Safeco Insurance Review 2025

Owned by Liberty Mutual, Safeco offers a number of coverage options — including great insurance for classic cars — but its customer satisfaction ratings are mixed.

Compare quotes from top providers

Safeco has been in the insurance business for over one hundred years — and though it was acquired by Liberty Mutual in 2008, it continues to operate as its own insurance brand. Safeco is not as well-known as some other big names in auto insurance, but Liberty Mutual is one of the largest insurers in the U.S. by market share, so Safeco benefits from its parent company’s reputation and financial strength.

Safeco is available in all 50 states and the District of Columbia. It can only be purchased through a local agent, so it’s ideal for drivers who value personalized advice and recommendations over the ability to shop online. We also named Safeco one of the best auto insurance companies for classic car coverage. However, take note that some customer satisfaction data for service and claims are less-than-stellar.

I’m a senior editor and analyst at AutoInsurance.com, and I’ll take you through the benefits and drawbacks of Safeco insurance based on our industry research to help you decide if it might be a good option for you. In addition, we’ve reviewed Liberty Mutual and rounded up the best auto insurance companies overall.

At a Glance: Safeco’s Pros and Cons

Pros

Backed by a reputable company, Liberty Mutual, with a solid financial strength rating

Has flexible coverage add-ons to customize your policy

Offers unique discounts, such as Claims Free Cash Back

Available in most states

Cons

Quotes are only available through local agents

Earned a low D+ score from CRASH network, indicating below-average claims handling policies1

Who Is Safeco Auto Insurance Best For?

Safeco is ideal for drivers who want the personalized approach of working with an agent and the ability to customize their policy with various coverage options.

Safeco Is Best for Those Who:

- Want to work with a local agent for personalized advice and recommendations

- Have alternative vehicles they’re looking to insure, including classic cars

- Are looking to bundle home and auto insurance

- Are safe drivers and can take advantage of Safeco’s telematics program

Safeco Is Not Best for Those Who:

- Want to shop online

- Prioritize a high claims satisfaction score

How Much Does Safeco Car Insurance Cost?

Data on average Safeco rates is not available, so you’ll need to reach out to an agent to get a quote and see how it stacks up to other quotes you receive for the same coverage. Generally, it’s always a good idea to compare quotes from at least three insurers before deciding who to go with.

The table below shows the average rates of major national insurers so you can get an idea of how Safeco’s rates compare:

| Company | Average annual premium for full coverage | Average annual premium for minimum coverage |

|---|---|---|

| Allstate | $2,605 | $840 |

| American Family | $1,936 | $604 |

| Farmers | $2,979 | $1,002 |

| GEICO | $1,731 | $517 |

| Nationwide | $1,808 | $718 |

| Progressive | $1,960 | $638 |

| State Farm | $2,167 | $674 |

| Travelers | $1,597 | $576 |

| USAA | $1,407 | $417 |

I spoke with a friend who has Safeco for their auto insurance, and they said their premium has increased by about $200 at the last renewal. That said, premiums have increased across the board, so it’s not unique to Safeco but still something to keep in mind.

TIP:

Remember to compare apples to apples when getting car insurance quotes. That means looking at rates for the same liability limits, coverage add-ons, etc., for every insurer.

How You Can Save On Your Policy With Safeco

Safeco offers various auto insurance discounts, particularly aimed at safe drivers. Keep in mind that available discounts can vary by state. If you’re getting a quote, talk to the agent to see if you’re eligible for any of the following savings opportunities.

Highlighted Discount: RightTrack Telematics Program

Safeco’s usage-based insurance program, called RightTrack, is one of the best ways to save on your premiums if you drive safely. You’ll receive a 10 percent discount just for signing up, and you can earn a discount of up to 30 percent thereafter if you continue driving safely. However, if your final discount is less than your initial discount, expect to be billed for the difference.

