Country Financial Car Insurance Review 2026

Country Financial sells auto insurance in 19 states. It has an excellent customer service record but above-average rates.

Get quotes from providers in your area

Questions? Call us: 844-966-4864

Country Financial is an insurance and financial services company with various affiliates that operate in 19 states, mostly in the midwestern and western U.S. The company, which is headquartered in Bloomington, Illinois, started in 1925 by providing fire and lightning insurance to farmers.

It has since expanded to offer various types of insurance policies, including auto, motorcycle, boat, property, business, farm, crop, life and pet insurance. Country Financial also provides investment and trust services.

Country Financial’s auto insurance rates are slightly above average, but it has very strong customer service and financial stability ratings. It sells policies through local agents, so although you can start a quote online, you’ll need to speak with an agent to complete your purchase.

As a senior editor and analyst at AutoInsurance.com, I used my industry knowledge and personal experience to compile this review of Country Financial. I’ll provide an overview of the insurer’s most important features and offerings to help you decide if it could be a good option for you.

Quick Look: Country Financial Pros and Cons

Pros

High customer satisfaction ratings

Many available discounts

Wide range of coverage options and policy types

Cons

No online quotes

Above-average rates

Available in only 19 states

Who Is Country Financial Auto Insurance Best For?

Country Financial sells insurance and other financial products exclusively through local agents, without an option to get a quote online.

Country Financial is best for those who:

- Live in one of the 19 states Country Financial serves.

- Prefer to work with a local agent.

- Want to get insurance and additional financial products and services from the same company.

- Have a teen driver on the policy.

Country Financial is not best for those who:

- Live outside the company’s area of operation.

- Lease or finance their car and need gap coverage.

FYI:

Country Financial is available in the following states: Alabama, Alaska, Arizona, Colorado, Georgia, Idaho, Illinois, Indiana, Iowa, Kansas, Minnesota, Missouri, Nevada, North Dakota, Oklahoma, Oregon, Tennessee, Washington, and Wisconsin.

How Much Does Country Financial Car Insurance Cost?

Country Financial’s average annual full coverage rate is $1,862, which is cheaper than the national average of $2,356. Minimum coverage rates are also cheaper than average at $681 annually, compared to the national average of $722.

Additionally, Country Financial’s rates are competitive for households with teen drivers. On average, a Country Financial policy with a teen is $4,459 annually, while the national average is $6,054.

Keep in mind that average rates are useful for getting an idea of how rates vary among companies, but your individual rate can vary greatly based on your driving record, location and other factors. I still recommend getting a quote from Country Financial if you’re interested in its offerings because you may be quoted less.

Below, I’ve included a table with major national insurers and their respective rates to give you an idea of how Country Financial stacks up:

| Company | Average annual premium for full coverage | Average annual premium for minimum coverage |

|---|---|---|

| Allstate | $2,915 | $823 |

| American Family | $2,181 | $686 |

| Country Financial | $1,862 | $681 |

| Farmers | $3,023 | $1,090 |

| GEICO | $1,867 | $558 |

| Nationwide | $1,987 | $722 |

| Progressive | $2,060 | $702 |

| State Farm | $2,030 | $650 |

| Travelers | $1,837 | $684 |

| USAA | $1,533 | $436 |

| U.S. average | $2,356 | $722 |

How You Can Save on Your Policy With Country Financial

Although Country Financial’s premiums are higher than average, the company advertises many auto insurance discounts that can help you save.

Country Financial DriverIQ

Country Financial’s telematics program, called DriverIQ, allows drivers to earn additional savings. Unlike most insurance companies, which have rolled their telematics programs into their main apps, Country Financial requires you to download a separate DriverIQ app.

The app will then track your driving habits, including your phone use while driving, as well as your speeding and braking. You’ll save 10 percent just for signing up, and up to an additional 25 percent based on your driving habits.

GOOD TO KNOW:

Country Financial’s DriverIQ won’t increase your rates if you drive unsafely; it will only lower them. The worst-case scenario is that your rate will stay the same, so it’s a low-risk option if you’re interested in trying it.

