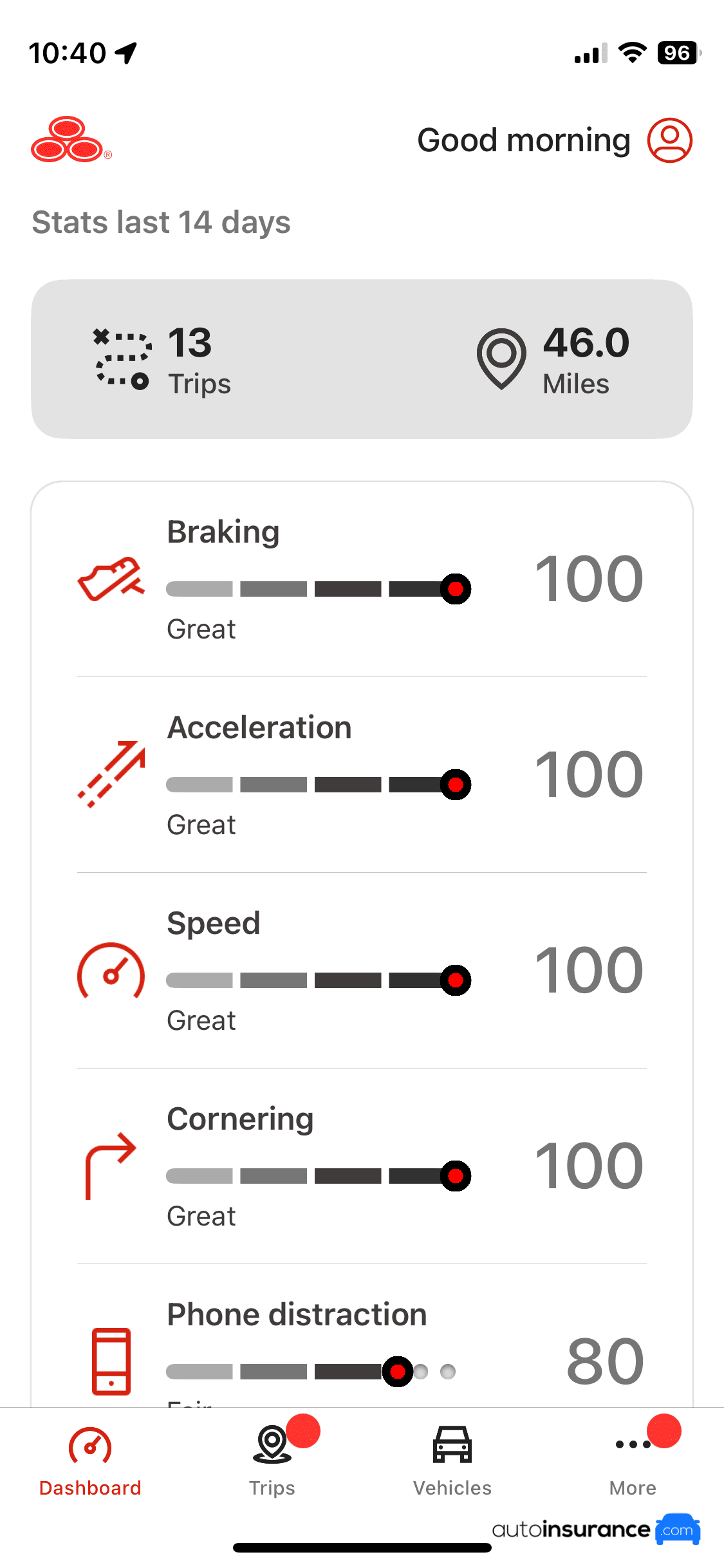

State Farm offers a 5 to 10 percent discount for enrolling in its safe driving program, Drive Safe & Save. It advertises that you can save up to an additional 30 percent at your next renewal, depending on your driving habits. Drive Safe & Save will never increase your premium or add a surcharge to your insurance.

