American National Car Insurance Review 2026

American National offers affordable auto insurance rates. Its customer service ratings are about average.

Get quotes from providers in your area

Questions? Call us: 844-966-4864

American National Insurance Co. is a national insurance company founded in 1905 and based in Galveston, Texas. It operates in all 50 states as well as Puerto Rico. American National was acquired by Brookfield Reinsurance in 2022.

American National offers a wide variety of insurance policies, including home, renters, auto, business, farm, recreational, classic car, and life insurance, as well as annuities. It does not offer online quotes or online purchasing; instead, it sells policies through a network of local agents.

American National’s rates are low, on average. However, there are limited opportunities for additional discounts, and the company’s customer service ratings are mixed. That said, American National has solid coverage options and some nice perks, such as rental reimbursement included with comprehensive and/or collision plans.

I used my knowledge and experience as a senior editor and analyst at AutoInsurance.com to put together this detailed review with everything you need to know about American National. If you’re considering the company, read on to determine whether it might be a good fit for you.

Quick Look: American National Pros and Cons

Pros

Availability in all 50 states

Affordable rates

Classic-car coverage

Cons

No online quotes

Average customer service ratings

Who Is American National Auto Insurance Best For?

American National operates nationwide, so wherever you are in the country, you can locate an agent to get a quote.

American National is best for those who:

- Prefer working with an agent for personalized service.

- Are looking for low-cost auto insurance.

- Lease or finance their car and need gap coverage.

American National is not best for those who:

- Are looking for a large selection of add-on coverages, such as accident forgiveness.

- Prioritize the absolute best customer service.

- Want to purchase and manage their policy entirely online.

How Much Does American National Car Insurance Cost?

American National has very affordable rates for full coverage policies. Its average rate of $1,005 per year ($84 per month) is 58 percent cheaper than the national average. Pricing data for American National’s minimum coverage policies is limited, but you can expect them to be even cheaper.

These rates are averages, so your premium will depend on factors like your driving record, your vehicle make and model, and your age.

The table below displays the average rates of major national insurers so you can see how American National’s rates compare:

| Company | Average annual premium for full coverage | Average annual premium for minimum coverage |

|---|---|---|

| Allstate | $2,605 | $840 |

| American Family | $1,936 | $604 |

| American National | $1,005 | Data unavailable |

| Farmers | $2,979 | $1,002 |

| GEICO | $1,731 | $517 |

| Nationwide | $1,808 | $718 |

| Progressive | $1,960 | $638 |

| State Farm | $2,167 | $674 |

| Travelers | $1,597 | $576 |

| USAA | $1,407 | $417 |

How You Can Save on Your Policy With American National

American National does not mention many auto insurance discounts on its website — but it already has low average rates, so this isn’t necessarily a major downside. American National does have a few savings opportunities, which I’ve covered below.

Deductible Savings

American National offers two perks related to your policy deductible. First, the company will discount or completely waive your auto deductible if you’re involved in an accident with another driver who is also insured by American National or one of its affiliate companies.

In addition, if you have both an auto and home policy with American National, the company will combine your deductibles if you incur damage to both your car and your home in the same incident. In other words, you’ll pay a single deductible for both claims instead of one for each.

American National doesn’t advertise any additional discounts. But most insurers offer discounts for bundling policies, so it’s worth asking an agent what’s available. Unlike most major insurers, American National does not have a telematics discount program.

GOOD TO KNOW:

A lack of discounts doesn’t necessarily mean higher premiums. You may get a cheaper rate with American National than with another company that offers you a bunch of discounts, so it’s always worth getting a quote.

American National Quote and Purchase Process

American National sells policies exclusively through local agents, so you can’t get a quote or purchase a policy online. You can easily locate an agent near you by clicking “Find an Agent” on the American National website and entering your ZIP code.

I tried searching for one, and it pulled up three agents within 30 miles of me. The listings included their office address, phone number, and email address. You can either stop by an office in person or call an agent to request a quote and get more information about coverage options in your area.

What Types of Auto Insurance Coverage Does American National Offer?

American National has a relatively basic selection of coverage types, but it does offer some useful add-ons. It has the standard options you’d expect, including liability, collision, comprehensive, uninsured and underinsured motorist, and medical payments coverage, as well as personal injury protection.