Simply Drive

Country Financial offers a driver’s safety course specifically for new drivers, which can help to offset the high cost of adding a teen driver to your policy. Simply Drive is a fully online course that provides up to 10 percent off your teen’s auto insurance once they complete it. To be eligible, they must be either 16 or 17 years old and have a clean driving record.

Other Discounts

In addition to the discounts highlighted above, Country Financial offers the following savings opportunities:

- Multiple-policy discount: You’ll qualify for this discount if you bundle an auto and home policy with Country Financial. If you have home and auto, you can also add another product, like life insurance, and save on all three.

- Occupation discount: This discount is available to certain professions, including full-time K-12 teachers, firefighters, police officers, EMTs and paramedics.

- Multicar discount: You can save if you insure two or more cars with Country Financial.

- Legacy discount: If you qualify for multipolicy or multicar discounts, you can pass these on to unmarried drivers under age 25 in your family, even if they don’t live with you.

- Engaged couple discount: Get a discount on your car insurance if you’re engaged, your wedding date is within the next year, you and your fiance/fiancee are between the ages of 21 and 29, and both your cars are insured with Country Financial.

- Good student discount: Full-time students with at least a B average could save up to 35 percent, and recent college grads under 25 can also get a discount by sending their college transcripts or diploma.

- Good driver discount: You may qualify if you haven’t had any violations in the past three years.

- Advance quote discount: Get a discount if you request a quote from Country Financial before your current policy expires and end up switching.

- Defensive driver discount: You can save money if you complete a state-approved motor vehicle defensive driving course.

- Anti-theft discount: Save on comprehensive coverage if your car is equipped with theft-deterrent systems, like alarms or anti-theft devices.