I use this discount on my own policy. My agent applied the discount to my policy immediately, and State Farm mailed me a small transponder, which sticks to the vehicle’s windshield. The app doesn’t significantly drain my iPhone battery, and it’s intuitive to use. When the transponder’s battery gets low (after a year or so), State Farm sends a new transponder. Removing the old transponder is relatively easy and does not leave residue on the windshield.

The transponder attaches unobtrusively to my windshield.

The app lets you track trips, driving scores, and discount amount. However, at my renewal — despite holding high driving scores — the discount amounted to only a few dollars per month.

When I spoke to my agent, I learned more. State Farm determines your renewal discount 60 to 90 days before your renewal. Because I didn’t set up Drive Safe & Save until September and my discount was calculated in November, State Farm didn’t have enough data to give me a bigger discount.

Here’s what happened: my agent applied a low mileage discount to my policy and asked underwriting to recalculate my Drive Safe & Save discount. Combined, these steps saved me an additional $20 monthly, or $120 on my six-month policy. Overall, I was impressed by my agent’s service. If you enroll in Drive Safe & Save, I recommend setting it up as soon as possible.

A little more about my experience using the Drive Safe & Save app:

The app is solid but could be better. For example, even though I never use my phone while driving (this is extremely important to me, as I know several people who have lost loved ones to distracted driving), I received only an 80 in the phone distraction category. State Farm counts “phone use” as any time the phone screen is on and the phone itself moves while the car is in motion. Sometimes the passenger will use my phone to change the music or check directions, and it seems State Farm conflates this with driver phone use. You can manually update a trip to note this, but it’s tedious to do this every time you drive.

The screenshots below give you a sense of the app and provide more details. Note that the scores get updated every two weeks.

How I Saved by Adjusting My Coverage

In addition to applying the additional discounts, my agent and I looked for ways to save by adjusting my policy. He had a few ideas:

- Increase my collision deductible from $500 to $1,000, saving me $18 monthly.

- Drop rental reimbursement coverage, saving me $7 monthly.

- Lower my uninsured/underinsured motorist coverage limits, saving me $11 monthly.

Ultimately, I decided to increase the deductible and keep the other coverages. My reasoning:

- Filing claims is a hassle, and I reasoned that I am unlikely to file unless the damage is over $1,000.

- I like the peace of mind of having rental reimbursement, and it doesn’t cost that much, especially compared to the expense of renting a car.

- I live in a city that unfortunately sees a lot of hit-and-runs, and I wanted the peace of mind of knowing that I am covered if that happens.

By increasing my deductible, I saved $18 monthly, or $108 on my six-month policy. With the discounts I discussed above, my total policy savings came to nearly $250.

The Bottom Line on State Farm Discounts

Bottom line: to get the most out of your State Farm policy, make sure you’re applying all possible discounts. Discounts vary by location, but what’s nifty about State Farm is — unlike other providers, which veil available discounts in a shroud of unnecessary mystery — it makes it easy to see which discounts are available in each state.

If you live in a state like California, where insurance companies are under pressure to make money (for several reasons, including state regulations), this step is extra important. Recently, a friend of mine in Los Angeles told me he was able to save close to $100 monthly by asking the State Farm agent to apply discounts they had left off the quote.

Here’s a list of ways to earn discounts with State Farm:

- Attend school at least 100 miles away from where the car is kept, if you’re under age 25

- Buy another State Farm policy, like home or life insurance

- Complete State Farm’s Steer Clear program, if you’re under age 25

- Driving fewer than 7,500 miles annually

- Have an anti-theft device of features in your vehicle

- Have certain vehicle safety features

- Insure multiple vehicles on the same State Farm policy

- Maintain a 3.0 GPA or higher, if you’re a full-time student under age 25

- Remain accident-free and violations-free for three years

- Take a driver education course, if you’re under age 21

- Track your driving habits with Drive Safe & Save

- Voluntarily take a defensive driver course, if you’re age 55 or older

- Pay your policy in full

My policy includes the following discounts, which combined save me about $43 per month:

- Anti-Theft Discount, for an anti-theft device my car came with

- Drive Safe and Save Discount, for tracking my driving habits; the low mileage discount I discussed is folded into the Drive Save & Save Discount

- Auto Multiple Line Discount, because I also have a renters policy with State Farm

- Vehicle Safety Discount, for safety features my car came with

Highlighted Discount: Steer Clear

State Farm has an app-based discount for young drivers, called Steer Clear. Drivers under age 25 with no at-fault accidents or moving violations in the past three years are eligible. To earn the discount, a driver must complete learning modules in the Steer Clear mobile app and five hours of practice driving in at least 10 trips.

I don’t personally qualify for this discount because I am too old (alas!), but I think it’s worth mentioning. The cost of insurance for young drivers is incredibly expensive — the highest of any age group — so any way to save is worth exploring.

State Farm Quote and Purchase Process

When I bought my policy I started the quote process online with State Farm. To learn premium costs and complete the purchase of the policy, I had to finalize the quote on the phone with an agent. Other insurers I shopped with — including GEICO, Progressive, and Erie — gave me an initial quote online, so State Farm fell a little short in this regard. That said, I don’t mind talking on the phone, so it wasn’t a huge deal.

To start, I entered standard vehicle and personal information, then answered questions about driving history, habits, and potential discounts.

After completing the online portion of the quote process, an agent followed up promptly with a phone call. State Farm is known for its network of over 19,000 agents and its commitment to personalized service, which was consistent with my experience. The agent was friendly and knowledgeable, explaining a few Pennsylvania-specific car insurance coverages and patiently answering my questions. I never felt like he was trying to “make a sale.” After the conversation, he emailed me a copy of the quote.

Overall, my experience getting a quote with State Farm was positive. It bears repeating: For customers seeking a relationship with their insurance agent, State Farm is a good fit. On the other hand, if you prefer to shop online, you may dislike that the company provides pricing over the phone only.

TIP:

When getting a quote, don’t be afraid to tell the agent you need more time to compare options before finalizing the purchase.

What Types of Auto Insurance Coverage Does State Farm Offer?

State Farm offers all of the standard auto insurance coverages: liability, medical payments, personal injury protection, uninsured/underinsured motorist, collision, and comprehensive.

In addition to standard coverages, State Farm offers the following, some of which I have on my own policy:

| Coverage | What it covers | How much it added to my policy* |

|---|---|---|

| Car rental and travel expenses | Rental reimbursement subsidizes the cost of a rental if your car is in the shop for repair. Travel expense coverage helps pay for meals, lodging, and transportation if you’re in an accident more than 50 miles from home. | Less than $7 per month for $50 daily reimbursement (up to $1,500) |

| Emergency road service | Towing to the nearest repair facility, fuel delivery (not including fuel cost), and up to one hour of labor at the breakdown site (including locksmith labor) | $3 per month |

| Rideshare driver | Accidents that occur when you’re driving for a service like Lyft or Uber | Not included, though State Farm reports it typically increases premiums by 15 to 20 percent, depending on your coverage |

| Repayment of deductible expense | Up to $500 toward the deductible if you have a covered-loss accident in a rental car | Not included, though it typically adds less than $1 per month |

* 30-year-old driver in Pennsylvania (me)

GOOD TO KNOW:

While every state has different minimum limits for liability coverage, we recommend purchasing coverage above the minimum to protect your assets in the event of an accident.

Knock on wood, I haven’t had to use the car rental or emergency road service coverages with State Farm. If I did, I’m hopeful based on my experiences with State Farm customer service that it would be a positive experience (at least given the circumstances!).

State Farm sells insurance in 48 states — it is no longer selling new policies in Massachusetts or Rhode Island. It does not sell stand-alone gap insurance; however, if you financed your vehicle with a loan from State Farm Bank, you can purchase gap insurance, called “payoff protector coverage.”