American National also offers these optional add-ons:

| Coverage | What it covers |

|---|---|

| Rental car coverage | Car rentals are included at no extra cost with comprehensive and collision plans, which can come in handy if your car is being repaired and is out of commission. |

| Custom parts and equipment coverage | If you have comprehensive and collision coverage, American National will cover up to $2,000 of customized equipment on your vehicle. |

| Gap coverage | This helps pay for the difference between your car’s value and the remaining balance on your loan if your vehicle is totaled. |

| Roadside assistance | American National’s 24-hour roadside assistance provides peace of mind in case your car breaks down. It includes services such as flat-tire changes, jump starts, gas delivery, towing, and windshield chip repair. |

| Added coverage endorsement (ACE) | American National has an added coverage endorsement to help cover replacement parts for damaged vehicles, but the company doesn’t provide any details on its website and recommends speaking to an agent. |

American National Customer Satisfaction

American National’s customer satisfaction ratings are mixed based on the metrics I reviewed. The company is not included in J.D. Power’s studies, but I used the 2025 CRASH Network Insurer Report Card and the National Association of Insurance Commissioners Complaint Index to get an idea of American National’s customer service record.

The CRASH Network Insurer Report Card rates insurers based on auto-body repair shops’ experience with them, which provides a unique perspective of how insurance companies handle claims. American National received a grade of C+ and ranked 54th out of 97 on the CRASH Network Insurer Report Card. These marks are higher than those of some major national insurers, such as State Farm and Progressive, but they’re a little below average.

American National has an NAIC Complaint Index score of 2.72, which means it receives almost three times as many complaints as average. However, when I filtered for private passenger passenger complaints only, that score dropped to 0.75, indicating American National receives fewer complaints than average in that subcategory.

American National’s financial stability is solid, however, with a rating of A from AM Best. This means it can handle its financial obligations and can be trusted to pay out legitimate claims.

| Category | American National score |

| NAIC Complaint Index1 | Overall: 2.72 (more complaints than average)

Private Passenger: 0.75 (fewer complaints than average) |

| 2025 CRASH Network Insurer Report Card2 | C+ (54th out of 97) |

| AM Best financial strength rating3 | A (excellent) |

Filing a Claim With American National

You can file a claim through American National’s online portal, via the app, or over the phone. To track your claim, you need to email claims@americannational.com. That process is not as seamless as those of some competitors that let you track your claim status right from your account without reaching out.

American National doesn’t provide much additional information on its claims process. But as with other insurers, you can expect the process to depend on the type and complexity of the damage and whether other parties were involved. Some claims may be resolved within a few days, while others can take months.

American National's Website and Mobile App

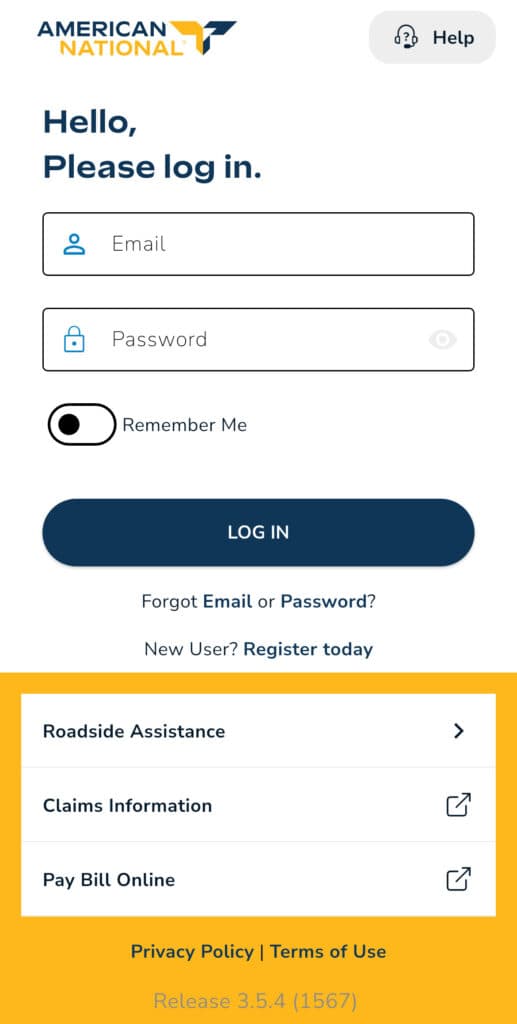

American National has an online platform and a mobile app that allow policyholders to access policy information, file claims, and pay bills. Its website provides an overview of all of the company’s products and services. However, it’s light on details, so it’s best to reach out to an agent if you have any questions.