Country Financial Quote and Purchase Process

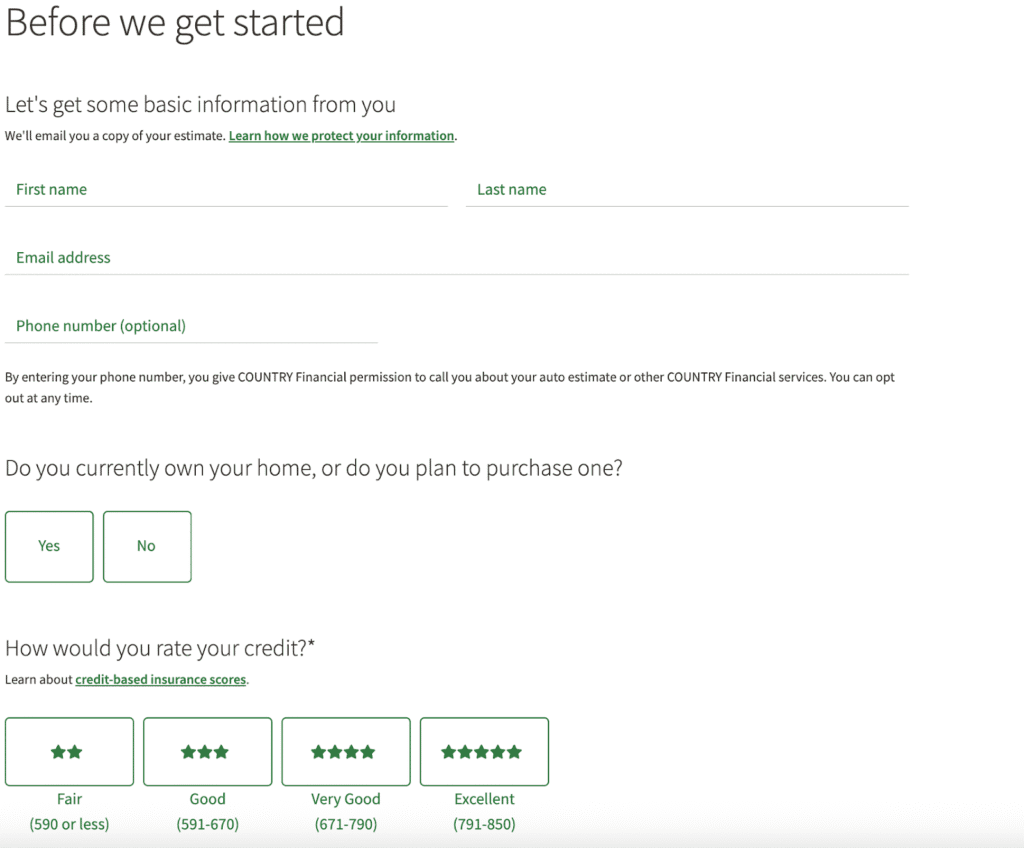

Country Financial allows you to start the quote process online, but you’ll need to speak with an agent to complete the quote and purchase a policy. I found the online quote tool straightforward and user-friendly. Once you enter your ZIP code, it starts by asking for basic personal information, as well as your credit standing and whether you currently own a home.

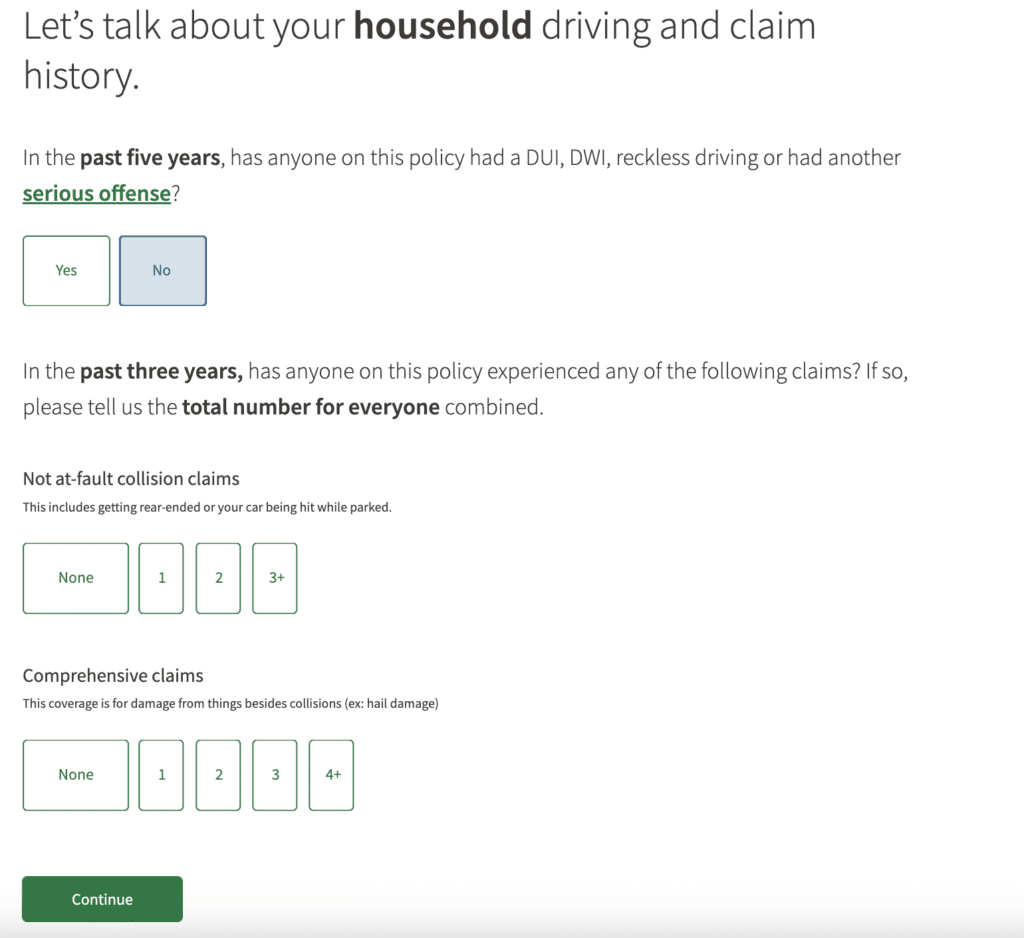

The next page asks for details about the driving record of anyone who will be insured by the policy, specifically about DUIs, not-at-fault collision claims, and comprehensive claims.