To enroll, you’ll need to download the Safeco app after purchasing a policy and register using either your Safeco online account information or the activation code included in your welcome email. The program lasts 90 days, after which Safeco will calculate a RightTrack score based on the driving behavior of all participating drivers on your policy. It will then apply a discount to your policy, which could be anywhere between 5 and 30 percent based on how safe it deems your driving. This discount will apply for the life of your policy.

RightTrack monitors total miles driven, nighttime driving between the hours of midnight and 4 a.m., braking and acceleration. Currently, the program is available in every state where Safeco operates except the following: California, New York, and North Carolina.

GOOD TO KNOW:

Drivers on your policy who do not participate in the program will lower the overall score (and therefore the discount), so try to get everyone to participate!

Highlighted Discount: Claims Free Cash Back

If you have a 12-month Superior or Ultra Safeco auto policy and have no at-fault claims over a six-month period, Safeco will automatically mail you a check for 2.5 percent of your policy premium, for a total of up to 5 percent each year. Many insurers offer claims-free discounts, but Safeco’s cash-back approach is rather unique in my experience, and it gives you some extra cash in your pocket if you’re already budgeting for the amount of the premium.

The company does not count claims where you’re not at fault (as determined by Safeco), comprehensive-only claims, and claims that fall under the threshold for surcharging. Also, keep in mind that you won’t qualify for the cash back if you have an outstanding payment on the day your policy is renewed, so be sure to stay on top of your payments.

The following are additional discounts you may qualify for with Safeco:

- Safeco Package: Get a bundling discount if you purchase two or more policy types with the company, such as auto and home or auto and renters.

- Safe Driver: You may qualify for additional savings if you’ve gone at least three years without getting a moving violation or getting into an accident.

- Multi-vehicle discount: If you own more than one vehicle, you can earn a discount by insuring both of them with Safeco.

- Teen Driver: If you’ve been with Safeco for more than a year, you can get a discount when you add a teen driver or have previously added a teen driver to your policy.

Safeco Quote and Purchase Process

Safeco policies are exclusively offered through independent agents, so in order to get a quote, you’ll need to find a local agent that works with Safeco. You can input your ZIP code on Safeco’s website to find an agency near you that you can contact to start the process.

What Types of Auto Insurance Coverage Does Safeco Offer?

Safeco offers the standard car insurance coverages you’d expect from any insurer — this includes liability coverage, collision and comprehensive coverages (also known as full coverage), uninsured/underinsured motorist coverage, and medical payments coverage.

I have increased liability limits as well as comprehensive and collision coverage on my own policy, which I recommend if you can afford it, as it provides added financial protection in case you get into an accident or your car is damaged.

Safeco also offers the following optional coverage:

| Coverage | What it covers |

|---|---|

| New Vehicle Replacement | Safeco will pay for the value of a comparable car if your car is totaled or stolen as long as you are the original owner of the car, it is less than one year old and it has fewer than 15,000 miles. |

| Rental Car Reimbursement | If your car needs repairs after a covered loss, Safeco will help you pay for a rental until your car is ready to drive again. |

| 24-Hour Roadside Assistance | Covers towing to the closest qualified repair shop and other basic emergency services such as changing a flat tire, delivering gas or oil, and locksmith services if you’re locked out of your car. |

| Accident Forgiveness | Safeco will waive the first accident on your policy once you’ve been with the company for a certain number of years (not disclosed online) without an at-fault collision or violation. |

| Classic Car Coverage | This coverage is tailored for classic and antique cars and includes agreed value coverage and limited use coverage if you drive fewer than 5,000 miles per year. |

| Diminishing Deductible | Safeco will reduce your deductible (the amount you pay out of pocket before the insurance kicks in) by $50 for a six-month policy or $100 for an annual policy if you maintain a clean driving record. It will be reduced up to $500 or for a maximum of five years. |

| Auto glass repair/replacement | This coverage pays to repair your cracked or damaged windshield, or replace it if necessary, subject to your deductible. |

DID YOU KNOW?

Most car insurance companies place a per-day and overall cap on rental reimbursement benefits, so the more expensive your rental car, the more quickly your reimbursement benefits will dry up.

