Best Car Insurance in Washington in 2026

PEMCO, State Farm, USAA, Mutual of Enumclaw, and The Hartford are our top picks for car insurance rates, discounts, and coverage options in Washington.

Average Cost in Washington

- Full Coverage: $142 monthly

- Minimum Coverage: $56 monthly

Average Cost in Washington

- Full Coverage: $169 monthly

- Minimum Coverage: $62 monthly

Average Cost in Washington

- Full Coverage: $122 monthly

- Minimum Coverage: $33 monthly

Key Takeaways:

- The average cost of full coverage car insurance in the Evergreen State is $2,433, while minimum coverage costs an average of $787 — both of which are higher than the respective national averages.

- Based on our analysis of Washington auto insurance companies, PEMCO offers the best value coverage in the state. Drivers should also consider State Farm, USAA, Mutual of Enumclaw, and The Hartford, depending on their needs.

- The rates shown are averages and are useful for estimating what you might pay, but keep in mind that they may not match your quoted price.

Summary of the Best Auto Insurance in Washington

- Best Value: PEMCO

- Best for Major Insurer: State Farm

- Best for Military and Veterans: USAA

- Best for Young Drivers: Mutual of Enumclaw

- Best for Seniors: The Hartford

A comparison of top car insurers in Washington for various needs, including budget drivers, military families, young drivers, and seniors.

Compare the Best Cheap Auto Insurance in Washington

| Company | Full Coverage Monthly Avg. in WA | Minimum Coverage Monthly Avg. in WA | Northwest customer satisfaction (J.D. Power) |

|---|---|---|---|

| PEMCO | $142 | $56 | Below average |

| State Farm | $169 | $62 | Above average |

| USAA | $122 | $33 | Above average |

| Mutual of Enumclaw | $137 | $57 | Not rated |

| The Hartford | Data not available | Data not available | Above average |

| Washington | $203 | $66 | – |

Breaking Down the Best Cheap Auto Insurance in Washington

1. Best Value - PEMCO

What We Like Most:

- State-specific discounts

- Headquartered in Seattle

- Large selection of agents in Washington

Why we chose it

Available in Washington and Oregon only, PEMCO is our choice for the best value car insurance in Washington. It has some of the cheapest rates for minimum and full coverage in the state. While it ranked below average in J.D. Power’s study, it earned a spot on the CRASH Network’s Honor Roll with a B rating, and it receives far fewer customer complaints than average according to the NAIC.

PEMCO offers a wide range of car insurance discounts, including discounts exclusive to drivers in Washington, such as an auto and umbrella bundling discount and a leased auto discount. In addition, if you drive less than 8,000 miles per year, you may be eligible for a sizable discount. Speak to a PEMCO agent to learn more about which savings opportunities you may qualify for. PEMCO offers its insurance through 67 independent agents who can ensure you’re getting the right coverage and understand the needs of customers in your area.

Who it’s best for

People on a budget, drivers who want to work with a local agent, low-mileage drivers

PEMCO Washington Pricing

| PEMCO Washington | Full coverage | Minimum coverage |

|---|---|---|

| Monthly | $142 | $56 |

| Annually | $1,707 | $672 |

| Difference from Washington average | -30% | -15% |

2. Best for Major Insurer - State Farm

What We Like Most:

- Largest provider in Washington

- Ranked first for Northwest customer service according to J.D. Power

- Young driver-focused safety program

Why we chose it

State Farm insures nearly 10 percent of all drivers in Washington, making it the largest car insurance company in the state.1 It sells policies through local agents and ranked first in J.D. Power’s most recent Auto Insurance Study for Northwest customer satisfaction (USAA scored higher, but it’s not technically ranked). It’s a great option for drivers who want the best of both worlds: a major national insurer with a strong customer service record and the personalized touch of a local company.