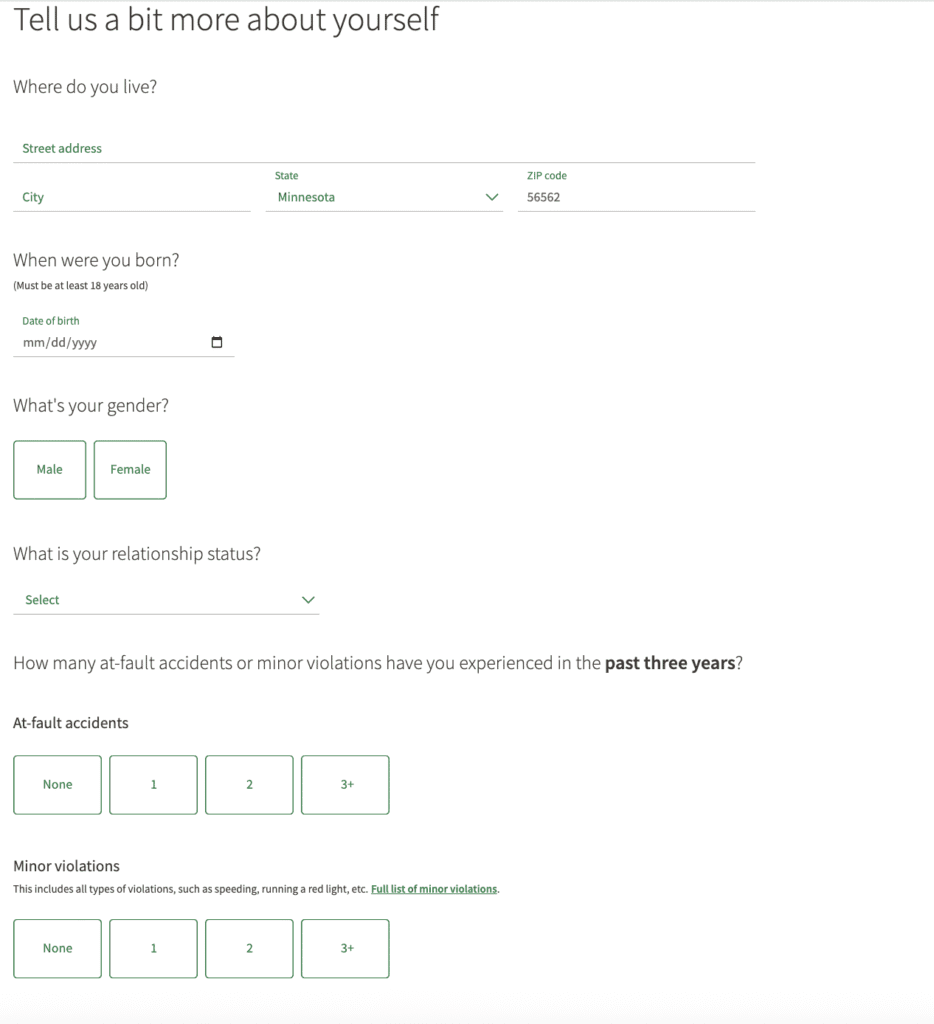

Next, you’ll need to provide your address, additional personal details, and information about your driving history. I couldn’t go any further because Country Financial is not available in my state.

However, once you finish filling out the online form, an agent will contact you to discuss your coverage needs and any discounts you may qualify for, before providing you with your quote.

What Types of Auto Insurance Coverage Does Country Financial Offer?

Country Financial offers the following standard types of coverage that you would expect from any insurer: liability coverage (including both bodily injury and property damage), comprehensive and collision coverage, medical payments coverage, personal injury protection, and uninsured and underinsured motorist coverage.

