Esurance Insurance Review 2025

If you want to buy Allstate-backed auto insurance quickly and online, Esurance provides a frictionless process.

Compare quotes from top providers

Editor’s Note: Esurance is no longer available as a separate brand. Allstate, which acquired Esurance in 2011, has been phasing out the brand and transitioning customers to Allstate policies. As of 2023, Esurance no longer offers new auto insurance policies. If you’re an existing customer, your policy may already be managed under Allstate. For up-to-date information or to explore current coverage options, visit Allstate’s website. To make sure you’re getting the best deal, compare quotes from multiple insurers—even if you were previously considering Esurance.

I’ll be honest: As a millennial, I’ll do anything to avoid a phone call. That’s why I was initially intrigued by Esurance, Allstate’s online insurance company that lets me get a quote, choose coverages, and pay for my premium completely online. Plus, with lower-than-average pricing, Esurance is going to appeal to a lot of people, not just antisocial millennials like me.

We’ve also rounded up the best cheap auto insurance companies and put together a guide for first-time auto insurance buyers.

Quick Look: Esurance Pros and Cons

Pros

Online quoting and buying process

Bundle auto with home or motorcycle insurance

Average annual cost is 12 percent below the national average

Cons

Cons

High rates of customer complaints

Not available in Alaska, Delaware, Hawaii, Montana, New Hampshire, Vermont, Wyoming, or Washington, D.C.

Many policies are underwritten by Allstate or its affiliates — not Esurance itself

Who Is Esurance Auto Insurance Best For?

Esurance is Best For:

- People who want to buy their auto insurance policies online

- People who want to bundle their auto insurance with homeowners, renters, or motorcycle insurance

- Rideshare drivers in California, New Jersey, and Illinois

Esurance is Not Best For:

- Customers who want to work with an agent

- Drivers in Alaska, Delaware, Hawaii, Montana, New Hampshire, Vermont, Wyoming, and Washington, D.C.

How Much Does Esurance Car Insurance Cost?

With an average annual rate of $1,712, Esurance’s costs are 12 percent below the national average when it comes to full coverage car insurance. It’s also cheaper than average for those with an at-fault accident on their record, with an average rate of $2,687 per year compared to the national average of $2,809. However, Esurance is actually 33 percent above the national average when it comes to minimum coverage, with an average cost of $728 compared to $547, so it may not be the cheapest option if you just want your state’s minimum coverages and limits required.

DID YOU KNOW?

In every state except California, Hawaii, Michigan, and Massachusetts, insurance companies can base your rate on your credit score, as people with a low credit score tend to have more claims.

Compare Esurance Rates

</thead.

| Company | Average annual premium for full coverage | Average annual premium for minimum coverage |

|---|---|---|

| Allstate | $2,639 | $597 |

| American Family | $1,785 | $713 |

| Erie | $1,495 | $483 |

| Esurance | $1,712 | $728 |

| Farmers | $2,320 | $634 |

| GEICO | $1,572 | $413 |

| Nationwide | $1,805 | $613 |

| Progressive | $1,891 | $481 |

| State Farm | $1,697 | $482 |

| Travelers | $1,630 | $530 |

| USAA | $1,322 | $356 |

| National average | $1,924 | $547 |

Esurance Rates by Driver Profile

| Driver profile | Esurance average annual rate for full coverage | National average annual rate for full coverage |

|---|---|---|

| Good driver with good credit | $1,712 | $1,924 |

| Driver with a DUI | $4,173 | $3,328 |

| Driver with an at-fault accident | $2,687 | $2,809 |

How You Can Save on Your Policy With Esurance

I’m a relatively safe driver. I’ve never caused an accident or had a DUI, which is why I was intrigued by Esurance’s usage-based insurance (UBI) program, DriveSense. Essentially, all I would have had to do is download the DriveSense Mobile by Esurance app onto my iPhone. That was literally it. The app knew once the car was moving and automatically tracked my trips (when I was a passenger in a friend’s car, I simply opened the app and put it on standby mode, or deleted the trip afterwards if I forgot.) Using the data from my first 50 trips, Esurance would calculate my discount, on top of the discount I got just for signing up.

But note that your premium could actually increase if your driving behaviors aren’t safe, and to maintain the discount, all drivers on your policy will need to download the app. So, while this is a good option for safe drivers, it is a poor option for unsafe drivers. It’s also not available in every state, but it’s an option if you live in:

- Alabama

- Arizona

- Arkansas

- Colorado

- Connecticut

- Georgia

- Iowa

- Idaho

- Illinois

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Michigan

- Minnesota

- Missouri

- North Dakota

- Nebraska

- New Jersey

- New Mexico

- Nevada

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Virginia

- Washington

- West Virginia

Aside from DriveSense, Esurance offers a discount for bundling auto insurance with other types of policies, like renters, homeowners, and motorcycle insurance. However, those were the only two discounts available to me, which pales in comparison to most of the other car insurance companies I’ve investigated.

