Horace Mann Insurance Review 2026

Horace Mann offers auto insurance with discounts and benefits designed for the education community.

Get quotes from providers in your area

Questions? Call us: 844-966-4864

Horace Mann is a financial services company offering products and services tailored to the education community, which includes teachers, administrators, and public school employees. It was founded in 1945 in Springfield, Illinois, and provides a range of insurance and investment products.

Although it doesn’t exclusively sell to educators, it offers specific discounts, programs, and other benefits for those working in education, so it is best suited to this demographic. In addition to auto insurance, Horace Mann underwrites property, life, umbrella, and supplemental health insurance policies. Its financial products include 529 college savings plans and retirement accounts.

Horace Mann sells through local agents, making it ideal for those who want to work with and purchase via a human instead of online. In addition, it has strong third-party financial stability ratings, so it can be trusted to pay out claims.

I’m a senior editor and analyst at AutoInsurance.com, and I’ll walk you through what you need to know about Horace Mann using our team’s industry research, as well as my own knowledge and experience, to help you decide if it’s a good fit for you.

Jump to:

Quick Look: Horace Mann Pros & Cons

Pros

Great discounts for teachers and other educators

Local agents provide personalized service

Access to tailored programs like Student Loan Solutions

Cons

No online quotes or purchasing

Limited coverage options

Who Is Horace Mann Auto Insurance Best For?

Horace Mann auto insurance is best for drivers who work in education and aren’t looking for a digital-first insurance company.

Horace Mann Is Best for Those Who:

- Work in education

- Don’t have specialized coverage needs

- Are looking to bundle their car insurance with other policy types, like property or life insurance

Horace Mann Is Not Best for Those Who:

- Are not part of the education community

- Prefer to purchase policies online and value highly-rated digital tools

- Need coverages beyond the basic options

How Much Does Horace Mann Car Insurance Cost?

Pricing data for Horace Mann is not widely available, but the company advertises that educators save an average of $624 per year when switching from other insurers. If you work in education, I recommend getting a quote to see if you could save money.

TIP:

If you’re considering switching insurers, comparing quotes from at least three different companies is usually a good idea. Keep in mind that Horace Mann’s benefits for educators may outweigh a slightly cheaper quote you get elsewhere.

What Real Horace Mann Policyholders Say

In addition to sharing my experience getting a quote with Horace Mann, our team analyzed real-life customer feedback and review patterns to understand what other drivers think. By analyzing over 300 customer reviews from major platforms like Reddit, BBB, and more, we identified common themes in customer satisfaction, complaints, and overall experience. Here’s what we found:

| Category | Details |

|---|---|

| Total Reviews Analyzed | ~320 reviews analyzed (Trustpilot, BBB, plus select Yelp and Reddit insights) |

| Top 3 Positives |

|

| Top 3 Negatives |

|

| Key Takeaway | Horace Mann stands out for its educator-focused savings and personalized local agent service. Many customers report excellent enrollment experiences and meaningful savings, especially teachers. While some encounter service or claims challenges, strong, responsive local agents often make a positive difference in satisfaction. |

How You Can Save on Your Policy With Horace Mann

Horace Mann offers several discounts to help policyholders save on insurance, including some aimed specifically at educators.

Highlighted Discount: Educator Discount

Horace Mann offers an auto insurance discount to teachers and administrators because it states that, according to its research, educators tend to be better-than-average drivers.

Highlighted Discount: Educator Advantage

As an educator, you can also qualify for Horace Mann’s Educator Advantage package, which is available at no additional cost on auto and home insurance policies.

With an auto policy, this package includes:

- Liability coverage when you transport students in a vehicle insured by Horace Mann

- Up to $1,000 in personal property coverage for work-related items if they are stolen or damaged in your car

- Up to $1,000 in pet coverage

In addition, Horace Mann will pay to replace your car if your new car is totaled, and will cover up to $35 in transportation expenses in the event you’re away from home and feel you can’t drive safely (applies only if you already carry rental reimbursement coverage).

The Educator Advantage package also waives the deductible for the following situations:

- Covered vandalism losses on or near school property or while you’re attending a school-sponsored event

- A collision claim on or near school property or while you’re attending a school-sponsored event

- A collision claim with another car insured by Horace Mann

Other Horace Mann Discounts

Horace Mann also offers the following discounts:

- Multiline discount: Also known as a bundling discount, this saves you money if you have multiple policies with Horace Mann, such as auto and home or renters.

