The General Insurance Review 2025

If you’ve had trouble finding auto insurance because of a DUI, bad credit, or an at-fault accident, The General may be the insurance company for you.

Compare quotes from top providers

I’m a low-risk driver, or at least that’s how car insurance companies view me. I’ve never caused an accident, I’ve never been convicted of driving under the influence, and my credit score is solid. But if that’s not the case for you, whether you’ve had an at-fault accident or just forgot to pay a bill, you will want to find a company that caters to high-risk drivers. The General is just that company. It offers solid insurance coverage for drivers with a bad driving record, but note that because it caters to high-risk drivers, it has higher-than-average prices to account for this risk.

As a senior writer for AutoInsurance.com, I’ve researched dozens of car insurance companies, from the lowest risk to the highest, from the cheapest car insurance to the most expensive, and in both categories, The General is at the top of the pack.

Quick Look: The General Pros and Cons

Pros

Accepts people with an SR-22

Available to people with a low credit score

Accepts people who have been involved in an at-fault accident, convicted of a DUI, or received multiple speeding tickets

Cons

Not available in all states

High prices

Who Is The General Auto Insurance Best For?

The General is best for someone with an SR-22, FR-44, at-fault accident, DUI, or speeding ticket on their record. It’s also a good choice for someone with poor credit, as some companies don’t accept drivers whose scores fall below a certain threshold.

However, if you have a stellar driving record and great credit, you’ll find more affordable car insurance elsewhere. I got much lower quotes from Erie and GEICO, for example.

How Much Does The General Car Insurance Cost?

Compared to the annual averages for full coverage car insurance, The General is the most expensive, with an average annual cost of $3,069. It’s also expensive for minimum coverage at $959 annually. Compared to the national averages of $2,399 and $635, respectively, these are high prices. It’s also one of the most expensive providers for those with an at-fault accident at $4,332, compared to an average of $2,812.

The General’s higher-than-average prices are to be expected, given it caters to high risk drivers. If you have a DUI, need an SR-22, or fall into another category, you may find The General’s prices competitive compared to a standard provider’s.

That being said, as I played around on the request-a-quote website, I found that The General is actually fairly average when it came to rates for people with a DUI. While the national average is $3,305 per year, The General costs slightly less at $3,300.

If you’ve been convicted of a DUI and have an SR-22 or FR-44, proof of a certain amount of legally required coverage, consider The General, as you may find surprisingly affordable prices.

Compare Rates From The General

| Company | Average annual cost for full coverage | Average annual cost for minimum coverage |

|---|---|---|

| AAA | $3,014 | $1,056 |

| Allstate | $2,605 | $840 |

| Erie | $1,647 | $581 |

| Farmers | $2,979 | $1,002 |

| The General | $3,069 | $959 |

| GEICO | $1,731 | $517 |

| Liberty Mutual | $3,061 | $1,467 |

| Mercury | $2,014 | $738 |

| Nationwide | $1,808 | $718 |

| Progressive | $1,960 | $638 |

| State Farm | $2,167 | $674 |

| Travelers | $1,597 | $576 |

| USAA | $1,407 | $356 |

| National Average | $2,399 | $417 |

How You Can Save on Your Policy With The General

That being said, these are just average prices. Prices will vary by state, customer, and a slew of other factors. Don’t forget to consider car insurance discounts.

Safe Driving Discount

When I got a quote, I got a discount because my driving record has been clean for the past five years.

Good Student Discount

Additionally, I’m a full-time student with a 4.0 GPA, so The General rewarded me with a discount. This discount appears to be available for all full-time students, regardless of age.

Homeowner’s Discount

Unfortunately, I’m a renter, so I couldn’t get the homeowner’s discount, but if you’re lucky enough to own a home, you can save money. This discount applies even if another insurer covers your home, not just The General.

Here is a list of all the discounts The General offered me:

- Multi-car

- Homeowner’s

- Good grades for full-time students

- Cars with factory-installed passive restraints

- Defensive driving course

- Clean driving record for the past three to five years

- Double your deductible for the first 45 days of your policy

- Pay in full

My Experience Getting a Quote and Buying a Policy With The General

I was wondering exactly how much The General would charge me for car insurance, so I went on its website. While I could have called to speak to someone directly, I prefer dealing with computers, not humans, so I typed in my ZIP code and clicked “Start a Quote.”