State Farm doesn’t have the cheapest rates in Washington, but its rates are below average for both full and minimum coverage. It offers several ways to save, including a teen driver program and good student discounts for full-time students under age 25 who have a 3.0 GPA or higher. The company also has a good driving discount that is available to drivers who have had no moving violations or accidents in the past three years.

Who it’s best for

Drivers who prefer to purchase a policy from a national insurer, people who want to work with a local agent

State Farm Washington Pricing

| State Farm Washington | Full coverage | Minimum coverage |

|---|---|---|

| Monthly | $169 | $62 |

| Annually | $2,028 | $743 |

| Difference from Washington average | -17% | -6% |

3. Best for Military and Veterans - USAA

What We Like Most:

- Cheapest average rates in Washington

- Best regional customer service scores

- Military-focused coverage and discounts

Why we chose it

USAA memberships are exclusive to military members, veterans, and military families. With some of the cheapest rates in Washington, excellent service scores, and membership perks, USAA is one of the highest-reviewed car insurance providers in the state and the country. Its average full coverage rate is $1,465 annually, which is 40 percent below the state average.

USAA earned a score of 729 for overall customer satisfaction in the Northwest in J.D Power’s study, which is 100 points higher than the regional average. While USAA technically doesn’t qualify to rank due to its limited availability, this still indicates customers are highly satisfied with the service they receive.

The company also offers additional perks and membership benefits, including banking resources, access to financial advice and tools, and discounts on rental cars and repair shops.

DID YOU KNOW?

Washington has nearly 50,000 active duty military members, including about 30,000 National Guard and reserve members. It’s also home to one of the largest veteran populations, with nearly 500,000 veterans residing in the Evergreen State.2

Who it’s best for

Military members, veterans, and military families; people who want to take advantage of USAA perks, like free financial guidance; safe drivers

USAA Washington Pricing

| USAA Washington | Full coverage | Minimum coverage |

|---|---|---|

| Monthly | $122 | $33 |

| Annually | $1,465 | $399 |

| Difference from Washington average | -40% | -49% |

4. Best for Young Drivers - Mutual of Enumclaw

What We Like Most:

- Excellent customer satisfaction ratings

- Young driver-focused telematics program

- Competitive rates

Why we chose it

Mutual of Enumclaw is another regional insurer that operates in seven states in the Northwest and parts of the Southwest. It ranked 10th on the CRASH Network Report Card with a B rating, indicating that auto repair shops have a seamless experience dealing with the company when customers file claims. It also has a Complaint Index of 0.93 from the NAIC, which means it receives fewer customer complaints than average.

Families with teen drivers will find affordable rates from Mutual of Enumclaw, whose average rate in Washington for young drivers is 38 percent cheaper than the state average at $4,484 per year. It also has a driver training program called teenSMART®, which combines online lessons with real-world driving practice. Once a teen completes the program, they will receive a significant discount. The program costs $70 to sign up, but it can easily pay for itself if successfully completed.

Who it’s best for

Families with teen drivers, drivers looking for a full coverage policy, those who want to work with a local agent

Mutual of Enumclaw Washington Pricing

| Mutual of Enumclaw Washington | Full coverage | Minimum coverage |

|---|---|---|

| Monthly | $137 | $57 |

| Annually | $1,644 | $684 |

| Difference from Washington average | -32% | -13% |

5. Best for Seniors - The Hartford

What We Like Most:

- Excellent regional customer service

- Exclusive benefits for AARP members

- Policies tailored for seniors

Why we chose it

The Hartford underwrites home and auto insurance policies exclusively for AARP members through its partnership with the organization. It has strong regional customer service ratings, ranking second on J.D. Power’s study for Northwest customer satisfaction. It also ranked above average in J.D. Power’s Auto Claims Satisfaction Study. You must be at least 50 years old and an AARP member to access insurance from The Hartford, but you can add younger spouses and children to your policy.