- Multicar discount: Get a discount if you insure more than one vehicle in your household.

- Payroll discount: Save money if you choose to have your premiums deducted directly from your paycheck.

- New customer discount: Available to new customers who switch their insurance to Horace Mann.

- Safe driver: Drivers who have gone a certain amount of time without violations can save money.

- Car safety discount: Get a discount for having safety features installed in your vehicle, which may include anti-lock brake systems or airbags.

- Good student discount: If you have a full-time student on your policy, like a teen or college student, they can get a discount for maintaining a certain GPA.

FYI:

Horace Mann offers more discounts than those that are listed on its website, so be sure to ask your agent about all of the savings opportunities you are eligible for when you get a quote.

Horace Mann Quote and Purchase Process

Horace Mann sells policies via its network of local agents, but it allows you to begin a quote online by clicking “Get a Quote” on its homepage. You’ll first need to select what type of insurance you want a quote for — you can choose between auto, home, renters, life, and retirement.

I selected auto to try out the quote process and was prompted to input my ZIP code. The next screen asked whether I work in education.

I answered no, and I then had to input my basic information, including my name, address, email address, and phone number. As soon as I had done that, I was shown the following screen, which informed me that I would be hearing from an agent to finish the quote process.

(Note that we’ve taken out the agent’s information here for privacy reasons, but it shows the agent’s name, address, and phone number.)

I also tested out a different ZIP code because my initial quote process was unexpectedly quick and basic, and interestingly, it opened up a more robust portal:

This time, I was prompted to add more of my current information and coverage preferences using one of three methods: linking the info via my current insurance company, looking up public records, or simply entering it myself.

Either way, you will need to complete your quote and purchase process by speaking with an agent, but you may have a different experience beginning your quote online depending on your ZIP code.

What Types of Auto Insurance Coverage Does Horace Mann Offer?

Horace Mann’s coverage options are pretty basic. You’ll find standard options, including liability, collision, comprehensive, and uninsured motorist coverage, but not much beyond that.

The only two add-on coverages that Horace Mann offers aside from those listed above are as follows:

| Coverage | What it covers |

|---|---|

| Rental Reimbursement | This helps pay for a rental car up to a daily limit if your car is in the shop due to a covered incident. |

| Emergency Road Service | This covers roadside assistance services including towing, mechanical labor at the place of your breakdown, battery jump start, tire change, gas, oil, and water delivery, and lockout service. The cost of items delivered is not covered. |

Horace Mann: Customer Satisfaction

Customer reviews for Horace Mann are mixed. It’s a relatively niche, specialized insurer, so it’s not included in some of the common customer satisfaction metrics I would usually look at, such as J.D. Power’s studies.

However, it is included in the CRASH Network’s annual report card, which surveys auto shops about their experiences working with insurers on claims. This can give you an idea of how smooth the process would be as a customer. Horace Mann earned a score of B- on the 2025 report card, ranking 48th out of 97 insurers with a score of 701. The average was a score of 663, equivalent to a C+, placing Horace Mann right around or slightly above average.

I also checked the NAIC Complaint Index for the company, which is 1.96 for private passenger insurance complaints. This means that Horace Mann receives about twice as many complaints as would be expected for a company of a similar size in the market. Across all policy types, its complaint index is 4.86.

In terms of financial stability, Horace Mann has an A rating from AM Best, which is a good rating and indicates that it can handle its financial responsibilities — namely, paying out claims.

| Category | Horace Mann score |

|---|---|

| NAIC Complaint Index1 | 1.96 — above average (filtering for private passenger complaints) |

| CRASH Network 2025 Insurer Report Card2 | B- — 48th out of 97 |

| AM Best Financial Strength Rating3 | A (Excellent) |

Filing a Claim With Horace Mann

You can file a claim with Horace Mann online, over the phone with your agent, or, technically, via the mobile app. However, the claim filing on the mobile app is through a web browser, so there’s not much difference between going through the app versus the website.

If you file a claim using the website portal, you’ll need to first select whether you’re a Horace Mann customer or had an incident with a Horace Mann customer. Then, you can select the type of claim you’re filing: emergency roadside service, glass-only auto, auto, or property. You will move on to providing more details about the claim, and you’ll need your policy number or your name and phone number. The company notes that this process takes about 10 minutes to complete.