From there, the website asked me for a lot of information, like my insurance history, residence type, and email address, as well as who drives the vehicle. I had to fill out my name, birth date, gender, and marital status, as well as if I’ve completed a DMV-approved accident prevention course, for discount purposes. Finally, it asked if I’ve had any violations or accidents in the past three years; I’ll get a lower quote due to my lack of accidents.

DID YOU KNOW?

In most states, it’s legal for car insurance companies to use customers’ marital status to determine premiums. Married people are less likely to have claims, and they tend to get lower rates than single people.

Of course, it also asked me about my vehicle, including its year, make, and model; whether I own, lease, or finance it; and whether or not my car has an anti-theft device. I had the opportunity to purchase roadside assistance from Nation Safe Drivers for an additional $11.50 per month. Not too bad for 24/7 tows, first aid, jump-starts, and other services!

Once I filled out all of the relevant information, The General gave me a 12-month quote: a $96.29 down payment along with 11 monthly payments of $108.41. In total, that quote was only $1,156, less than the national average and much less than The General’s average of $3,069.

If I accepted that, I could have completed the purchase process online, selecting a policy type, limits, and deductibles. I loved that this process took only a few minutes and that I didn’t need to speak with any agents to get there. But if you want to talk to an agent over the phone, that’s an option as well.

What Types of Auto Insurance Coverage Does The General Offer?

When it comes to car insurance coverage, The General offers the standards: liability insurance, which includes bodily injury and property damage coverage; comprehensive and collision coverage; uninsured/underinsured motorist coverage; and medical payments coverage.

These are the basics that every provider I’ve looked at has, but in addition, The General offers rental car coverage, gap insurance, and roadside assistance, as I found out when I requested a quote. Here’s some information about these services:

- Rental coverage: Rental car coverage means that if my car were getting repaired or replaced under a covered claim, like someone rear-ended me, The General would reimburse me for a rental car to use in the meantime.

- Gap insurance: Gap insurance is a requirement for people who lease their vehicles or purchase them with a loan. Essentially, if you total your car, meaning its repairs cost more than its actual cash value (ACV), the amount you’d get if you totaled it tomorrow, gap insurance covers the difference between the ACV and what you still owe on the lease/loan. This ensures that you won’t have to pay for a totaled car.

- Roadside assistance: Last but not least, The General outsources roadside assistance to Nation Safe Drivers. I would’ve definitely chosen this feature, as it offers towing of up to 15 miles, mechanical first aid, and battery, tire, and lockout services. That means if I need a jump-start, tire change, new battery, or even fuel, I could get it delivered straight to my car, 24/7.

NOTE:

The General’s roadside assistance covers up to five calls per year, or up to three every six months. It also includes a rental car reimbursement for up to $15 per day for a maximum of five days.

The General does not have accident forgiveness or add-ons like classic car insurance and new-car replacement coverage. Also note that you can’t buy insurance from The General in all states. The quickest way to find out if The General sells policies where you live is to enter your zip code into its online quote tool.

Currently, I’m living in Pennsylvania, a state that requires $15,000 of bodily injury coverage per person, $30,000 per accident, and only $5,000 of property damage coverage per accident. It also requires $5,000 of medical payments coverage.1 These liability limits are not high enough, and important coverages like uninsured/underinsured motorist coverage are not included. I played around with the request-a-quote feature to see how much I’d pay for various levels of coverage. Note that I have a clean driving record, so my rates will be much lower than those of someone with a bad driving record.

The quote I got was for limits of $15,000/$30,000/$10,000 for bodily injury and property damage, but when I changed those limits to $100,000/$300,000/$50,000, the highest limits possible, my quote became a down payment of about $140 with monthly payments around $150, for a total annual premium of $1,680. I recommend playing around with your limits to see how much you’d pay for The General.