While rate data is not available for Washington, The Hartford tends to offer affordable rates for seniors. It offers many discounts, including a discount of up to 10 percent if you’ve maintained a clean driving record for five years, and up to 40 percent with the company’s telematics program, TrueLane. It also has a variety of coverages, including some tailored to seniors like RecoverCare, which helps pay for home services like cleaning if you’re injured in an accident.

Who it’s best for

Older drivers, AARP members

Best Cheap Picks — Detailed Customer Satisfaction Summary

| Company | J.D. Power Auto Insurance Study – Northwest3 | CRASH Network Report Card4 | J.D. Power Claims Satisfaction5 | NAIC Complaint Index6 |

|---|---|---|---|---|

| PEMCO | 619 | B | Not rated | 0.32 |

| State Farm | 648 | C- | 716 | 2.46 |

| USAA | 749 | D+ | 741 | 3.10 |

| Mutual of Enumclaw | Not rated | B+ | Not rated | 0.93 |

| The Hartford | 645 | C+ | 716 | 2.18 |

| Average | 629 (out of 1,000) | C+ | 700 (out of 1,000) | 1 |

| What the study measures | Customer satisfaction regionally, based on responses from over 40,000 customers | Claims handling and payment practices, based on an annual survey of collision repair shops | Satisfaction with the claims process, based on responses from nearly 10,000 customers who recently filed a claim | Consumer complaints relative to market share. The lower the score, the better |

Average Cost of Auto Insurance in Washington

Full Coverage Rates in Washington

With an average annual rate of $2,433 per year for full coverage, car insurance in Washington is slightly more expensive than the national average of $2,356.

| Category | Full coverage average (annual) | Full coverage average (monthly) |

|---|---|---|

| Washington Average | $2,433 | $203 |

| National Average | $2,356 | $196 |

Minimum Coverage

Minimum coverage in Washington is also a bit more expensive than the national average ($722 annually) at $787 per year, or $66 per month.

| Category | Minimum coverage average (annual) | Minimum coverage average (monthly) |

|---|---|---|

| Washington Average | $787 | $66 |

| National Average | $722 | $60 |

Auto Insurance Costs by City in Washington

Among the state’s largest cities, Spokane offers the cheapest average rate at $2,298 per year, which is below the state average. Tacoma, the state’s third-largest city by population, has the highest average rate of $2,916 per year — significantly more than the state average. Keep in mind that these are average rates for cities, and rural areas tend to have lower auto insurance rates.