My Experience Getting a Quote From Esurance

I live in Pennsylvania, so when I typed in my Philadelphia ZIP code, I was surprised that Esurance doesn’t actually underwrite policies in the Keystone State. Rather, when I said that I was not already covered by insurance, Direct Auto was the underwriter. To test it out, I started the process over and said that I was currently covered by other insurance, and then I got directed to Allstate. Why the different underwriters? Direct Auto is known for providing coverage to high-risk drivers, and having a lapse in insurance makes you high risk. Plus, Allstate owns Direct Auto along with Esurance.1 The plot thickens.

To test it out further, I put in my old Brooklyn ZIP code and was automatically redirected to Allstate. While I didn’t try out the quote process for all 50 states, it’s unclear if Esurance underwrites any of its own policies. If that’s the case for your ZIP code, it may make sense to go straight to the company that’s actually underwriting your policy and not use Esurance as a middle man.

What Types of Auto Insurance Coverage Does Esurance Offer?

In addition to standard car insurance coverages like liability, uninsured/underinsured motorist liability, collision and comprehensive coverage, medical payments coverage, and personal injury protection, Esurance offers:

- Loan/lease gap coverage: Gap coverage, required by most finance and lease companies, would cover the remainder of your loan/lease if you totaled your car, ensuring that you don’t have to pay for an undrivable car.

- Rental car coverage: Rental car coverage covers the cost of a rental car if your car is in the shop under a covered claim or if it’s undrivable post-accident. However, in order to have rental car coverage, you’ll need both collision and comprehensive coverage, which apply to your car’s damages in accidents you caused or damages from non-collision events like weather.

- Roadside assistance (towing/labor coverage): Roadside assistance would have helped me out if I was stranded on the side of the road and needed a tow, a spare tire, or fuel delivery. Esurance’s version covers up to $75 per incident.