The General: Customer Satisfaction Data

Since The General is not one of the larger auto insurance companies in the U.S., I couldn’t find any ratings for it on financial strength websites like Moody’s, Standard & Poor’s, or AM Best. It also wasn’t included on J.D. Power’s 2024 auto insurance customer satisfaction survey.2

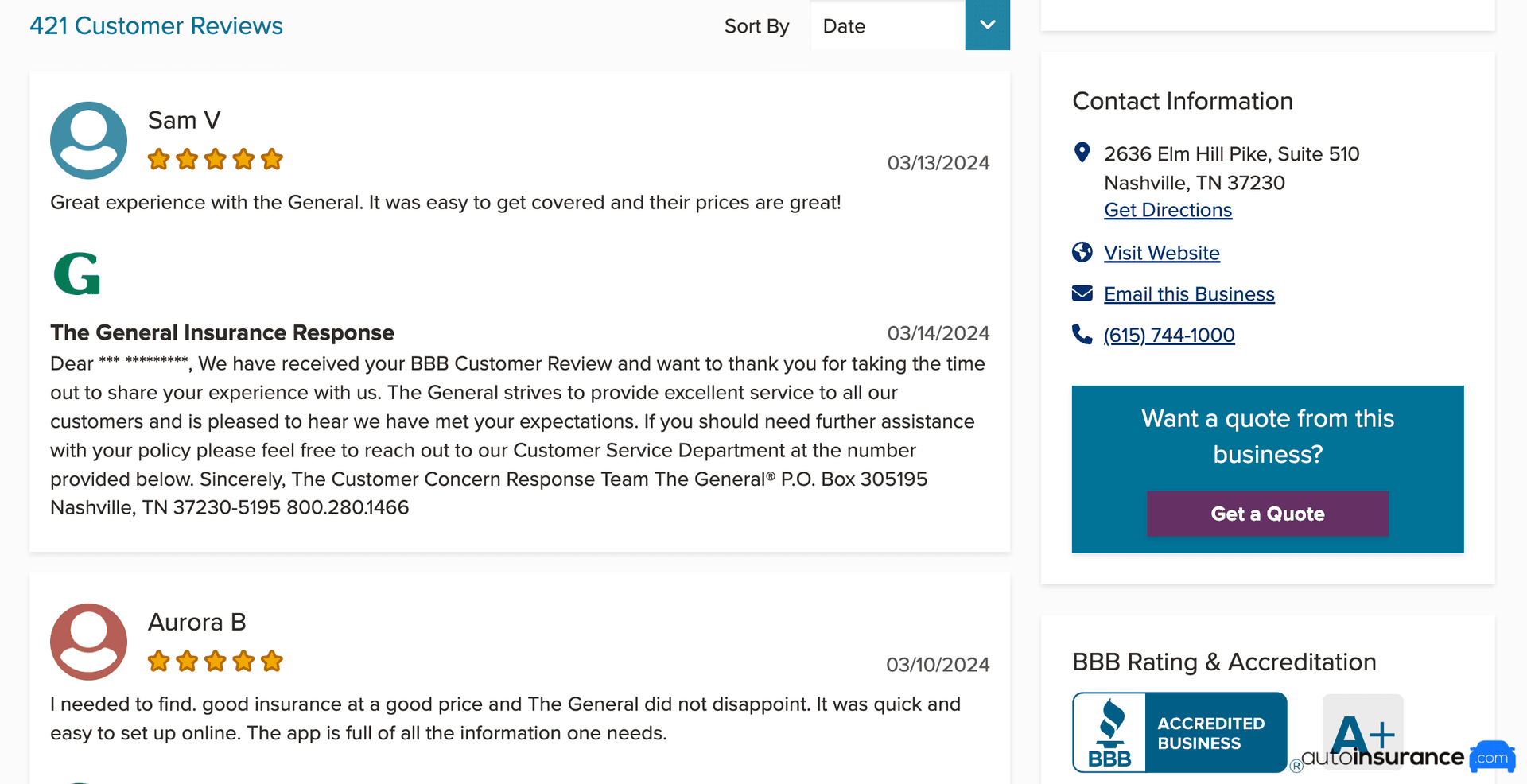

The good news is that The General has been accredited by the Better Business Bureau (BBB) since 2005 and has an overall A+ rating.3 Additionally, The General has an average of 2.89 stars (out of 5) stars from 246 customer reviews. Many people said they got reasonable prices and it was easy to get covered, and I loved the fact that The General responded to most of the reviews personally. Most people just go on the BBB’s website to complain, so this is a good sign, in my eyes.

Finally, while it remains a separate brand, The General is owned by American Family, which holds an A rating for financial strength from AM Best. This means that The General can reliably pay claims.

Filing a Claim With The General

There are a few ways to file a claim with The General. You can do it online, call its 24/7 claims number, or use the iOS or Android app, which I’ll discuss in more detail below. For existing claims, email, fax, and mail are options as well. I recommend the app so you can keep track of everything and upload photos from your phone easily.

