Average Cost of Car Insurance in Rhode Island in 2026

Drivers in the Ocean State can expect to pay right around the national average for full coverage car insurance.

Get quotes from providers in your area

Though Rhode Island is the smallest state in size, there are still 872,100 vehicles registered in the state1. Because Rhode Island is an at-fault state, drivers are financially responsible for the accidents they cause. The state requires every driver to have adequate car insurance with minimum liability coverage limits, which affects how much you spend on auto insurance.

The cost of auto insurance in Rhode Island depends on many factors, including age, gender, ZIP code, car make and model, and credit score. Here’s a breakdown of what you can expect when it comes to costs in the state.

Average Cost of Car Insurance in Rhode Island

On average, you can expect to pay $2,759 per year in Rhode Island for full coverage auto insurance. This is right around the national average full coverage cost, which is $2,356. However, your price may be well above or below that, depending on your demographic details and the amount of coverage you opt for. Let’s take a closer look at the demographic details below.

By Coverage Level

When you opt for more coverage on your auto insurance policy, you will pay more. In Rhode Island, drivers pay about twice as much for full coverage versus liability only. However, full coverage will prevent high out-of-pocket costs in the event of an accident.

| Coverage level | Average annual cost of car insurance |

|---|---|

| Minimum | $1,171 |

| Full | $2,759 |

By City

Where you live will impact your rate. Some places have a higher number of claims than others, which causes insurance rates to go up in those areas.

| City | Average annual cost of car insurance |

|---|---|

| Providence | $4,001 |

| Cranston | $3,658 |

| Pawtucket | $3,519 |

| East Providence | $3,224 |

| Warwick | $2,965 |

By Age

Age is one of the most significant factors affecting your car insurance rates. Younger drivers, especially teen drivers, tend to be more expensive than older drivers because they lack the experience and safety mindset of older drivers. This is true in Rhode Island and across the country. When drivers hit their 20s, they can expect a decrease in premiums.

| Age | Average annual cost of car insurance |

|---|---|

| 16 | $8,296 |

| 17 | $9,207 |

| 18 | $8,485 |

| 19 | $4,638 |

| 20 | $4,812 |

| 25 | $3,090 |

| Adult | $2,759 |

| Senior | $2,426 |

16-year-old drivers’ rates are slightly lower as part of a household policy.

By Violation

You will pay more for auto insurance when you have an accident or a ticket on your record. The higher rate is because insurance companies consider you a higher risk for accidents and other violations.

RELATED:

Learn more about how DUIs and tickets impact your insurance in Rhode Island.

| Driving record | Average annual cost of car insurance |

|---|---|

| Clean | $2,759 |

| At-fault accident | $3,293 |

| Speeding ticket | $3,688 |

| DUI | $5,188 |

By Company

It’s always a good idea to shop around for the best rate. Different insurance companies rate different demographics differently based on company experience. It means you’ll get different rates from each company you get a quote from.

| Company | Average annual cost of car insurance |

|---|---|

| Travelers | $2,228 |

| Amica | $2,451 |

| Allstate | $3,122 |

| Progressive | $2,301 |

| Nationwide | $2,722 |

| GEICO | $2,763 |

| USAA | $1,806 |

| Allstate | $3,122 |

| Farmers | $3,859 |

GOOD TO KNOW:

When you shop for the best rates, be sure to compare multiple providers with the same coverage. You want to make sure you are getting the coverage you want for the best price, not just getting a better price because a certain coverage was omitted from your quote.

By Credit

Unlike its neighbor, Massachusetts, Rhode Island allows insurance carriers to use credit score to help determine insurance rates. The better your credit score is, the lower your premium will be.

| Credit score | Average annual cost of car insurance |

|---|---|

| Excellent | $4,499 |

| Good | $3,198 |

| Average | $2,726 |

| Poor | $2,094 |

TIP:

Improve your credit score and ask your insurance company to reassess your premium based on better credit. Good credit can save you money.

Cheapest Car Insurance in Rhode Island

| Demographic | The cheapest company | Annual rate |

|---|---|---|

| Speeding ticket | Amica* | $3,331 |

| Accident | Travelers* | $2,243 |

| DUI | Progressive | $2,853 |

| Teens | Allstate* | $7,344 |

| Full coverage | Travelers* | $2,228 |

| Minimum coverage | Travelers* | $751 |

| Poor credit | Progressive | $3,651 |

| Military members, veterans, and their families | USAA | $1,806 |

*USAA has cheaper average rates in these categories, but is only available to military members, veterans, and their families.

How to Save on Car Insurance in Rhode Island

Drivers can lower their car insurance costs by adjusting deductibles and coverage, and by asking about available discounts.

There are some standard ways to save on car insurance in Rhode Island. One example is to adjust your deductible. The deductible is what you pay to repair your car if you are in an at-fault accident. The higher your deductible is, the lower your premium will be because you are assuming more responsibility for the cost.

Some people will also adjust coverages and liability limits. The lower your limits are, the less your premium will be. Keep in mind that if you reduce coverage, you could be on the hook for the difference between what your insurance covers and overall damages from the accident.

Also, ask your carrier about any discounts that you are eligible for. You may get a reduced premium if you drive fewer than 5,000 miles per year or have taken a driver’s safety course (usually for senior drivers). Some companies, such as State Farm, have a program for new drivers and good students to help lower the cost of insurance for teen drivers.