Once you submit the claim, it will be forwarded to a Horace Mann regional office, and you will be contacted shortly after by a representative from the office handling the claim. The timeline for the claims process will depend on the severity of the incident and whether someone else was involved.

If the damage is minor, Horace Mann may allow you to submit through the Horace Mann photo app, but you’ll need instructions from your claim representative if your claim is eligible.

Horace Mann's Website and Mobile App

Horace Mann’s website is easy to navigate and provides detailed information on the products and services that it offers. You can start a quote right from the homepage, although as I mentioned earlier, you will not be able to complete it without speaking to an agent.

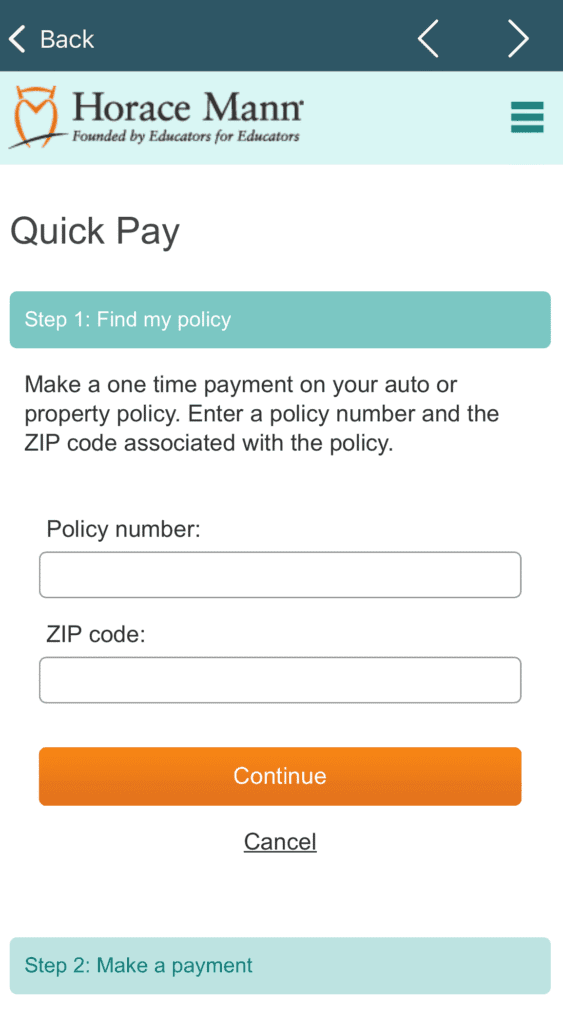

The website also provides access to online customer accounts, through which policyholders can view policy documents, make payments, and more. There is a Quick Pay option that allows you to make a payment without logging in.