| City | Average annual premium | Average monthly premium |

|---|---|---|

| Tacoma | $2,916 | $243 |

| Seattle | $2,856 | $238 |

| Bellevue | $2,628 | $219 |

| Vancouver | $2,478 | $207 |

| Spokane | $2,298 | $192 |

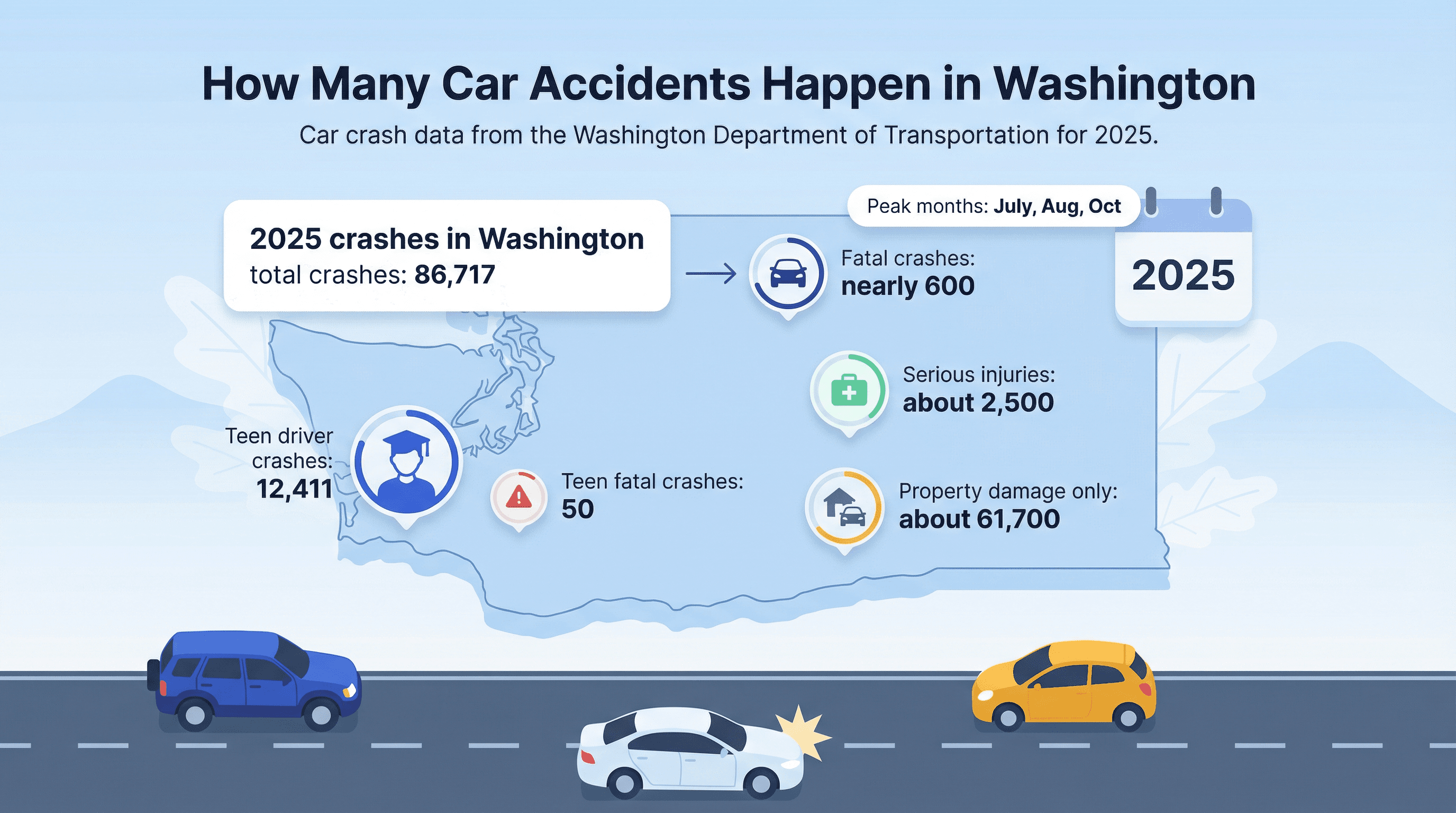

How Many Car Accidents Happen in Washington?

According to data from the Washington Department of Transportation, there were 86,717 car accidents in Washington in 2025.7 Nearly 600 of those accidents were fatal, around 2,500 resulted in serious injuries, and around 61,700 involved only property damage. The months during which most crashes occurred were October, July, and August.

Teen drivers were involved in 12,411 total accidents, including 50 fatal crashes.

Minimum Auto Insurance Requirements in Georgia

Washington drivers must carry auto insurance with at least the following minimum coverage limits according to state law:

- Bodily injury liability: $25,000 per person/$50,000 per accident

- Property damage liability: $10,000 per accident

- Washington’s minimum coverage limits are quite low, and we recommend increasing your limits if you can afford it for added financial protection and peace of mind. If you’d also like coverage for damage to your own vehicle, you’ll need to add full coverage as well. In addition, it’s wise to include uninsured motorist coverage — if you’re hit by an uninsured driver and don’t have this coverage, your insurer will usually cover little to nothing.

FYI:

Washington ranks 10th in the country for the highest percentage of uninsured motorists.8 It’s a good idea to add uninsured/underinsured motorist coverage to your policy, which can save you thousands of dollars in a covered incident.