Country Financial also sells these coverage types:

| Coverage | What it covers |

|---|---|

| Vehicle rental and trip interruption coverage | This will cover up to $800 for a rental car if you get into an accident and your car is not drivable. It also applies to expenses such as transportation, lodging and meals if you have an accident more than 100 miles from home. Expense limits vary by state. |

| Windshield replacement insurance | This coverage will help pay for the repair or replacement of your windshield, car windows or headlights. |

| Emergency roadside assistance | Country Financial will reimburse you for up to $100 of roadside service costs. To be reimbursed, you’ll need to find a service provider and work with them directly and then submit a claim. |

| New-car replacement | Country Financial’s new-car-replacement coverage, which it calls The Keeper, will cover the cost of a brand-new car of the same make and model if your new vehicle is totaled. |

FYI:

Country Financial does not offer gap coverage, so if you have a car loan or lease, this insurer is likely not the best option for you (unless you purchase gap coverage elsewhere).

Country Financial Customer Satisfaction

Country Financial has a strong customer service record across the various industry studies I reviewed. It is included in J.D. Power’s Auto Insurance Study for the North Central region, where it ranked above average, in fifth place. While the company was not rated in other regions, likely due to its size, I looked at other, national metrics to assess customer satisfaction.

Country Financial has a National Association of Insurance Commissioners (NAIC) Complaint Index score of 0.87, indicating that it receives fewer customer complaints than average. A score of 1 is average, and the lower the number, the better. It’s always a good sign when I come across an insurer with a Complaint Index score below 1, as it doesn’t happen very often. Country Financial had an ever better score of 0.44 when I filtered for private passenger auto complaints only.

Country Financial also has an above-average rating of B- on the CRASH Network Insurer Report Card, and it ranks a bit higher than the middle of the pack, at 42nd out of 97. It received a high financial stability rating of A+ from AM Best, so I would have no worries about its ability to pay out claims.

| Category | Country Financial score |

| NAIC Complaint Index1 | Overall: 0.87 (fewer complaints than average)

Private passenger: 0.44 (fewer complaints than average) |

| J.D. Power 2025 Auto Insurance Study — North Central region2 | 659 out of 1,000 (above average) |

| CRASH Network 2025 Insurer Report Card3 | B- (42nd out of 97) |

| AM Best financial strength rating4 | A+ (Superior) |

Filing a Claim With Country Financial

To file a claim with Country Financial, you can go through your online account, use the mobile app, or call a representative at 866-Country (866-268-6879). Once your claim is received, a claims representative will contact you to discuss your claim, coverage and repair options.

Country Financial will arrange to have the damage inspected. The company notes that it offers several convenient appraisal options, but it doesn’t specify what they are. You can track an ongoing claim via the same three methods listed above. You can report a new claim by phone at any time, but for inquiries about existing claims, you’ll need to call Monday through Friday between the hours of 9 a.m. and 8 p.m. ET.

Country Financial's Website and Mobile App

Country Financial’s website has a clean and user-friendly interface, and I appreciate that it includes a lot of details about the company’s products and services. It’s very easy to start a quote, find an agent, or log in to your account right from the homepage.

From your online account, you can access your insurance cards, view bills and make payments, file claims, and more. If you prefer, you can do all of those things from the company’s mobile app. I downloaded the app, and the interface was straightforward. However, I wasn’t able to access much without logging in.

I could only view the Help page, which includes links to email and call customer support. It also has links to FAQ pages, which just redirect you to the corresponding pages from the company’s website in a separate browser window.

The app has low ratings in both the Apple App Store and the Google Play store, with many users complaining that it doesn’t work properly and won’t let them access their account. The Android app, in particular, seems to be having issues due to a recent update.

However, the separate telematics app, DriverIQ, has pretty high reviews in both stores. That surprised me, as these types of apps tend to have low ratings. It seems like, overall, policyholders are satisfied with the tracking and the discount they receive from participating in the program.

| App version | Rating (out of 5) |

|---|---|

| iPhone (App Store) – Country Financial Mobile | 3.5 stars |

| iPhone (App Store) – Country Financial DriverIQ | 4.5 stars |

| Android (Google Play) – Country Financial Mobile | 2.9 stars |

| Android (Google Play) – Country Financial DriverIQ | 4.2 stars |

Bottom Line: Should You Get Country Financial Car Insurance?