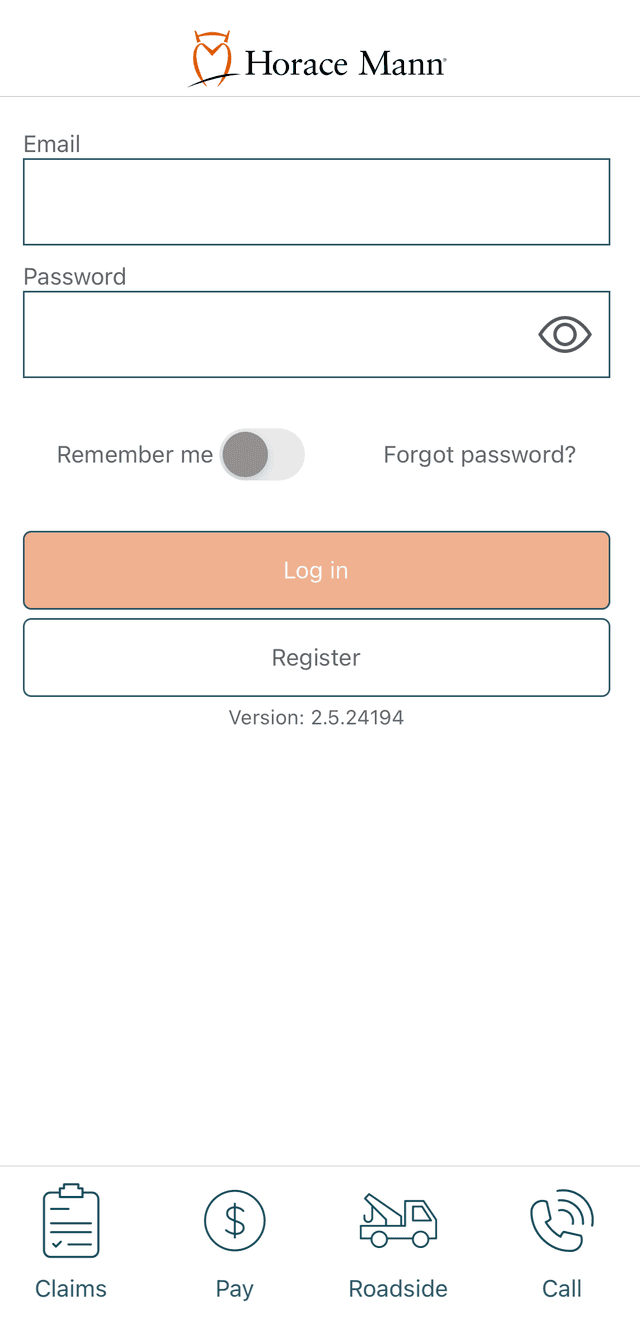

Horace Mann also has mobile apps for both iPhone and Android. I downloaded the iPhone app to test out what I could without logging in. The homescreen, unsurprisingly, features a login screen, but it also has additional options at the bottom for claims, payments, roadside assistance, and calling customer service.

The claims feature is not native to the app and instead takes you to a web browser, which doesn’t provide the best user experience. It also provides a phone number if you prefer to call in your claim. The Pay option is similar to the Quick Pay link on the website, allowing you to make a payment without logging in — you’ll just need your name and policy number, as shown below.

The mobile app has low ratings, especially on the Apple App Store. Most users complain about limited functionality and trouble accessing their accounts. It’s worth noting that the most recent reviews are over a year old, so some of the complaints may be outdated, but I would not recommend Horace Mann if digital and app functionality is a priority for you.

| App Version | Rating (out of 5) |

|---|---|

| iPhone (App Store) | 1.9 stars |

| Android (Google Play) | 3.1 stars |

Frequently Asked Questions

Horace Mann insurance is not only for teachers, although it’s designed for teachers and other people who work in education. It offers educators specific discounts and benefits, so it’s likely not the best insurance option for drivers who don’t work in education.

Horace Mann has solid financial strength ratings from several third-party rating agencies. It has an “A” rating from AM Best, S&P, and Fitch Ratings, and an “A2” rating from Moody’s Investor Service.

Annuities are one of the retirement products that Horace Mann offers. There are several types of annuities to choose from, including variable, fixed, immediate, and deferred annuities. Annuities allow you to pay premiums to an insurance company, either as a lump sum or over time, which accumulate interest and enable you to receive guaranteed income payouts later in life, generally during retirement.

Methodology – How We Review Insurance Companies

At AutoInsurance.com, we evaluate auto insurance providers based on four key factors:

- Price (40%): We analyze average full and minimum coverage premiums for safe drivers with good credit, as well as various driver profiles, including those with violations or low credit. We also consider the variety of available discounts. Full coverage averages use the following limits:

- Bodily injury liability: $100,000 per person/$300,000 per accident

- Property damage liability: $10,000 per accident

- Comprehensive and collision: $500 deductible

- Claims Handling (25%): Customers expect insurers to provide clear communication throughout the claims process, as well as a fair evaluation of damages and timely payment or resolution. We assess claims practices through sources like the CRASH Network Insurer Report Card and J.D. Power’s Claims Satisfaction Report. We also consider financial strength from sources like AM Best.

- Customer Experience (25%): We evaluate how seamless insurers make it for prospective customers to get a quote and purchase a policy, as well as make changes to or access existing documents. We consider the availability and quality of both online and agent interactions, as well as the user-friendliness of the company’s website and mobile app. Our sources include J.D. Power studies, the NAIC complaint index, BBB ratings, and app store reviews.

- Coverage Options (10%): We review each company’s coverage offerings, particularly whether they have options beyond the state-required minimums, such as accident forgiveness, gap coverage, and more.

Read more about our ratings and methodology.

Citations

Consumer Insurance Search Results. NAIC. (2025).

https://content.naic.org/cis_refined_results.htm?TABLEAU=CIS_COMPLAINTS&COCODE=22578&:refresh2025 Insurer Report Card. CRASH Network. (2025).

https://www.crashnetwork.com/irc/AM Best Releases Global Insurance Study. A.M. Best. (2025).

https://news.ambest.com/PR/PressContent.aspx?refnum=35050&altsrc=2