Best Cheap Car Insurance in New York City

GEICO, Progressive, USAA, New York Central Mutual, Travelers, and Erie offer some of the best car insurance coverage in NYC.

Average Cost in New York City

- Full Coverage Monthly: $337

- Minimum Coverage Monthly: $134

Average Cost in New York City

- Full Coverage Monthly: $207

- Minimum Coverage Monthly: $111

Average Cost in New York City

- Full Coverage Monthly: $315

- Minimum Coverage Monthly: $143

Key Takeaways

- New York City is an expensive city for car insurance. Full coverage costs an average of $5,279 per year, and minimum coverage costs around $1,480 per year.

- GEICO is our pick for the best value car insurance in the city, while New York Central Mutual has the best customer satisfaction record.

- Average rates offer a general sense of what a given company might quote you, but your actual premium will vary based on personal factors like your age and driving record.

Our Top Picks for the Best Cheap Auto Insurance in New York City

- Best Value: GEICO

- Cheapest: Progressive

- Best for Military: USAA

- Best for Customer Satisfaction: New York Central Mutual (NYCM)

- Best for Non-Owners: Travelers

- Best for Bundling: Erie

Compare the Best Cheap Auto Insurance in New York City

| Company | Full Coverage Annual Avg. | Minimum Coverage Annual Avg. | New York Customer Satisfaction (J.D. Power) |

|---|---|---|---|

| GEICO | $4,041 | $1,610 | Above average |

| Progressive | $2,483 | $1,328 | Below average |

| USAA | $3,781 | $1,711 | Above average |

| New York Central Mutual | $5,235 | $1,448 | Above average |

| Travelers | $4,284 | Data not available | Above average |

| Erie | $4,157 | Data not available | Not rated |

| New York City | $5,279 | $1,480 | – |

Breaking Down the Best Cheap Providers in New York City

1. Best Value - GEICO

What We Like Most:

- Long list of discounts

- Affordable rates in NY for drivers with low credit

- Easy online quotes and purchasing

Why we chose it

GEICO ranks above average for customer satisfaction in the New York region according to J.D. Power. It also has below-average full coverage rates in New York City and offers a variety of discounts that policyholders can benefit from. These include discounts of up to 25 percent for insuring multiple vehicles, up to 23 percent for having safety features installed in your vehicle, and up to 22 percent for being a safe driver.

It offers quick online quotes and purchasing, so you can be on your way without ever having to speak with an agent.

Who it’s best for

Drivers looking for full coverage, those who want to buy a policy online, drivers with poor credit

GEICO New York City Pricing

| GEICO | Full coverage | Minimum coverage |

|---|---|---|

| Monthly | $337 | $134 |

| Annually | $4,041 | $1,610 |

| Difference from NYC average | -23% | +9% |

2. Cheapest - Progressive

What We Like Most:

- Low average rates in NYC

- Competitive rates for higher-risk drivers

- Online quotes

Why we chose it

Progressive has some of the cheapest rates in New York City, at an average of $207 monthly for full coverage and $111 monthly for minimum coverage. The company also has some of the cheapest rates in the state for full coverage, and drivers with higher-risk profiles like those with a DUI, speeding ticket, or at-fault accident.

It offers a number of optional coverage add-ons, including loan/lease payoff protection (which operates similar to gap insurance), a diminishing deductible for safe driving, and coverage for custom parts and equipment. Note however that Progressive’s rideshare endorsement is not available in New York state.

Who it’s best for

Progressive scored below average in New York on J.D. Power’s customer satisfaction survey, so it’s best for drivers prioritizing low cost over top-tier service.

Progressive New York City Pricing

| Progressive | Full coverage | Minimum coverage |

|---|---|---|

| Monthly | $207 | $111 |

| Annually | $2,483 | $1,328 |

| Difference from NYC average | -53% | -10% |

3. Best for Military - USAA

What We Like Most:

- Military-focused coverage options

- High customer satisfaction ratings

- Low-mileage telematics program

Why we chose it

USAA is known for providing exceptional service and useful resources to the military community. Its insurance products can only be accessed by members, and its membership eligibility is limited to those affiliated with the military, including active duty military members, veterans, and certain family members.

