Average Cost of Car Insurance in Utah in 2026

Utah drivers can expect to pay less than the national average for full coverage car insurance.

Get quotes from providers in your area

While public transit is available in hubs like Salt Lake City, the majority of the Beehive State relies on personal vehicles to navigate the widespread high desert and mountain terrain. Because Utah enforces no-fault insurance laws, drivers are required to carry Personal Injury Protection (PIP), which can influence premiums.

Beyond state laws, your final premium is heavily influenced by personal rating factors such as age, vehicle type, and driving record. We have analyzed the latest data to help you understand what you might pay for coverage.

Average Cost of Car Insurance in Utah

For full coverage, the average rate for car insurance in Utah is $2,431 per year, or approximately $203 per month. This is competitive with the national average cost of full coverage auto insurance. We have broken down the costs below to show how different demographics affect pricing in the state.

By Age

If you’re a teen driver, you’ll pay the most for car insurance at $7,914 per year. However, the cost drops significantly as drivers gain experience and move into their 20s. The cost of car insurance is generally lower for adults in their 30s and older, with drivers in their 60s paying the least at $1,122 annually.

| Age | Average annual cost of car insurance |

|---|---|

| Teens | $7,914 |

| Adults | $2,431 |

| Seniors | $1,474 |

By Coverage Level

The more coverage you opt for, the more you’ll pay for car insurance. However, full coverage will also protect your assets in the event of a serious accident. Minimum coverage in Utah — which is one of a few states to require personal injury protection — runs $1,007 per year on average.

| Coverage level | Average annual cost of car insurance |

|---|---|

| Minimum | $1,007 |

| Full | $2,431 |

By City

The cost of auto insurance can vary significantly within your state, depending on the city you’re located in. West Valley City currently sees the highest average cost of auto insurance ($2,574 annually) among major cities, while Provo has the lowest average in our dataset at $2,315.

| City | Average annual rate for car insurance |

|---|---|

| West Valley City | $2,574 |

| Salt Lake City | $2,428 |

| West Jordan | $2,421 |

| Orem | $2,362 |

| Provo | $2,315 |

By Credit Score

When determining premiums for drivers in Utah, car insurance companies take credit score into account. Statistically, drivers with lower credit scores file more claims, leading insurers to charge higher rates. For example, a driver with low credit will shell out significantly more each year than a driver with an excellent score.

| Credit score | Average annual cost of car insurance |

|---|---|

| Low | $4,217 |

| Good | $2,431 |

By Violation

Depending on your driving history, you’ll also pay more annually if you’ve gotten a DUI, been in an accident, or received a speeding ticket.

| Driving history | Average annual cost of car insurance |

|---|---|

| Clean driving record | $2,431 |

| Speeding ticket | $2,823 |

| Accident | $3,460 |

| DUI | $3,649 |

By Company

Expect to pay different rates for car insurance depending on the carrier.Because insurers weigh risk variables differently, quotes can vary by hundreds of dollars for the exact same coverage. It’s important to shop around before choosing a car insurance company.

| Company | Average annual cost of full coverage | Average annual cost of minimum coverage |

|---|---|---|

| Allstate | $2,832 | $1,200 |

| GEICO | $1,622 | $678 |

| Progressive | $1,918 | $878 |

| State Farm | $4,036 | $1,916 |

| USAA | $1,394 | $472 |

| Auto-Owners | $1,971 | $731 |

| Farm Bureau | $2,765 | $1,004 |

| American Family | $1,834 | $962 |

| Nationwide | $1,711 | Data unavailable |

Cheapest Car Insurance in Utah

If you’re searching for the lowest car insurance rates in Utah, check out the providers’ costs by demographic.

| Demographic | Cheapest company | Average annual cost of car insurance |

|---|---|---|

| Full coverage | GEICO | $1,622 |

| Minimum coverage | GEICO | $678 |

| Bad credit | GEICO | $2,964 |

| Speeding ticket | GEICO | $2,204 |

| Accident | Nationwide | $2,296 |

| DUI | Progressive | $2,604 |

| Teens | GEICO | $4,532 |

| Military members, veterans, and their families | USAA | $1,394 |

*On average, USAA offers cheaper rates for several profiles, but is available only to military members and their families. In many categories above, GEICO often provides the lowest rate for the general public.