The length of the claims process varies. For simple incidents, like a small fender-bender, it could take a few weeks, but for more complicated incidents, like a head-on collision with injuries or fatalities, it could take months.

I was curious how The General ranks nationally in terms of how well it handles claims, so I looked at the 2025 Insurer Report Card from CRASH Network, an independent publication that covers the collision industry. I’ll be blunt: The General ranks 95th out of 97 companies, beating only Trexis Insurance and Loya. It received a grade of D- and a score of 179, well below the national average of 663. So, it’s fair to say that you may be waiting closer to a few months rather than a few weeks for your claim to be processed. Learn more about how long auto insurance claims take.

The General Website and Mobile App

The General has an iOS and an Android app. As of this writing, the iOS app has a 4.7-star rating (out of 5), and the Android version has a 4.7-star rating. I found the app super easy to use. I didn’t even have to log in to pay a bill, display my ID card, or enroll in paperless billing, and what’s even better is I could’ve signed in using my Facebook, Google, or Apple profile, not requiring me to make a separate account. Even looking at customer reviews on the iOS app, I noticed that most of the bad reviews weren’t about the app itself, but mostly billing issues, which The General responded to politely.

I found the website similarly easy to use. It took me only a few minutes to find the information I was looking for about car insurance coverages, and getting a car insurance quote was easy and frictionless. I also loved the fact that I could purchase the policy online; this is a rarity with auto insurance companies. Most of them still operate solely over the phone after you fill out an online quote, but The General makes it easy to be antisocial and get coverage.

Methodology: How We Review Insurance Companies

At AutoInsurance.com, our reviews account for four main factors:

- Price (40%): We analyze average premiums for full and minimum coverage, including for high-risk drivers such as those with DUIs, multiple accidents, or low credit scores. We also consider available discounts that may apply to these drivers, and availability of SR-22 filing. Our full coverage averages use the following limits:

- Bodily injury liability: $100,000 per person/$300,000 per accident

- Property damage liability: $50,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person/$100,000 per accident

- Comprehensive and collision: $500 deductible

- Claims Handling (25%): We evaluate insurers based on their ability to provide prompt, transparent, and efficient claims handling, with clear communication, fair evaluation of damages, and timely payment or resolution. Our assessments draw from sources like the CRASH Network Insurer Report Card and J.D. Power’s Claims Satisfaction Report, alongside financial strength ratings from AM Best and S&P. Real-life customer experiences are included whenever available.

- Customer Experience (25%): We assess the ease of obtaining quotes, purchasing policies, and making changes or accessing documents. The quality of both online and agent interactions, as well as the functionality of the company’s website and mobile app, are also considered. Our sources include J.D. Power studies, the NAIC complaint index, BBB ratings, and app store reviews.

- Coverage Options (10%): We review each provider’s coverage offerings that go beyond state-required minimums, such as accident forgiveness, gap coverage, and more.

Learn more about our ratings and methodology sources.

Frequently Asked Questions

Why is The General so expensive?

You may have an expensive car insurance premium from The General because of an at-fault accident, violation, or poor credit. Because The General caters to high-risk drivers, its average premium is much higher than the national average.

Is The General owned by Progressive?

No, Progressive does not own The General. Rather, The General is associated with PGC Holdings Corp., which is owned by American Family Insurance.

Where can I pay for my The General car insurance?

You can pay for your car insurance either on the company’s website, over the phone, or in the Android or iOS app.

What is the number to call for The General’s customer service?

The General’s customer service phone number is 1-844-328-0306.

Citations

Automobile Insurance Guide. Pennsylvania Insurance Department. (n.d.).

https://www.insurance.pa.gov/Documents/auto_guide.pdfTrust Emerges as Top Driver of Customer Satisfaction with Auto Insurance as Prices Continue to Surge, J.D. Power Finds. J.D. Power. (2024, June 11).

https://www.jdpower.com/business/press-releases/2024-us-auto-insurance-studyThe General Insurance: BBB Business Profile. Better Business Bureau (BBB). (n.d.).

https://www.bbb.org/us/tn/nashville/profile/auto-insurance/the-general-insurance-0573-10965Insurer Report Card. CRASH Network. (2025).

https://www.crashnetwork.com/irc/