Unlike some other major insurers, State Farm does not offer accident forgiveness. This may vary by state, so it’s worth checking with your agent, but for the most part this add-on is not available with State Farm. I always recommend buying accident forgiveness if you’re eligible, and it doesn’t add too much to your premiums. An accident can happen to anyone, and it’s a bummer if one raises your premium on top of the existing hassle and expense.

While the Drive Safe & Save Discount theoretically rewards you for low mileage, State Farm does not offer pay-per-mile insurance. Since moving back to a city, I have driven significantly less frequently.

TIP:

See how State Farm matches up against the competition with our comparison of State Farm vs Allstate.

State Farm provides additional liability with its umbrella policies. Liability includes protection against personal claims, like libel or slander, with minimum coverage of $1 million, increasing in $1 million increments.

State Farm: Customer Satisfaction

Since I am just one data point among the millions of State Farm customers, I’ve also assembled industry research and third-party data on State Farm’s financial stability and customer service.

State Farm’s competitive pricing and commitment to customer service are reflected in its No. 4 ranking in J.D. Power’s 2024 Insurance Shopping Study. The study evaluates companies on distribution channels (e.g., interaction with agents), the quote process, policy offerings, and price.

State Farm received an A++ from AM Best for financial strength — the highest possible score — which means it can reliably pay out claims.

When it comes to claims, State Farm received high scores in J.D. Power’s 2024 Claims Satisfaction Study. The study analyzes the claims experience across six factors: claim servicing, estimate process, first notice of loss (i.e., when you first file the claim), rental, repair process, and settlement.

However, for the second year in a row, State Farm received a grade of only “C-” from CRASH Network, which surveys collision repair shops on how easy a company is to work with. That said, the highest score among the 10 largest auto insurers was a C+.

| Source | State Farm score |

|---|---|

| AM Best Financial Strength Rating1 | A++ |

| CRASH Network 2025 Insurer Report Card2 | C- — No. 81 out of 97 |

| J.D. Power 2024 Claims Satisfaction Study3 | 710 out of 1,000 — No. 6 overall |

| J.D. Power 2024 Insurance Shopping Study4 | 695 out of 1,000 — No. 4 overall |

Finally, your experience with State Farm may vary by where you live. J.D. Power’s 2024 Auto Insurance Study assesses overall customer satisfaction with different insurers by region. State Farm performs above average in most regions and stands out particularly in the Southeast, North Central, and New England regions, where its scores are notably higher than the average. However, in the Mid-Atlantic region, State Farm falls slightly below the average, and in the Central region, it matches the average exactly.5

| Region | State Farm | Average |

|---|---|---|

| California | 658 | 637 |

| Central | 647 | 647 |

| Florida | 650 | 625 |

| Mid-Atlantic | 652 | 654 |

| New England | 664 | 637 |

| New York | 662 | 647 |

| North Central | 665 | 652 |

| Northwest | 656 | 643 |

| Southeast | 673 | 663 |

| Southwest | 646 | 635 |

| Texas | 654 | 645 |

My Experience Filing a Claim With State Farm

You can file a claim with State Farm by phone, online, or via mobile app. State Farm’s app allows you to upload photos and will give you a virtual estimate of repair costs. For minor damage, you may receive a payout within 48 hours. You can receive the payout by direct deposit or check. In cases of more serious damage, State Farm may pay the repair shop directly. In general, customers report a positive experience filing claims with State Farm.

I have filed a claim with State Farm. A flying object on the highway took out part of my front bumper, so it fell under my comprehensive coverage. I called my agent, who directed me to start the claim in the app. I took pictures and explained what happened; it was an easy process. Thankfully, it was a relatively inexpensive repair, and State Farm sent me a check directly. Overall, a positive experience.

Digital Tools

State Farm has a robust set of digital tools. From the State Farm website and mobile app, you can file and manage claims, access your ID cards, get roadside assistance, and connect with your agent.

Generally, I manage my policy online on State Farm’s website. Recently, I needed a document and the website was down, so I downloaded the app and found it easy to use (including accessing the document).