USAA has two telematics programs, one of which (SafePilot) rewards only safe driving, while the other (SafePilot Miles) rewards both safe driving and driving less than average.

USAA provides members with additional benefits, including discounts on a variety of products and services like rental cars and moving trucks.

Who it’s best for

Those eligible for membership, including active military members, veterans, and family members

USAA New York City Pricing

| USAA | Full coverage | Minimum coverage |

|---|---|---|

| Monthly | $315 | $143 |

| Annually | $3,781 | $1,711 |

| Difference from NYC average | -28% | +16% |

4. Best for Customer Satisfaction - New York Central Mutual (NYCM)

What We Like Most:

- Highest regional J.D. Power customer service ratings

- Network of local agents

- Offers OEM coverage

Why we chose it

New York Central Mutual operates exclusively in New York State and sells policies through a network of local agents throughout the state. The company ranked first for customer satisfaction in New York in J.D. Power’s most recent Auto Insurance Study and has an NAIC Complaint Index of 0.54, meaning it receives fewer customer complaints than average.

In addition to standard coverages, it offers new car replacement and original equipment manufacturer (OEM) coverage, as well as a new car discount, making it a great choice for new car owners.

Who it’s best for

Drivers who prioritize customer service, families with young drivers (lowest rates for teens in New York state), those who want to work with a local agent

NYCM New York City Pricing

| New York Central Mutual | Full coverage | Minimum coverage |

|---|---|---|

| Monthly | $436 | $121 |

| Annually | $5,235 | $1,448 |

| Difference from NYC average | -1% | -2% |

5. Best for Non-Owners - Travelers

What We Like Most:

- Affordable full coverage rates in NYC

- Offers non-owners insurance

- Convenient online purchasing

Why we chose it

New York is the only region in J.D. Power’s Auto Insurance Study in which Travelers ranks above average. It also has below-average full coverage rates in NYC, making it a solid choice for drivers looking for customized coverage.

Travelers also sells non-owner insurance, which provides coverage for rented or borrowed cars. If like many New Yorkers, you don’t own a car, but often rent or borrow cars (including carshares like ZipCar), it’s a good idea to purchase non-owner coverage. While it won’t cover damage to the vehicle itself, it provides liability coverage for any injuries or damages you cause while driving. You can also add uninsured motorist coverage, which pays for injuries and damages caused by an uninsured driver — either while you’re driving, or if you’re hit as a pedestrian or cyclist.

TIP:

If you frequently borrow a car from the same person (e.g., family you nanny for, partner’s car), a non-owner’s policy may not make sense. In that case, it’s usually better for the primary policyholder to add you as a named driver to their policy.

Travelers offers a wide range of coverage add-ons, including gap coverage, new car replacement, and accident forgiveness, in addition to the standard options. It also has discounts for bundling policies, being continuously insured, being a homeowner (even if you insure your home elsewhere), being a safe driver, and having an electric car.

Who it’s best for

Drivers looking for a wide range of coverage options, new car owners, drivers with leased or financed cars

Travelers New York City Pricing

| Travelers | Full coverage | Minimum coverage |

|---|---|---|

| Monthly | $357 | Data not available |

| Annually | $4,284 | Data not available |

| Difference from NYC average | -19% | – |

6. Best for Bundling - Erie

What We Like Most:

- Strong customer service record

- Rate lock option

- Below-average full coverage rates

Why we chose it

Erie consistently earns top customer satisfaction ratings, and although it’s not ranked in J.D. Power’s study for New York, it ranked first in the company’s Claims Satisfaction Study and earned an A- rating from the CRASH Network Report Card.

Erie offers several coverage options and discounts, including for bundling auto with a home or life insurance policy. It ranked third for customer satisfaction in J.D. Power’s Home Insurance study, so you can rest assured that it provides great service for both policy types.1

One of Erie’s most unique offerings is its rate lock option, which prevents your rates from increasing at renewal unless you make changes to your policy.