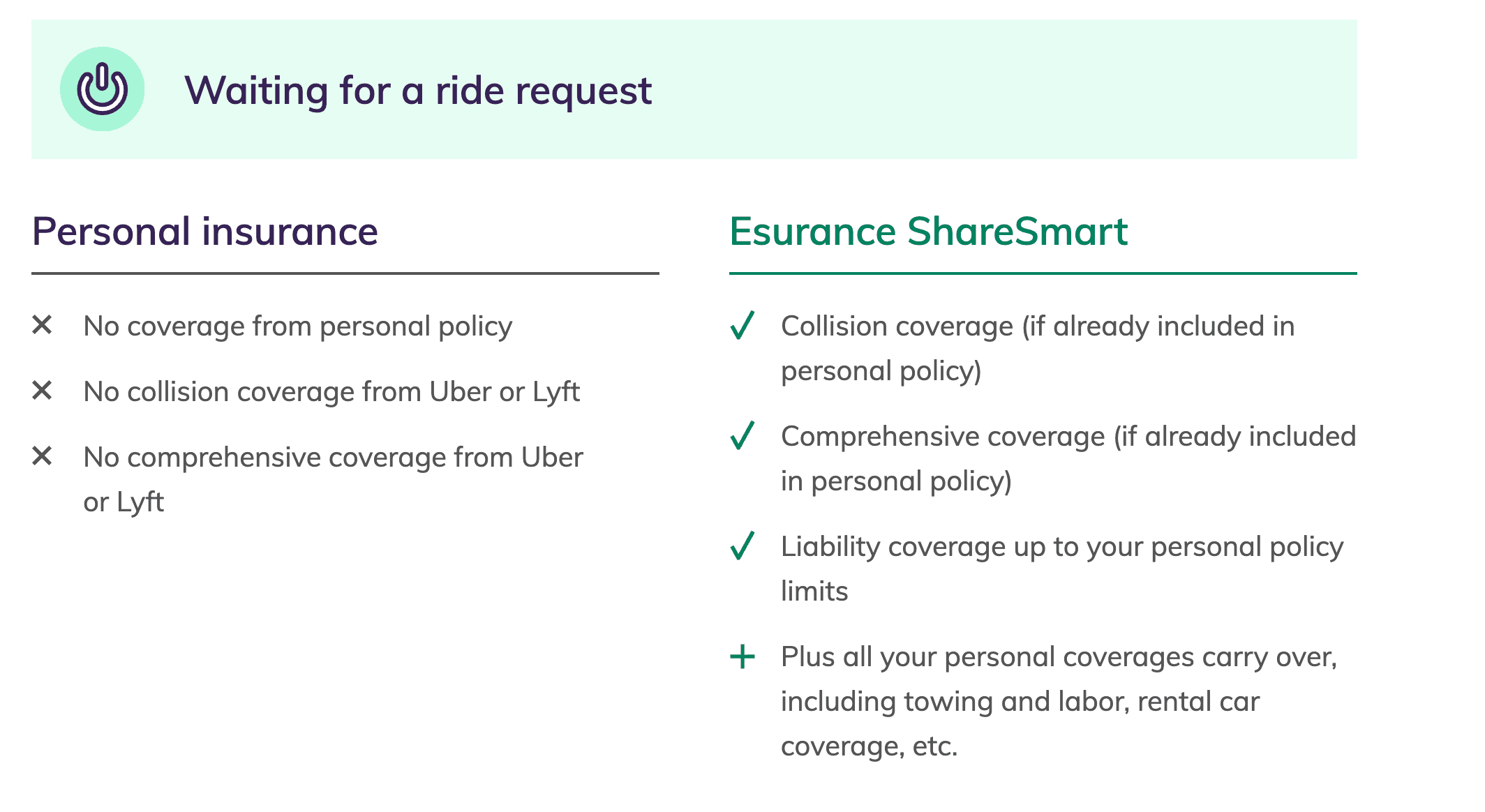

- Rideshare coverage: If you drive an Uber or Lyft in New Jersey, California, or Illinois, you can buy rideshare coverage from Esurance. While you may already think you’re covered, your rideshare employer’s insurance does not cover you when you’re waiting for a ride request or driving to pick someone up, and personal auto insurance does not cover commercial activities like rideshare driving. Rideshare coverage fills in the gaps, making sure you’re covered for the entire time you’re working, not just when a passenger is in your car. Plus, if you have damages, you won’t owe two deductibles to both your rideshare company and Esurance. Rather, you’ll pay the lower of the two, and Esurance will cover the remainder. Learn more about what rideshare drivers need to know about car insurance.

Just like the discounts, this is a pretty small number of coverages. There’s no accident forgiveness, no new-car replacement coverage, and no classic car coverage, to name a few.

TIP:

If you want more options, check out our Allstate review, as Esurance’s parent company offers a much wider range of coverages, including classic car coverage, personal umbrella coverage, and car insurance for driving in Mexico.

Esurance: Customer Satisfaction Data

While some third-party companies rate Esurance as its own entity, others review Allstate only. Overall, Esurance has positive financial strength reviews. However, I was concerned by the amount of complaints Esurance has received via the National Association of Insurance Commissioners’ Customer Complaint Index. The company has a 16.54, meaning it’s received nearly 17 times as many complaints as it should for a company of its size. This is among the worst ratings I’ve ever seen, leading me to think that customer service is a weak spot for Esurance.

| Category | Esurance score/rating |

|---|---|

| J.D. Power Claims Satisfaction | 816 out of 1,000 in California (under Allstate); above average2 |

| Better Business Bureau | 1.12 out of 5-star customer rating, A+ customer rating3 |

| AM Best | A+ (Superior)4 |

| National Association of Insurance Commissioners Customer Complaint Index | 16.545 |

| Moody’s | A3 senior6 |

| Standard & Poor’s | BBB+ (stable) |

Filing a Claim With Esurance

It’s very straightforward to file a claim with Esurance. I could do it online, by contacting my claims rep over the phone, or by using the Esurance app. But while that all sounds well and good, I was concerned by what I found when I looked into Esurance’s (via Allstate) third-party ratings regarding claims. In the 2024 CRASH Network Report, Allstate got a D+ rating, making it the lowest-ranked of the top 10 insurers.7 Numerically, that score translates to a 315, while the national average is 657, more than twice as high. Altogether, Allstate is ranked 80th, and when there are only 88 companies on a list, you know it’s a bad sign.

On a brighter note, Allstate fared well when it came to J.D. Power’s 2023 Claims Satisfaction study, with an overall rating of 882 out of 1,000 (the national average is 878). In general, the claims process goes faster if you use features like photo claims in the Esurance app. Just add a few photos right in the app, and you’ll receive a response in as little as one day. I recommend using this feature, if it’s available in your state, but make sure the damage is properly visible. Otherwise, it could lengthen the claims process significantly.