How to Save on Car Insurance in Utah

There are several ways to save on auto insurance in Utah:

- Request quotes from multiple insurance providers (usually at least three) to maximize your chances of finding the lowest premium.

- Take advantage of discounts for things like tracking your driving, staying with the same provider continuously, insuring multiple cars on the same policy, and bundling auto and home, renters, or condo insurance.

- Choosing a car with anti-theft features (or installing a device yourself) or buying a used car.

Saving on car insurance in Utah involves comparing multiple quotes, stacking available discounts, and choosing a vehicle that costs less to insure.

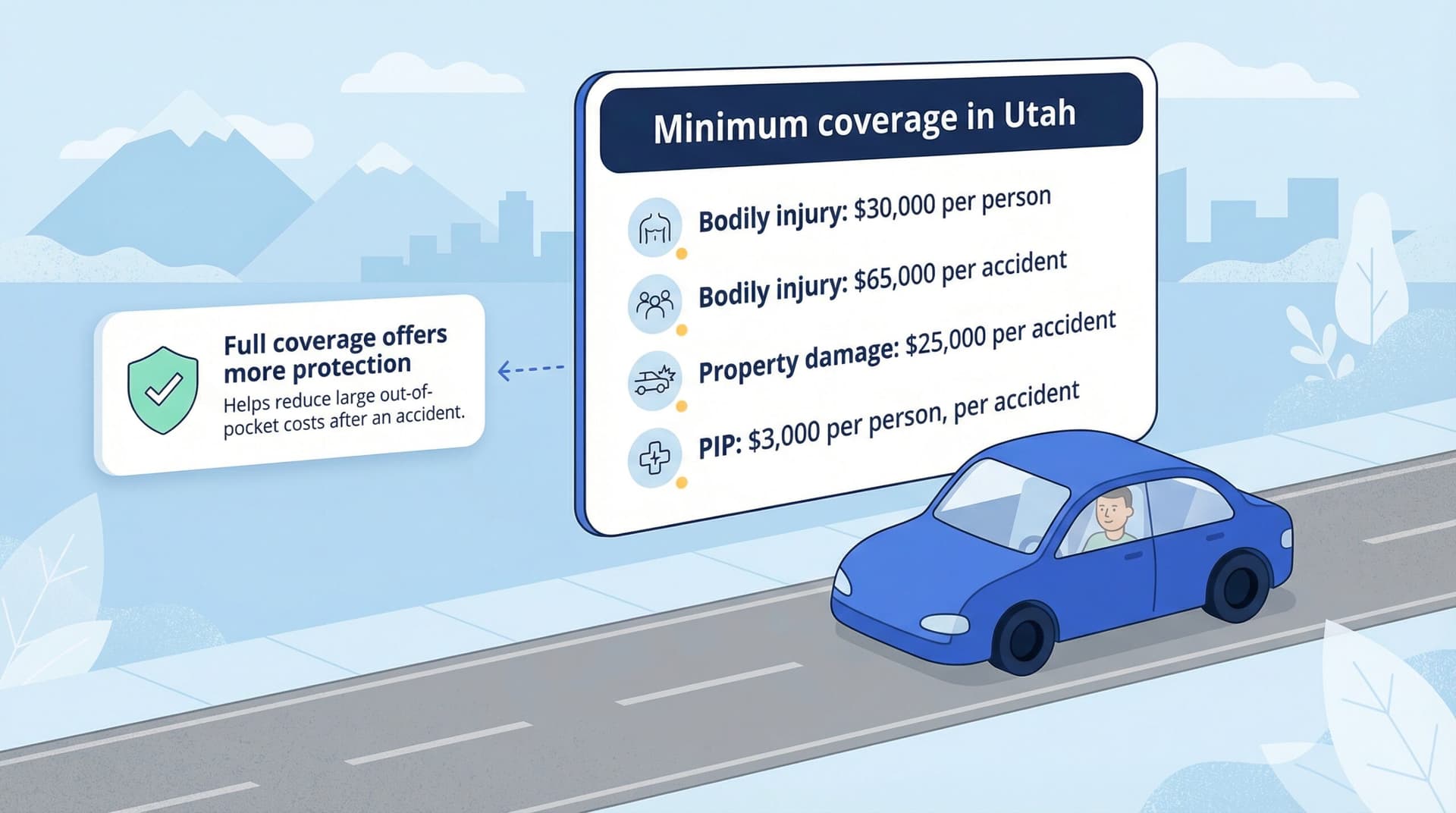

Minimum Car Insurance in Utah

While minimum car insurance in Utah has specific liability and PIP requirements, full coverage is recommended for greater financial protection.