Country Financial is a strong, service-focused insurer. It earns above-average ratings from J.D. Power and the NAIC, signaling that policyholders are generally happy with the company’s claims handling and overall support. Country Financial also offers a wide range of discounts and coverage types, including a telematics discount and unique ways to save on your car insurance, like engaged-couple and legacy discounts.

That said, Country Financial’s rates are slightly higher than average, and its availability is limited to 19 states. In addition, the company doesn’t offer gap coverage or provide a fully online quote-and-purchase experience.

Overall, Country Financial is best suited to drivers who don’t mind paying a little more for dependable service, personal relationships with local agents, and robust financial backing. If you live within Country Financial’s coverage area and prioritize customer service, Country Financial is a strong option worth considering.

Frequently Asked Questions

Whether Country Financial is good for auto insurance depends on your needs and priorities, but overall, it is a well-regarded insurer. It has above-average customer satisfaction ratings from various sources, as well as high financial strength ratings, making it a reliable option for car insurance. However, Country Financial may not offer the lowest rates.

On average, Country Financial is cheaper than State Farm for full and minimum coverage. However, exactly how much you pay depends on your individual driver profile, so it’s worth getting a quote from both to see which is cheaper.

Yes, in most states, insurance companies will run your credit when putting together your quote. However, it’s not quite the same as the credit check that a bank or credit card company runs and will not ding your credit score. Insurers use information from your credit report to estimate the likelihood that you will file a claim, which affects your premium. Learn more about how your credit score may affect your car insurance premium.

The best inexpensive auto insurance will depend on your location, coverage needs and priorities. Generally speaking, regional insurers tend to have better customer service ratings and lower rates than many national insurers, so you should always compare car insurance quotes. For example, Erie has some of the best average rates and customer satisfaction scores, but it’s available in only 12 states and Washington, D.C. It’s a good idea to check out sources like J.D. Power studies when you’re evaluating quotes to see which companies have good ratings in addition to cheap rates.

Methodology: How We Review Insurance Companies

At AutoInsurance.com, we review auto insurance providers based on four key factors:

- Price (40%): We analyze average full and minimum coverage rates for safe drivers with good credit, as well as other driver profiles, including those with violations or low credit. We also consider the available discounts. Full coverage averages use the following limits:

-

- Bodily injury liability: $100,000 per person/$300,000 per accident

- Property damage liability: $50,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person/$100,000 per accident

- Comprehensive and collision: $500 deductible

- Claims handling (25%): A good claims handling process from an auto insurer is prompt, transparent and efficient, with clear communication throughout, fair evaluation of the damages, and timely payment or resolution. We assess claims practices through sources like the CRASH Network Insurer Report Card and J.D. Power’s Auto Claims Satisfaction Study, and financial strength from sources like AM Best and S&P. Real-life customer experiences are included when available.

- Customer experience (25%): We evaluate the ease of the customer journey, from getting a quote and purchasing a policy to making changes or accessing documents. We consider the availability and quality of both online and agent interactions, as well as the functionality of the company’s website and mobile app. Our sources include J.D. Power studies, the NAIC Complaint Index, Better Business Bureau ratings, and app store reviews.

- Coverage options (10%): We review each company’s coverage offerings and value providers with options beyond the state required minimums, like accident forgiveness, gap coverage and rideshare coverage.

Read more about our ratings and methodology.

Sources

Results by Complaint Index. NAIC. (2024).

https://content.naic.org/cis_refined_results.htm?TABLEAU=CIS_COMPLAINTS&COCODE=20990&:refreshIt’s Now a Buyer’s Market for Auto Insurance, J.D. Power Finds. J.D. Power. (2025, June 10).

https://www.jdpower.com/business/press-releases/2025-us-auto-insurance-studyTop Rated U.S. Car Insurance Companies for 2025. Crash Network. (2025).

https://www.crashnetwork.com/irc/Search for a Rating. AM Best. (2025).

https://ratings.ambest.com/