Highlighted Coverage: Auto Glass Repair/Replacement

Safeco partners with Safelite Solutions, a glass repair company, to repair or replace damaged glass. If Safelite Solutions can repair your glass, rather than replace it, Safeco waives your deductible—essentially making the service free. My friend who insures their car with Safeco told me this coverage attracted them to the company, and has come in handy in repairing a cracked windshield.

Highlighted Coverage: Classic Car Insurance

In addition to traditional car insurance, Safeco also insures classic cars. Something I like to point out about Safeco’s classic car coverage is that Safeco gives you an option to drive your classic car regularly, up to 10,000 miles annually. Other companies don’t allow regular use for classic cars, and cap mileage around 7,500. And even if you don’t drive your classic car often, Safeco could be a good choice, as it has an option to cap your mileage at 5,000 miles and qualify for a lower premium.

Safeco insures the following types of classic cars:

- Modified collector cars

- Reproductions

- Replicas

- Restorations

- Modern classics (limited production, less than 10 years old)

- Antiques (at least 25 years old)

Safeco does not insure kit cars, restorations rebuilt to less than 50 percent, cars designed for racing, or cars with a jet or nitrous oxide engine.

Safeco: Customer Satisfaction

Since pricing data about Safeco is limited and it’s not possible to get a quote online, looking at industry research is particularly helpful in evaluating how Safeco customers feel about the company’s service on average. I’ve compiled some of the most useful data points to provide an overview of various customer satisfaction metrics.

Safeco’s best rating is its financial strength rating of A from AM Best, indicating that it is reliable when it comes to paying out claims.

On the other hand, it received a below-average score of 687 out of 1,000 from J.D. Power in its 2024 Claims Satisfaction Study, which evaluates customer satisfaction with various aspects of the claims process, including settlement, first notice of loss, claim servicing, estimation process, and repair process. Additionally, it scored very low on CRASH Network’s 2025 Insurer Report Card, where it’s combined with Liberty Mutual, meaning that auto repair shops find the companies difficult and inefficient to work with, which may translate to a poorer experience for customers.

Safeco also ranked third-to-last in J.D. Power 2024 U.S. Insurance Shopping Study, indicating that customers experience a less satisfactory purchase experience with Safeco than with its competitors. This may be due to higher average rates.

| Category | Safeco score |

|---|---|

| J.D. Power 2024 Claims Satisfaction Study2 | 687 out of 1,000 — Below average |

| J.D. Power 2024 U.S. Insurance Shopping Study3 | 646 out of 1,000 — Below average |

| CRASH Network 2025 Insurer Report Card | D+ — combined with Liberty Mutual, 89 out of 97 insurers |

| AM Best Financial Strength Rating4 | A (Excellent) |

Filing a Claim With Safeco

If you need to file a claim with Safeco, you can do so online or via the app, and you can get the help of your agent if needed. You’ll need to upload photos of the damage, and in some cases, the company may send an adjustor to review the damage in person. You’ll also be able to track your claim through your online account.

The amount of time it takes for a claim to be processed will depend on the severity of the damage and the details of the claim, but it should take about 30 days. However, many Safeco customers report that their process took several months, so your mileage may vary. Your agent will assist you through the process and can potentially help advocate for you, so if you run into any issues or have questions, don’t hesitate to contact them.

Safeco’s Website and Mobile App

Safeco has an online portal and mobile app through which you can do the following:

- Pay your bill

- Enroll in automatic payments

- Review and manage your policy

- View policy documents

- Get ID cards and add them to Apple Wallet on iPhone

- File and track a car insurance claim

- Get roadside assistance

- Connect with a customer service representative or call your agent

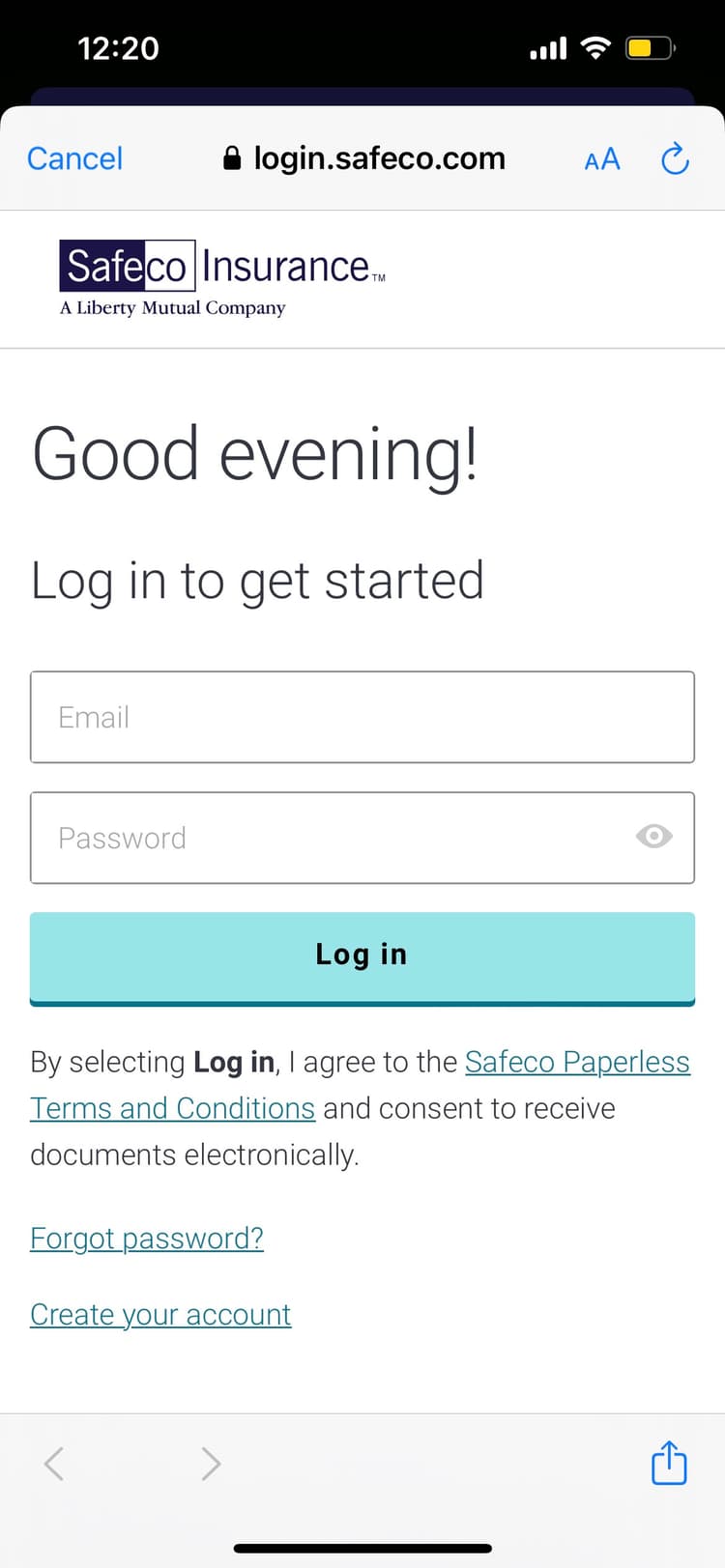

Here’s a look at the home screen of the app from the App Store’s preview image:

I also downloaded the app to get a feel for it, even though I couldn’t log in, given that I’m not a customer. Safeco’s telematics program, RightTrack, can be accessed through the same app — just click to enter your activation code instead of logging into your account. You can also skip logging in to file a claim or pay your bill.

Reviews from both iPhone and Android users note that RightTrack is highly sensitive and can record inaccurate driving behavior, especially for drivers dealing with city traffic who need to brake often (which is not a sign of driving unsafely in that context). Users report frustration with not being able to get much of a discount because of issues like this.