Who it’s best for

Renters or homeowners who want to bundle property insurance with auto, those who want to lock in their rate

Erie New York City Pricing

| Erie | Full coverage | Minimum coverage |

|---|---|---|

| Monthly | $346 | Data not available |

| Annually | $4,157 | Data not available |

| Difference from NYC average | -21% | – |

New York City Best Cheap Picks — Detailed Customer Satisfaction Summary

| Company | J.D. Power Auto Insurance Study – New York2 | CRASH Network Report Card3 | J.D. Power Claims Satisfaction4 | NAIC Complaint Index5 |

|---|---|---|---|---|

| GEICO | 637 | C- | 697 | 1.55 |

| New York Central Mutual | 652 | Not rated | Not rated | 0.54 |

| Travelers | 645 | C | 691 | 0.30 |

| Erie | Not rated | A- | 743 | 1.29 |

| USAA | 734 | C- | 741 | 2.74 |

| Average | 636 (out of 1,000) | C+ | 700 (out of 1,000) | 1 |

| What the study measures | Customer satisfaction regionally, based on responses from over 40,000 customers | Claims handling and payment practices, based on an annual survey of collision repair shops | Satisfaction with the claims process, based on responses from nearly 10,000 customers who recently filed a claim | Consumer complaints relative to market share. The lower the score, the better |

Cheapest Full Coverage Car Insurance in New York City

Progressive offers the cheapest average full coverage rates in New York City at $2,483 per year, which is 53 percent lower than the city average. USAA and GEICO also have competitive rates at $3,781 annually and $4,041 annually, respectively. Most rates, aside from Progressive’s, are more expensive than the New York State average.

| Company | Annual New York City Average | Monthly New York City Average |

|---|---|---|

| Progressive | $2,483 | $207 |

| USAA | $3,781 | $315 |

| GEICO | $4,041 | $337 |

| Erie | $4,157 | $346 |

| Travelers | $4,284 | $357 |

| Nationwide | $4,836 | $403 |

| State Farm | $4,986 | $416 |

| New York Central Mutual | $5,235 | $436 |

| Chubb | $5,251 | $438 |

| Utica National Ins Group | $5,912 | $493 |

| Allstate | $6,344 | $529 |

| New York City average | $5,279 | $440 |

| New York average | $2,882 | $240 |

| U.S. average | $2,356 | $196 |

Cheapest Minimum Coverage Car Insurance in New York City

For minimum coverage in NYC, Utica National has the cheapest rates at $1,305 per year on average. That’s 12 percent cheaper than the city average. Progressive and New York Central Mutual also offer below-average rates.

| Company | Annual New York City Average | Monthly New York City Average |

|---|---|---|

| Utica National Ins Group | $1,305 | $109 |

| Progressive | $1,328 | $111 |

| New York Central Mutual | $1,448 | $121 |

| GEICO | $1,610 | $134 |

| USAA | $1,711 | $143 |

| New York City average | $1,480 | $123 |

| New York average | $1,249 | $104 |

| U.S. average | $722 | $60 |

How Many Car Accidents Happen in New York City?

In 2025, there were a total of 85,743 car accidents in New York City, according to NYPD data.6 Over 200 people were killed as a result of car accidents, including 80 motorists, 118 pedestrians, and 23 cyclists, and nearly 50,000 people were injured. The borough with the most car accidents was Brooklyn, followed by Queens, Manhattan, the Bronx, and Staten Island.

Car crashes in New York City impact everyone, creating shared risks for multiple groups on city streets.