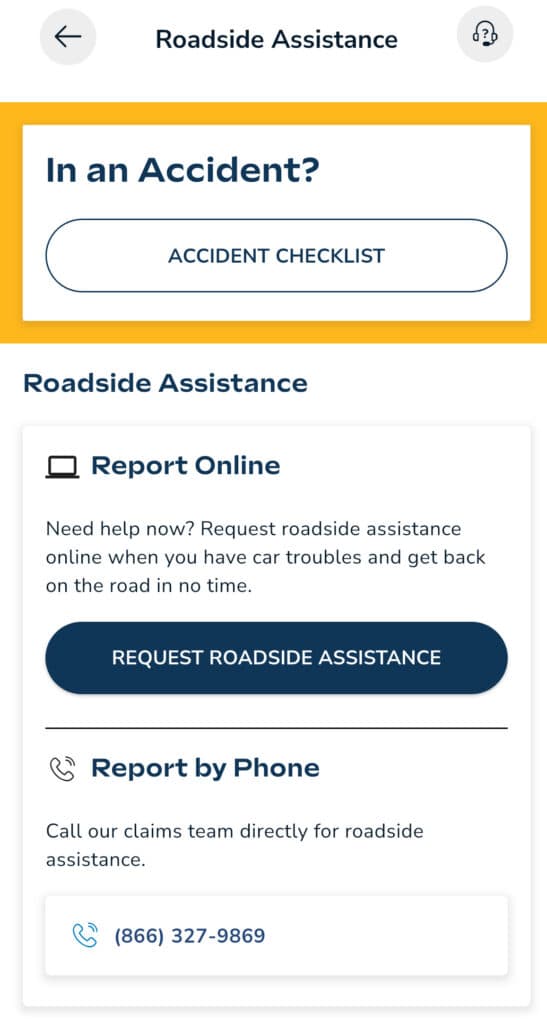

The auto insurance landing page has quick links to help you find an agent or to redirect you to roadside assistance if you need it. (However, this is not the most efficient way to get roadside assistance if you’re in urgent need of help. Instead, I recommend going through the app for that.) You can also pay a bill online.

I also downloaded the app, which allows you to contact support or request roadside assistance without logging in. It links to the claims information and bill-pay pages from the website via a web browser, but you can also file claims and pay bills from within the app if you log in.

