GEICO Car Insurance Pricing 2026

The average GEICO policy is $1,867 annually ($156 monthly) for full coverage and $558 annually ($46 monthly) for minimum coverage.

Get quotes from providers in your area

Questions? Call us: 844-966-4864

GEICO offers cheap auto insurance for both low- and high-risk drivers. Even if you have driven without a license, have poor credit, or have a traffic violation on your record, GEICO has coverage options at lower rates than most nonstandard insurers. We’ll break down what you can expect to pay with GEICO and highlight some of our favorite features.

GEICO Car Insurance Rates

The average rate from GEICO is $156 monthly ($1,867 annually) for full coverage and $46 monthly ($558 annually) for minimum coverage. Here are how your rates could differ based on your driver profile:

| Driver profile average cost | GEICO Full Coverage Monthly | National Full Coverage Monthly |

|---|---|---|

| Good driver with good credit | $156 | $196 |

| Driver with a speeding ticket | $180 | $228 |

| Driver with poor credit | $243 | $344 |

| Household with teen driver | $428 | $505 |

| 25-year-old driver | $169 | $177 |

| Senior driver | $151 | $187 |

| Driver with an at-fault accident | $236 | $263 |

| Driver with a DUI | $359 | $372 |

NOTE:

Everyone’s insurance rates are different. Your driver profile, which determines your rates, is based on your driving record, credit history, age, location, and other factors.

GEICO Car Insurance Pricing by State

| State | GEICO Full Coverage Annual Avg. | GEICO Minimum Coverage Annual Avg. |

|---|---|---|

| Alabama | $2,089 | $793 |

| Alaska | $1,692 | $451 |

| Arizona | $2,034 | $735 |

| Arkansas | $2,183 | $576 |

| California | $1,760 | $456 |

| Colorado | $2,416 | $555 |

| Connecticut | $1,622 | $694 |

| Delaware | $2,545 | $1,004 |

| Florida | $3,135 | $761 |

| Georgia | $2,734 | $839 |

| Hawaii | $1,016 | $362 |

| Idaho | $1,180 | $282 |

| Illinois | $2,129 | $636 |

| Indiana | $1,545 | $513 |

| Iowa | $1,716 | $379 |

| Kansas | $1,692 | $413 |

| Kentucky | $2,531 | $821 |

| Louisiana | $3,478 | $874 |

| Maine | $1,241 | $423 |

| Maryland | $1,679 | $651 |

| Massachusetts | $1,694 | $499 |

| Michigan | $2,092 | $914 |

| Minnesota | $2,838 | $901 |

| Mississippi | $2,318 | $586 |

| Missouri | $2,240 | $671 |

| Montana | $2,238 | $382 |

| Nebraska | $2,128 | $367 |

| Nevada | $2,907 | $1,090 |

| New Hampshire | $1,347 | $485 |

| New Jersey | $1,920 | $719 |

| New Mexico | $1,689 | $745 |

| New York | $2,081 | $838 |

| North Carolina | $1,841 | $837 |

| North Dakota | $1,990 | $503 |

| Ohio | $1,229 | $415 |

| Oklahoma | $2,315 | $603 |

| Oregon | $2,254 | $1,026 |

| Pennsylvania | $2,069 | $710 |

| Rhode Island | $2,755 | $1,030 |

| South Carolina | $2,108 | $745 |

| South Dakota | $2,254 | $420 |

| Tennessee | $1,824 | $519 |

| Texas | $2,247 | $689 |

| Utah | $1,763 | $798 |

| Vermont | $1,420 | $495 |

| Virginia | $1,364 | $592 |

| Washington | $1,884 | $633 |

| Washington, D.C. | $2,206 | $867 |

| West Virginia | $1,883 | $659 |

| Wisconsin | $1,510 | $417 |

| Wyoming | $1,648 | $196 |

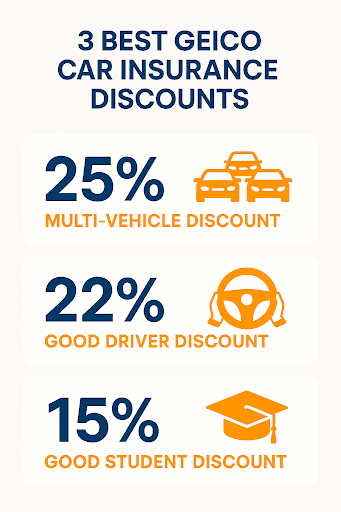

Discounts With GEICO

GEICO offers a variety of discounts that can help you lower your premium.