As of January 1, 2025, Minimum coverage in Utah includes the following:

- $30,000 per person for bodily injury

- $65,000 per accident for bodily injury

- $25,000 per accident for property

- $3,000 in personal injury protection (PIP) limit per person and per accident1

While you’ll save more on car insurance by choosing minimum coverage, it’s best to opt for full coverage. In the event of an accident, a full coverage policy limits steep out-of-pocket costs.

Fault Law in Utah

Utah is a no-fault state, which means that regardless of who is at fault, drivers typically seek the first $3,000 in medical expenses from their own insurance provider. Other costs covered under PIP include lost wages, household services, and disability costs. While each driver is responsible for their own medical expenses up to the PIP limit, the responsible party must cover the costs of the injured party’s property expenses (including their own).

SR-22s

Utah primarily requires SR-22 forms for people who have driven without insurance. You might also need one after a serious violation, like a DUI or hit-and-run. An SR-22 form is not insurance itself, but a certificate filed by your insurer that provides proof that a driver holds Utah’s minimum insurance requirements.

DID YOU KNOW?

Utah has the strict BAC limit in the nation at 0.05 (in almost all states, the limit is 0.08). After the law was passed, crash fatality rates in the state reduced by 18.3 percent — significantly better than the 5.9 percent reduction seen in the rest of the U.S during the same period.2

Recap

As a no-fault state, Utah has auto insurance rates that can be higher than states without mandatory PIP requirements. Drivers with a clean record can find competitive rates, especially if they compare quotes from carriers like GEICO, USAA, and Nationwide. Even if certain factors (like credit score or driving history) cause your premium to cost more, you can still find ways to pay less for insurance by researching and comparing quotes. When comparing rates, make sure you’re selecting the same coverages and liability limits; that way you’re comparing apples to apples. Check out our top auto insurance picks in Utah.

Methodology

We analyzed average auto insurance premiums in Utah for full and minimum coverage. We also reviewed different driver profiles, including drivers with good credit, those with DUIs, accidents, low credit, and teenagers. Full coverage averages use the following limits:

- Bodily injury liability: $100,000 per person/$300,000 per accident

- Property damage liability: $50,000 per accident

- PIP: $3,000

- Uninsured and underinsured motorist bodily injury: $50,000 per person/$100,000 per accident

- Comprehensive and collision: $500 deductible

Frequently Asked Questions

Car insurance in Utah is generally inline with or slightly higher than standard averages in neighboring states due to at least a couple factors:

- Utah is a no-fault state, so PIP is required in minimum coverage for drivers.

- The state is encountering more severe weather, including wildfires and droughts. These are unpredictable and cause more expensive damages, which car insurance companies have reflected in their premiums.

Uninsured motorist coverage isn’t required in Utah, but it’s a good idea in case you are involved in an accident where the responsible party doesn’t have car insurance. As of the latest available data, a little over 6 percent of drivers in Utah do not carry insurance — the good news is that this is the second-lowest rate of uninsured drivers in the country.3 Still, adding this coverage helps to avoid out-of-pocket costs the other party may not be able to cover, without suing them.

Yes. Car insurance rates in Utah have increased in recent years due to inflation, auto supply chain issues, and the increased price of used vehicles. While insurance costs are also higher in other states, Utah drivers also pay more due to an increased number of accidents.

The new-car insurance grace period varies by carrier but is often seven to 30 days. The grace period is the amount of time individuals can drive a new car before adding it to an insurance policy they already have. Drivers without a policy will need to purchase personal injury protection and liability coverage before getting on the road.

Citations

Utah Code: Motor Vehicle Insurance. Utah Legislature. (2025).

https://le.utah.gov/xcode/Title31A/Chapter22/C31A-22-P3_1800010118000101.pdf0.05 BAC Law. Utah Department of Public Safety. (2026).

https://highwaysafety.utah.gov/05-bac-law/Facts + Statistics: Uninsured motorists. Insurance Information Institute. (2025).

https://www.iii.org/fact-statistic/facts-statistics-uninsured-motorists