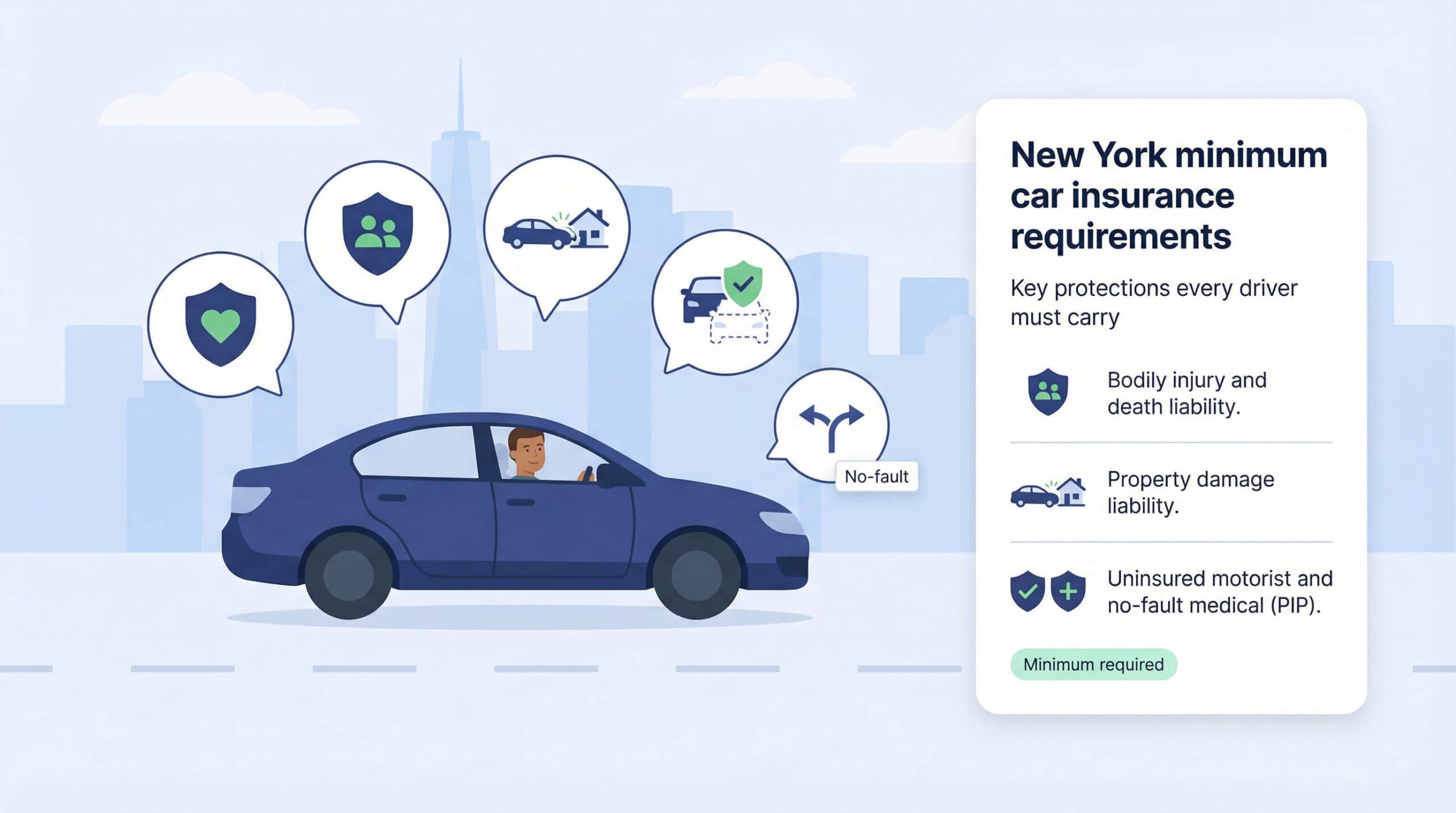

Minimum Auto Insurance Requirements in New York

New York has more minimum coverage requirements than many other states, although the limits are not particularly high. They are as follows:

- Bodily injury liability: $25,000 per person/$50,000 per accident

- Death: $50,000 per person/$100,000 per accident

- Property damage liability: $10,000 per accident

- Uninsured motorist coverage: $25,000 per person/$50,000 per accident

- Personal injury protection: $50,000 per person

New York is a no-fault state, which means that every driver involved in an accident pays for their own medical expenses, no matter who was at fault. The required PIP covers this for each driver. No-fault laws tend to drive up insurance rates, which is one factor in New York’s relatively high auto insurance costs. New York also requires uninsured motorist coverage, which helps pay for damages if you’re hit by someone without insurance, and is the only state that requires death liability coverage as well.