Esurance Website and Mobile App

Esurance’s website, while it looks nice and color coordinated, is pretty basic in terms of actual information. There was a little information about coverages and discounts, a space to submit claims, and exactly eight frequently asked questions and answers. That was it; there was no extensive support section or information about which policies, like photo claims, are available in specific states.

As far as Esurance’s apps go, there are two available: One is the regular Esurance app, which allows you to check out your policy, view your ID card, update your contact information, submit and track claims, and change coverages.

There’s also the DriveSense app, a requirement for that discount.

In general, I had no issues with the Esurance app, but the DriverSense Android app didn’t fare as well. Android users said it often didn’t record trips, leaving them indefinitely in “trips calculating” mode and requiring the user to start from scratch. So, if you’re an Android user, DriveSense may not make much sense for you, pun intended.

| App | Rating (out of 5) |

|---|---|

| Esurance Mobile | iPhone — 4.8 stars

Android — 4.3 stars |

| DriveSense Mobile by Esurance | iPhone — 4.5 stars

Android — 2.7 stars |

Methodology: How We Review Insurance Companies

Whenever we review an insurance company, we are keeping the following factors in mind for assessment:

- Coverages: Aside from the auto insurance coverages that nearly every state requires, like liability coverage at the very least, we look for coverages like rental car reimbursement, roadside assistance, and gap insurance, a typical requirement for loans and leases.

- Premiums: We use national data to compare average annual rates for full and minimum coverage, people with an at-fault accident or DUI on their record, and people with a low credit score.

- Customer experience: Aside from taking into account our own experiences getting quotes from companies, we look at third-party customer feedback from J.D. Power, the Better Business Bureau, and the National Association of Insurance Commissioners.

- Claims: We also find out how to submit claims, ideally on the web and on an app, as well as over the phone; how long claims typically take; and how customers have rated companies’ claims processes via J.D. Power and the CRASH Network.

- Financial strength ratings: We analyze the most recent data surrounding creditworthiness from financial reporting organizations like AM Best, Moody’s, and Standard & Poor’s.

- Mobile app and website: Finally, we make sure that each company has a user-friendly website and mobile apps for both iPhones and Android devices.

Frequently Asked Questions

Is Esurance good for auto insurance?

Yes. Esurance is a good company for auto insurance due to its strong creditworthiness, its lower-than-average annual cost of full coverage insurance, and its discount for safe driving. However, it’s not the best company for customer service, as it has higher-than-average rates of customer complaints to the National Association of Insurance Commissioners. Also, many of its policies are underwritten by Allstate, its parent company, or Direct Auto, another Allstate affiliate.

Which company is cheaper than Esurance?

Some companies with cheaper average annual costs for auto insurance include:

- Metromile

- USAA (available only to military members, veterans, and their families)

- Erie

- GEICO

- Travelers

- State Farm

That being said, Esurance’s average annual price is only $1,712, which is 12 percent below the national average.

Is Esurance still owned by Allstate?

Yes. As of April of 2024, Allstate still owns Esurance.

Is Esurance being phased out?

It’s unclear if Esurance is being phased out. Despite the 2019 announcement from Allstate that the company will phase out the Esurance brand in 2020, as of April 2024, Esurance still exists as an Allstate-owned brand that accepts new customers. According to a 2020 press release from Allstate, the company has instead decided to merge Esurance and Allstate’s brand direct operations, restructuring the brands so that Esurane can remain. That being said, some Esurance customers are redirected to Allstate or another of Allstate’s affiliates, Direct Auto, so it’s unclear if it underwrites any of its own policies or if it will be phased out eventually.

Citations

Why Choose Direct Auto Insurance? Direct Auto Insurance. (2024).

https://www.directauto.com/about-directAuto Insurance Customer Satisfaction Plummets as Rates Continue to Surge, J.D. Power Finds. J.D. Power. (2023, Jun 13).

https://www.jdpower.com/business/press-releases/2023-us-auto-insurance-studyAllstate Insurance. Better Business Bureau. (2024).

https://www.bbb.org/us/il/northbrook/profile/insurance-companies/allstate-insurance-0654-12014144Rating and state licenses. Esurance. (2024).

https://www.esurance.com/legal/rating-and-state-licensesEsurance Prop & Cas Ins Co National Complaint Index Report. National Association of Insurance Commissioners. (2024).

https://content.naic.org/cis_refined_results.htmAllstate Corporation (The). Moody’s. (2024).

https://www.moodys.com/credit-ratings/Allstate-Corporation-The-credit-rating-600010717/reportsTop Rated U.S. Car Insurance Companies for 2024. Crash Network. (2024).

https://www.crashnetwork.com/irc/