Here’s a complete list of discounts:

| Discount name | Discount qualification | Potential savings |

|---|---|---|

| Anti-lock brakes | If your vehicle has a factory installed anti-lock braking system | 5% |

| Anti-theft system | If your vehicle has a built-in anti-theft system to prevent car theft; discount applies to comprehensive coverage. | 23% |

| Daytime running lights | If your vehicle has daytime running lights as standard equipment | 3% |

| New vehicle discount | If your vehicle is three model years old or newer | 15% |

| Clean driving record | If you’ve been accident-free for at least one year | 22% |

| Restraint device | If your vehicle has air bags, seat belts and/or passive restraint systems; discount applies to medical payments or PIP coverage. | 23% |

| Defensive driving | If you’ve completed a defensive driving course | Varies |

| Driver’s education course | If a young driver in your family has completed a driver’s education course | Varies |

| DriveEasy | If you enroll in DriveEasy, GEICO’s, usage-based discount program, and practice safe driving habits. | 5% to 15%, depending on your driving score — can potentially raise raises for risky driving behaviors |

| Good student | If you or a driver on your policy is a full-time student in good academic standing | 15% |

| Early shopper | When you buy a new GEICO policy in advance of your existing policy’s expiration; higher discount the earlier you shop. | Varies |

| Emergency deployment | If you’re part of an emergency deployment to an imminent danger zone | 25% |

| Federal employee | If you’re an active or retired federal employee | 12% |

| Homeownership | If you own a home, even if you insure it with another provider. | Varies |

| Internet quote | For shopping online. | Varies |

| Membership & employee | If you belong to one of GEICO’s 500+ affiliate groups | Varies |

| Military | If you are active duty or retired from the military, or a member of the National Guard or Reserves | 15% |

| Multivehicle | If you insure more than one car with GEICO | 25% |

| Multipolicy | If you have an auto policy as well as a homeowners, renters, condo, mobile home, or life insurance policy with GEICO | Varies |

| Auto pay | When you set up automatic payment for your premiums. | Varies |

| Paid in full | When you pay for your policy upfront. | Varies |

| Paperless | For receiving important documents electronically. | Varies1 |

Favorite Features

GEICO offers more than just affordable rates. Here are some of the features that stand out:

Superior Financial Strength

GEICO has an A++ (Superior) financial strength rating from AM Best.2 Financial strength ratings indicate an insurance provider’s ability to pay its customers’ claims. A Superior rating means GEICO has the capital and management capacity to cover customer losses in the event of accidents, which is necessary for claims fulfillment.

Emergency Roadside Assistance

If you run into issues on the road, GEICO offers 24/7 roadside assistance. This additional coverage provides the following:

- Battery jump starts

- Fuel delivery (fuel cost not included)

- Lockout services (up to $100)

- Tire change services (if you have a spare)

- Towing to the nearest repair facility

- Winching your vehicle if it is stuck on or immediately next to a publicly-maintained roadway

Here’s what you need to do to request help:

- Open the GEICO Mobile app and select Roadside Assistance.

- Visit https://geico.app.link/staticAutoERSGetHelpNow.

- Call (800) 42-GEICO.

Compare: Geico vs Allstate

Mechanical Breakdown Insurance

For vehicles less than 15 months old or with fewer than 15,000 miles, GEICO offers mechanical breakdown coverage. In the event of a vehicle breakdown, this additional coverage applies to the following:

- Repair costs

- Replacement parts

- Other mechanical problems

To start your mechanical breakdown insurance claim, call (800) 443-7411.

Commercial Auto Insurance

Small-business owners can find competitive rates for commercial auto insurance. GEICO’s commercial auto insurance covers the following types of vehicles:

- Semi trucks

- Cars

- Food trucks

- Pickup trucks

- Service utility trucks

- Vans

Where Is GEICO Available?

GEICO provides private passenger automobile insurance in all 50 states and the District of Columbia.

FYI

Always get more than one car insurance quote before you purchase an insurance policy. Compare car insurance quotes from different car insurance companies to find the lowest auto insurance rates.