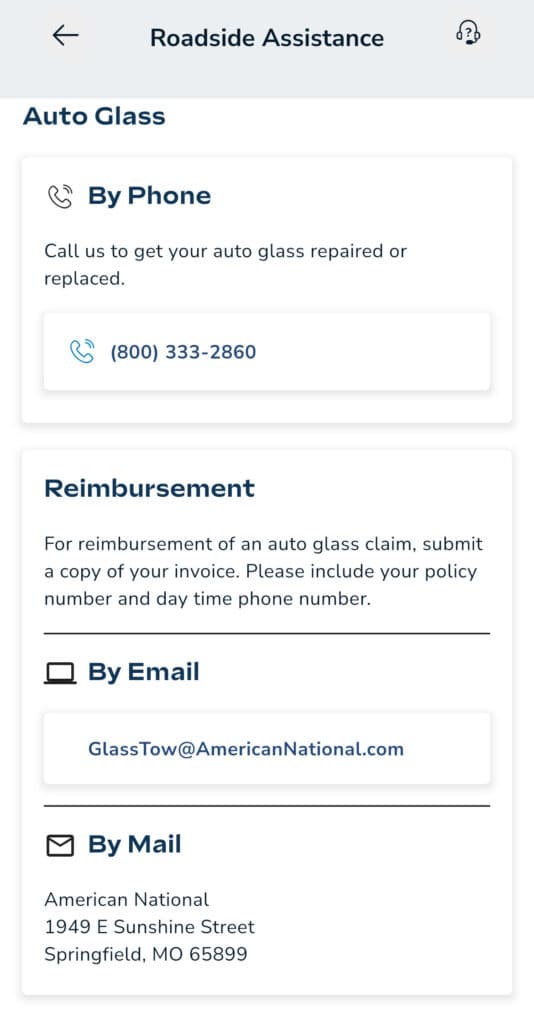

Clicking “Roadside Assistance” takes you to a page with an accident checklist, as well as a link to request roadside assistance online (which also opens a web browser). You’ll need to input your phone number to select the type of service you need. You can also call for help if you prefer.

This page also includes a phone number to call if you need your auto glass repaired or replaced.

American National’s app has low ratings in both the Apple App Store and the Google Play store, with most users reporting that it’s glitchy and doesn’t let them get past the verification screen.

| App version | Rating (out of 5) |

|---|---|

| iPhone (Apple App Store) | 3.2 stars |

| Android (Google Play) | 2.6 stars |

Bottom Line: Is American National Car Insurance Worth It?

American National stands out for its affordable rates and nationwide availability, making it a solid choice for budget-conscious drivers who prefer working directly with a local agent. Its financial strength and reliable core coverage options provide peace of mind, while perks like rental reimbursement and deductible savings add extra value.

However, American National’s limited online tools, lack of broad discounts, and average customer service scores might not be the best fit for drivers looking for a fully digital experience or superior claims handling.

If you want low-cost, straightforward auto insurance from a financially stable company, and you don’t mind (or prefer) doing business through an agent, American National is a good option. On the other hand,if you prioritize a smooth online experience or extensive add-ons, you may find better options elsewhere.

Frequently Asked Questions

American National is a good insurance company, depending on what you prioritize. It’s financially stable and has very affordable average rates for auto insurance, and it’s ideal if you prefer working with a local agent. However, it has mixed reviews for customer service and claims processing, and its mobile tools are not highly rated. Therefore, American National is not the best fit for people who prioritize these areas.

American National is owned by a holding company called Brookfield Reinsurance. It acquired American National Group Inc. in 2022.

American National offers several types of insurance, including auto, home, renters, business, farm, recreational, classic car, and life insurance. It also sells retirement products, including annuities.

American National has an A rating from Fitch Ratings, which measures financial strength, similar to AM Best. This high rating means the company is financially stable and can reliably meet its financial obligations.

Methodology: How We Review Insurance Companies

At AutoInsurance.com, we evaluate auto insurance providers based on four key factors:

- Price (40%): We analyze average rates for both full and minimum coverage for safe drivers with good credit. We also consider the available discounts. Full coverage averages use the following limits:

-

- Bodily injury liability: $100,000 per person/$300,000 per accident

- Property damage liability: $100,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person/$100,000 per accident

- Comprehensive and collision: $500 deductible

- Claims handling (25%): Claims processing is the most important role of an insurance company. We evaluate insurers’ claims practices through sources like the CRASH Network Insurer Report Card. We also consider financial strength from sources like AM Best.

- Customer experience (25%): We evaluate the whole customer experience, from getting a quote to purchasing and managing a policy. We also consider the availability of online tools, as well as local agents. Our sources include the NAIC Complaint Index, Better Business Bureau ratings, and app store reviews.

- Coverage options (10%): We review each company’s coverage offerings, including whether they have selections beyond the state-required minimums, such as accident forgiveness and gap coverage.

Read more about our ratings and methodology.

Sources:

Results by Complaint Index. NAIC. (2024).

https://content.naic.org/cis_refined_results.htm?TABLEAU=CIS_COMPLAINTS&COCODE=28401&:refreshTop Rated U.S. Car Insurance Companies for 2025. Crash Network. (2025).

https://www.crashnetwork.com/irc/American National Insurance Company. Better Business Bureau. (2025).

https://www.bbb.org/us/tx/galveston/profile/insurance-companies/american-national-insurance-company-0915-62463Search for a Rating. AM Best. (2025).

https://ratings.ambest.com/