It’s also worth noting that when you go to log in, the app brings up an embedded web browser, which somewhat defeats the purpose of an app and doesn’t make for a great experience. This means you may not get a much better experience from the app than you would simply using your mobile browser to access the site.

That said, it has high overall ratings on both the App Store and Google Play Stores, so customers are generally satisfied with the app.

| App Version | Rating (out of 5) |

|---|---|

| iPhone (App Store) | 4.8 stars |

| Android (Google Play) | 4.6 stars |

Frequently Asked Questions

Is Safeco a reputable insurance company?

Yes. Safeco is owned by Liberty Mutual, one of the largest auto insurance providers in the U.S. It has an A rating for financial strength from AM Best, so you can count on Safeco’s ability to fulfill claims.

Does Safeco pay claims well?

While Safeco has the financial strength to complete claim payments, it ranked below average in J.D. Power’s 2024 Claims Satisfaction Study. Customer reviews on Safeco’s Better Business Bureau page mention difficulty getting into contact with adjusters and challenges getting claim payments.5

Is Safeco affordable?

It’s unclear whether Safeco is affordable because Safeco pricing data isn’t available, so you’ll have to reach out to an agent to get a quote and see how it compares to other companies.

How does Safeco determine my insurance rates?

Safeco will determine your insurance rates based on several factors, including your location, age, vehicle, gender, credit score and driving history. Rates vary significantly depending on these individual determinants, so the best way to learn about your rates is to speak directly with an agent.

What is Safeco best known for?

While Safeco writes mostly auto and home insurance policies, it’s also known for its classic car insurance and motorcycle insurance (especially for Harley-Davidson riders).

Methodology – How We Review Insurance Companies

At AutoInsurance.com, we evaluate auto insurance providers based on four key factors:

- Price (40%): We analyze average premiums for full and minimum coverage for good drivers with good credit, as well as various driver profiles, including those with DUIs, accidents, or low credit. We also consider available discounts. Full coverage averages use the following limits:

- Bodily injury liability: $100,000 per person/$300,000 per accident

- Property damage liability: $50,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person/$100,000 per accident

- Comprehensive and collision: $500 deductible

- Claims Handling (25%): A good claims handling process from an auto insurer is prompt, transparent, and efficient, with clear communication throughout, fair evaluation of damages, and timely payment or resolution. We assess claims practices through sources like the CRASH Network Insurer Report Card and J.D. Power’s Claims Satisfaction Report, and financial strength from sources like AM Best and S&P Ratings. Real-life customer experiences are included when available.

- Customer Experience (25%): We evaluate the ease of the customer journey, from getting a quote and purchasing a policy to making changes or accessing documents. We consider the availability and quality of both online and agent interactions, as well as the functionality of the company’s website and mobile app. Our sources include J.D. Power studies, the NAIC complaint index, BBB ratings, and app store reviews.

- Coverage Options (10%): We review each company’s coverage offerings and value providers with options beyond the state required minimums, like accident forgiveness, gap coverage, rideshare coverage, and more.

Read more about our ratings and methodology.

Citations

Top Rated U.S. Car Insurance Companies for 2024. Crash Network. (2025).

https://www.crashnetwork.com/irc/Auto Insurance Repair Cycle Times Improve but Price Increases Take a Toll, J.D. Power Finds. J.D. Power. (2024, Oct 29).

https://www.jdpower.com/business/press-releases/2024-us-auto-claims-satisfaction-studyHalf of Auto Insurance Customers Currently Shopping for New Policies, J.D. Power Finds. J.D. Power. (2024, Apr 30).

https://www.jdpower.com/business/press-releases/2024-us-insurance-shopping-studyAM Best Rating Disclosure – Safeco Insurance Company of America. AM Best. (2024).

https://ratings.ambest.com/DisclosurePDF.aspx?AMBNum=2448Safeco Corporation. Better Business Bureau. (2024).

https://www.bbb.org/us/wa/seattle/profile/insurance-companies/safeco-corporation-1296-500123