New York auto insurance mandates include specific coverage limits for bodily injury, death, property damage, uninsured motorists, and personal injury protection.

Frequently Asked Questions

Progressive offers the most affordable auto insurance in NYC for full coverage, with an average annual premium of $2,483. Utica National Insurance Group has the cheapest minimum coverage rates at $1,305 per year.

In New York City, GEICO is cheaper than New York Central Mutual (NYCM) for full coverage, with an average annual premium of $4,041 compared to NYCM’s $5,235. For minimum coverage, NYCM is cheaper by about $300 per year.

Car insurance in NYC costs an average of $5,279 per year for full coverage for safe drivers in their 30s with good credit. Minimum coverage costs an average of $1,480 annually. If you fit this demographic, you can expect to pay around that much, but you may be quoted more or less depending on various factors. If you have violations on your record, have low credit, or are a young driver, you may pay much more.

The best way to lower your car insurance rates is to focus on driving safely. Safe drivers are quoted the best rates, on average. Always ask your insurer about discounts you may be eligible for, such as discounts for bundling, having a safe car, or being a good student. If you have low credit, working to improve it over time can result in significant savings.

Methodology

At AutoInsurance.com, we evaluate auto insurance providers based on four key factors:

- Price (40%): We analyzed average full and minimum coverage premiums for safe drivers with good credit in New York City. Full coverage averages use the following limits:

-

- Bodily injury liability: $100,000 per person/$300,000 per accident

- Property damage liability: $100,000 per accident

- Personal injury protection: $50,000

- Uninsured and underinsured motorist bodily injury: $100,000 per person/$300,000 per accident

- Comprehensive and collision: $500 deductible

- Claims handling (25%): Customers expect their insurers to handle claims quickly and fairly. We assess insurance companies’ claims practices through sources like the CRASH Network Insurer Report Card and J.D. Power’s Auto Claims Satisfaction Study, and financial strength from sources like AM Best.

- Customer experience (25%): We assess various aspects of the customer experience, including the process of getting a quote and purchasing coverage. We also look at the availability and quality of online and agent support, as well as the website and mobile app user experience. Our analysis uses insights from J.D. Power, the NAIC Complaint Index, BBB ratings, and app store reviews.

- Coverage options (10%): We consider each company’s coverage options and prioritize those with offerings beyond the state-required minimums, like new car replacement, gap coverage, non-owners coverage, and more.

Read more about our ratings and methodology.

Sources

Homeowners Insurance Premium Increases Threaten Customer Loyalty, Long-Term Profitability, J.D. Power Finds. J.D. Power. (2025, Sept 16).

https://www.jdpower.com/business/press-releases/2025-us-home-insurance-studyTrust Emerges as Top Driver of Customer Satisfaction with Auto Insurance as Prices Continue to Surge, J.D. Power Finds. J.D. Power. (2024, June 11).

https://www.jdpower.com/business/press-releases/2024-us-auto-insurance-studyTop Rated U.S. Car Insurance Companies for 2026. Crash Network. (2026).

https://www.crashnetwork.com/irc/Satisfaction with Auto Insurance Claims Strained by Higher Deductibles, More Total Losses, J.D. Power Finds. J.D. Power. (2025, Oct 28).

https://www.jdpower.com/business/press-releases/2025-us-auto-claims-satisfaction-studyConsumer Insurance Search Results. NAIC. (2026).

https://content.naic.org/cis_refined_results.htmMotor Vehicle Collisions – Crashes. NYC OpenData. (2026, Feb 02).

https://data.cityofnewyork.us/Public-Safety/Motor-Vehicle-Collisions-Crashes/h9gi-nx95/about_data