I learned that the app allows you to add your insurance ID card to your virtual wallet and make it available offline. I can also request roadside assistance and see how much I’m saving with discounts on my policy.

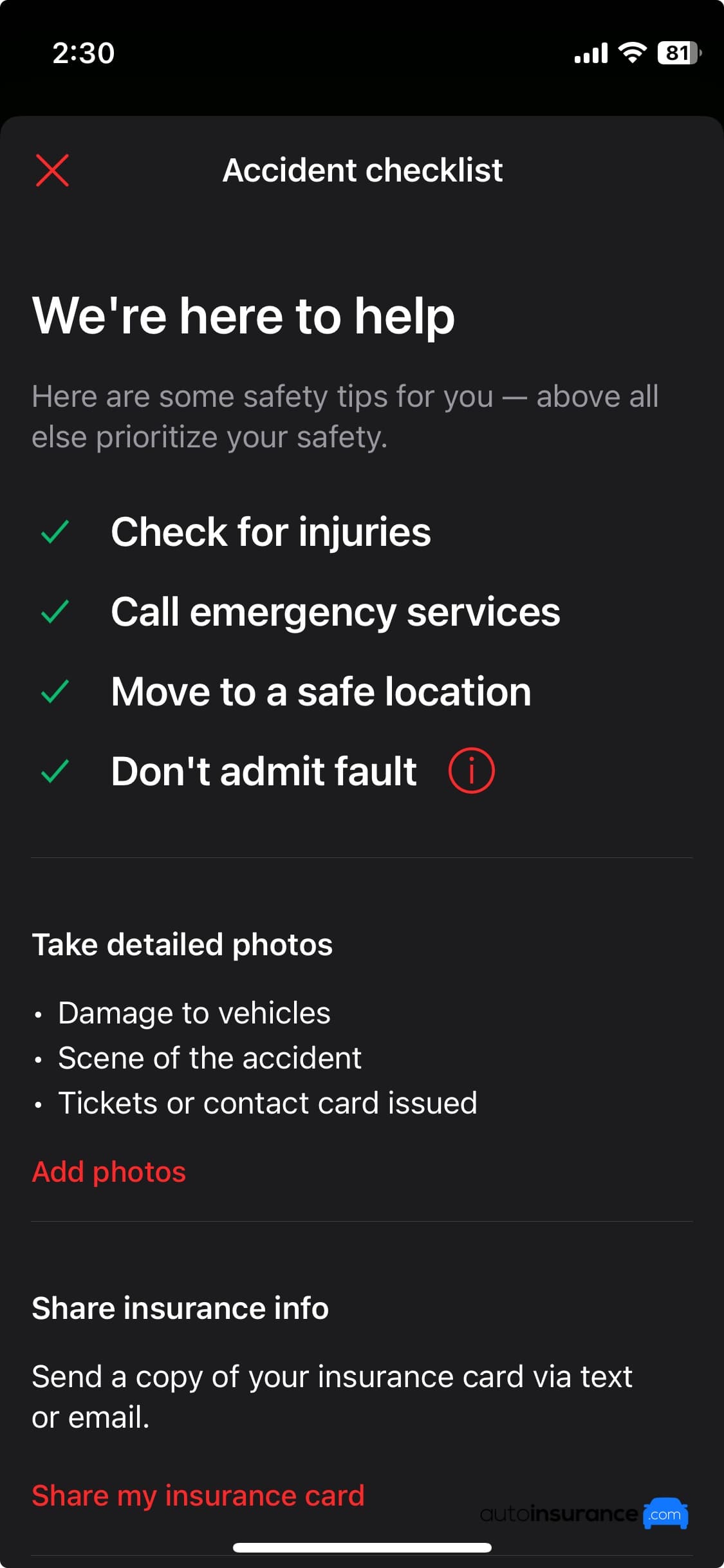

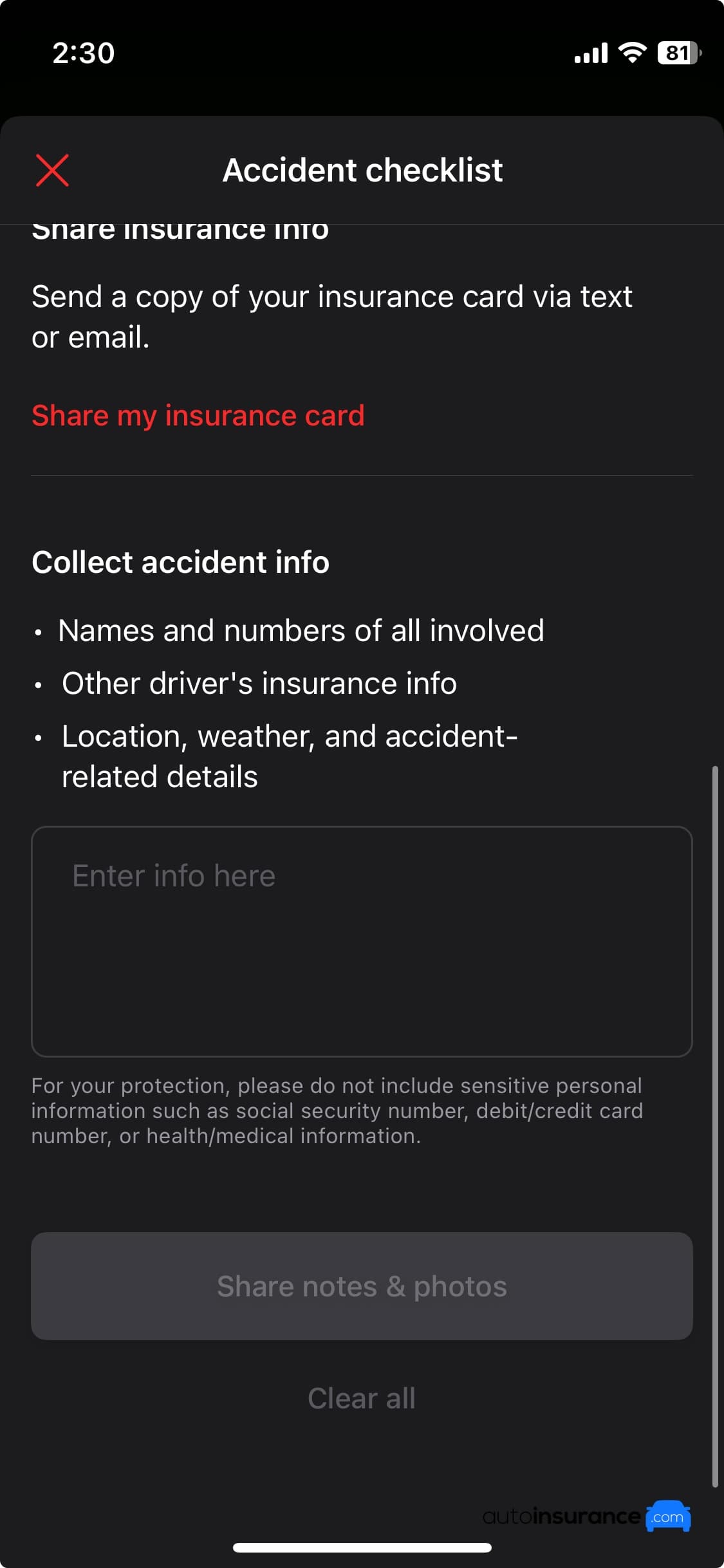

The app also offers an accident checklist, which breaks down what to do if you’re in an accident. I think this is a great feature. Accidents are stressful and it can be hard to think clearly after one happens, so it’s helpful to have all of the information in one place.