How to Cancel GEICO Auto Insurance

If you need to cancel your policy with GEICO, here’s how:

- Have your GEICO policy number accessible.

- Call 800-841-1587.

- Ask the licensed agent to proceed in canceling your policy. If you’re prompted to speak to the automated system, say “cancel insurance policy” and then “auto.”

You can cancel your policy at any time with no fees.

GEICO Contact Information

Here’s how you can get in touch with GEICO:

- Online: www.geico.com/contact-us/

- By mail: Mailing addresses differ by state and inquiry.

- By phone: 1-800-207-7847

Conclusion

GEICO offers competitive rates and solid coverage options for standard and nonstandard insurance policies. With the financial strength to back claims, you can rest easy knowing you and your vehicle have protection in the event of an accident. Check out our GEICO review to learn more about what GEICO has to offer.

Frequently Asked Questions

Yes. In general, car insurance premiums have risen in the last few years due to increased natural disasters, inflation, and higher car accident rates. However, GEICO’s average full coverage rates are 21 percent lower than the national average.

GEICO usually offers cheaper premiums than Progressive. GEICO charges $1,867 annually for a full coverage policy, while Progressive’s full coverage policies cost $2,060 annually. While GEICO’s prices are generally lower, Progressive does charge 35 percent less annually than GEICO for drivers with a DUI conviction.

GEICO offers rideshare insurance — but unlike other insurance companies, it doesn’t offer this coverage as an add-on to your personal policy. Instead, GEICO’s rideshare insurance typically replaces your personal policy with a commercial policy. It provides continuous protection throughout all phases of rideshare driving, including when the app is on but you haven’t accepted a ride, when you’re en route to pick up a passenger, and when you have a passenger in your car

GEICO does not offer rideshare coverage everywhere — for example, it is not available in Florida or New York. To get a quote or check if rideshare insurance is available in your area, you should contact GEICO directly or speak with a local agent.

Yes, GEICO auto insurance covers rental cars if you have rental reimbursement coverage on your policy. If you do not pay to have rental reimbursement on your policy, GEICO does not cover a rental car. If you’re renting a car from a rental company, your personal policy extends to any rental car you drive. GEICO recommends getting additional coverage if you rent a car that has a market value higher than your own vehicle.

Yes, GEICO offers SR-22 and FR-44 certification.

Methodology

Our goal is to offer consumers precise and impartial information. Our methodology includes the following steps for evaluating companies:

- Cost (40 percent): We analyze average premiums for full and minimum coverage across multiple driver profiles, including those with strong credit and clean records, as well as individuals with DUIs, at-fault accidents, or poor credit. We also factor in available discounts. Our full coverage calculations are based on these standard policy limits:

- Bodily injury liability: $100,000 per person/$300,000 per accident

- Property damage liability: $50,000 per accident

- Uninsured/underinsured motorist bodily injury: $50,000 per person/$100,000 per accident

- Comprehensive and collision coverage: $500 deductible

- Claims Service (25 percent): We examine how efficiently insurers manage claims, focusing on their speed, communication transparency, and fairness in assessing damage. Our analysis uses independent sources such as the CRASH Network Insurer Report Card and J.D. Power’s Claims Satisfaction Survey. We also review financial strength ratings from agencies like AM Best and S&P to ensure insurers have the ability to meet claims obligations. Where applicable, firsthand experience and real customer feedback adds further insights.

- Customer Satisfaction (25 percent): We evaluate the quality of the customer experience, from obtaining a quote to policy management. This includes ease of making policy changes, accessing documents, and interacting with representatives. Our assessment draws on data from sources like J.D. Power, the NAIC complaint index, Better Business Bureau ratings, and app store reviews. We also interview customers and include our own experiences, aiming to provide readers with firsthand insights.

- Coverage Options (10 percent): We assess each company’s range of coverage options, with an emphasis on additional protections beyond the state-required minimums. We give extra weight to insurers that offer add-ons such as rideshare coverage, rental reimbursement, rideshare insurance, and more.

Learn more about our methodology and ratings.

Sources

Car Insurance Discounts – Save Money on Auto Insurance. GEICO. (2025).

https://www.geico.com/save/discounts/car-insurance-discounts/AM Best Affirms Credit Ratings of Members of GEICO. AM Best. (2025, February 21).

https://news.ambest.com/PR/PressContent.aspx?refnum=35768&altsrc=9