Methodology

We evaluated auto insurance providers in Washington based on four key categories: pricing, claims service, customer satisfaction, and insurance offerings. Here’s a breakdown of how we rated insurers in each area:

- Pricing (40%): We analyzed average premiums across a range of driver profiles and coverage levels throughout Washington. This includes rates for both minimum liability and full coverage, along with variations based on age, driving history, credit score, bundled policies, vehicle types, and driving frequency. Full coverage averages use the following limits:

- Bodily injury liability: $100,000 per person/$300,000 per accident

- Property damage liability: $50,000 per accident

- Uninsured and underinsured motorist bodily injury: $100,000 per person/$300,000 per accident

- Comprehensive and collision: $500 deductible

- Claims Service (25%): A smooth and reliable claims process is a top priority when choosing an insurer. To assess how well companies handle claims, we reviewed independent evaluations from sources like J.D. Power, CRASH Network, AM Best, and Moody’s. These ratings reflect each company’s ability to process and pay out claims fairly and efficiently.

- Customer Satisfaction (25%): A seamless experience matters at every step, from getting a quote to finalizing policy purchases. To gauge customer satisfaction, we analyzed complaint data and satisfaction scores from trusted sources, including the National Association of Insurance Commissioners (NAIC) and J.D. Power. We looked at how customers rate their experience during quoting, purchasing, and servicing their policies in Washington.

- Insurance Offerings (10%): We prioritize insurers that go beyond the basics. Companies that offer useful extras, including gap insurance, rental car coverage, roadside assistance, accident forgiveness, and rideshare coverage, earned higher marks in this category.

Read more about our ratings and methodology.

Frequently Asked Questions

USAA offers the cheapest rates for car insurance in Washington, with the average policy starting at $1,465 per year for full coverage. For non-military drivers, Mutual of Enumclaw offers the cheapest full coverage rates at $1,644 per year, and GEICO has the cheapest average minimum coverage rates at $650 annually.

Washington state car insurance is so expensive for several reasons, including its high rate of uninsured drivers and rising repair costs. However, your rate will depend on factors unique to you, like your driving record, age, and vehicle type, so it’s still possible to find affordable rates.

Individuals with fleets of 26 or more vehicles may be eligible for a self-insurance policy. Contact the Driver Records department at the Department of Licensing for more information.

Yes, Washington is an at-fault state, which means the party responsible for an accident is also responsible for paying damages and injuries to the other party.

Washington is a pure comparative negligence state, which means you’re able to collect damages proportional to your degree of fault. If, for example, you’re 90 percent at fault for an accident, you can still seek payments for 10 percent of your damages/injuries.

Sources

2024 Market Share Reports for Property/Casualty Groups and Companies by State and Countrywide. National Association of Insurance Commissioners. (2025, June).

https://content.naic.org/sites/default/files/publication-msr-pb-property-casualty.pdfWashington. Military OneSource. (2026).

https://statepolicy.militaryonesource.mil/state/WAIt’s Now a Buyer’s Market for Auto Insurance, J.D. Power Finds. J.D. Power. (2025, Jun 10).

https://www.jdpower.com/business/press-releases/2025-us-auto-insurance-studyTop Rated U.S. Car Insurance Companies for 2025. Crash Network. (2025).

https://www.crashnetwork.com/irc/Satisfaction with Auto Insurance Claims Strained by Higher Deductibles, More Total Losses, J.D. Power Finds. J.D. Power. (2025, Oct. 28).

https://www.jdpower.com/business/press-releases/2025-us-auto-claims-satisfaction-studyConsumer Insurance Search Results. NAIC. (2026).

https://content.naic.org/cis_refined_results.htmReport. WSDOT. (2026).

https://remoteapps.wsdot.wa.gov/highwaysafety/collision/data/portal/public/Facts + Statistics: Uninsured motorists. Insurance Information Institute. (2026).

https://www.iii.org/fact-statistic/facts-statistics-uninsured-motorists