To earn the Drive Safe & Save, you can sign up for the program right within the State Farm app. Steer Clear (the discount for young drivers) requires a separate app, which you may find cumbersome.

| App | Rating (out of 5) |

|---|---|

| State Farm | iPhone — 4.8 stars

Android — 4.6 stars |

| Steer Clear | iPhone — 4.7 stars

Android — 4.4 stars |

Methodology: How We Review Insurance Companies

At AutoInsurance.com, we evaluate auto insurance providers using a comprehensive methodology based on four key factors:

- Price (40 percent): We analyze average premiums for both full and minimum coverage across various driver profiles. This includes good drivers with good credit, and drivers with DUIs, at-fault accidents, or low credit scores. Our assessment also takes into account available discounts. For full coverage averages, we use the following standard limits:

- Bodily injury liability: $100,000 per person/$300,000 per accident

- Property damage liability: $50,000 per accident

- Uninsured/underinsured motorist bodily injury: $50,000 per person/$100,000 per accident

- Comprehensive and collision: $500 deductible

- Claims Handling (25 percent): We evaluate insurers’ claims processes based on their efficiency, transparency, and fairness. Key aspects include:

- Promptness of response

- Clear communication throughout the process

- Fair evaluation of damages

- Timely payment or resolution

Our assessment uses industry benchmarks such as the CRASH Network Insurer Report Card and J.D. Power Claims Satisfaction Report. We also consider financial strength ratings from AM Best and S&P to ensure insurers can meet their claims obligations. When available, we incorporate real-world customer experiences to provide additional insights.

- Customer Experience (25 percent): We assess the overall customer journey, from obtaining a quote to policy management. Our evaluation covers:

- Ease of getting a quote and purchasing a policy

- Simplicity of making policy changes

- Accessibility of policy documents

- Quality of online and agent interactions

- Functionality of website and mobile app

Sources for this assessment include J.D. Power studies, NAIC complaint index, BBB ratings, and app store reviews. We also interview customers and include our own experiences, aiming to provide readers with firsthand insights.

- Coverage Options (10 percent): We examine each insurer’s range of coverage offerings, giving preference to those that provide options beyond state-required minimums. Valuable add-ons may include: accident forgiveness, roadside assistance, gap insurance, rideshare coverage, and more.

Learn more about our methodology and ratings system.

State Farm: Frequently Asked Questions

How do you file a claim with State Farm?

You can file a claim with State Farm on its website, via its mobile app, or by calling 800-SF-Claim (800-732-5246). State Farm has agents available 24/7. After you file a claim, State Farm will review it, estimate the damage, and either pay the shop directly or send you the payout via direct deposit or check.

Is State Farm insurance expensive?

For many drivers, State Farm insurance is not expensive — the company’s premiums are about 11 percent below the national average. State Farm has competitive rates for drivers with a good record and good credit score, as well as for drivers with an at-fault accident. State Farm is expensive for drivers with bad credit, with rates more than double the national average for drivers with bad credit.

What states does State Farm offer coverage?

State Farm offers coverage in every state except Massachusetts and Rhode Island, where it is no longer selling new policies.

Does State Farm have a grace period for payments?

Yes. State Farm gives you a grace period of 10 days after the due date to pay your bill without a lapse in coverage. If no payment is made in 10 days, State Farm will cancel your policy.

Citations

Search for a Rating. AM Best. (2025).

https://ratings.ambest.com/Top Rated U.S. Car Insurance Companies for 2024. Crash Network. (2025).

https://www.crashnetwork.com/irc/Auto Insurance Repair Cycle Times Improve but Price Increases Take a Toll, J.D. Power Finds. J.D. Power. (2024, Oct 29).

https://www.jdpower.com/business/press-releases/2024-us-auto-claims-satisfaction-studyHalf of Auto Insurance Customers Currently Shopping for New Policies, J.D. Power Finds. J.D. Power. (2024, Apr 30).

https://www.jdpower.com/business/press-releases/2024-us-insurance-shopping-studyTrust Emerges as Top Driver of Customer Satisfaction with Auto Insurance as Prices Continue to Surge, J.D. Power Finds. J.D. Power. (2024, Jun 11).

https://www.jdpower.com/business/press-releases/2024-us-auto-insurance-study