Minimum Car Insurance in Rhode Island

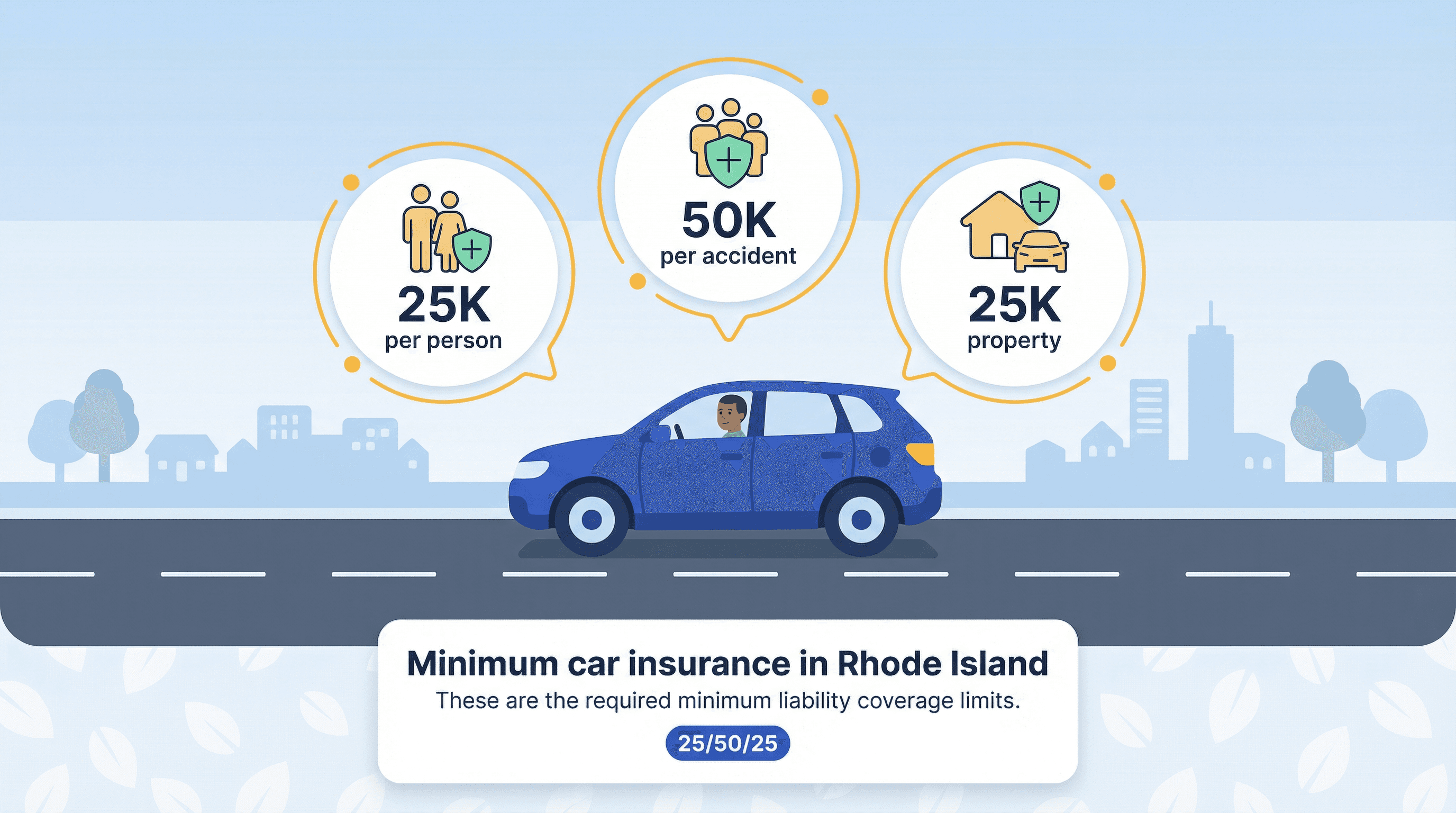

Rhode Island has a minimum insurance requirement. This legal minimum means that every driver must maintain a certain amount of coverage. More coverage is recommended but not required.

The minimum liability requirement in Rhode Island is:

- $25,000 in bodily injury per person

- $50,000 in total bodily injury per accident

- $25,000 in property damage2

Rhode Island law requires drivers to have minimum liability coverage limits of 25/50/25.

Fault Law in Rhode Island

Like many other states, Rhode Island is considered an at-fault state. This means that the person responsible for an accident is liable for the injuries and damages incurred by the harmed party. Without insurance, this could result in many thousands of dollars in damages owed by the at-fault driver in a car accident.

SR-22s or FR-44s

An SR-22 or FR-44 is a financial responsibility filing with the state for those who have lost their driver’s license or had a major infraction, such as a DUI.

In the past, Rhode Island used SR-22s for drivers with these infractions to prove that they had the required vehicle insurance. However, since July 2018, the state no longer requires an SR-22 to prove financial responsibility.

Recap

Car insurance in Rhode Island is not cheap, though you can get a better deal if you have a good driving record and good credit. Make sure to get quotes from various carriers to get the best rate for you. Your demographic will change your rate, and you shouldn’t rely on just one company’s quote.

Methodology

We analyzed average auto insurance premiums in Rhode Island for full and minimum coverage. In addition, we reviewed different driver profiles, including drivers with good credit, those with DUIs, accidents, teenagers, and those with low credit. Full coverage averages use the following limits:

- Bodily injury liability: $100,000 per person/$300,000 per accident

- Property damage liability: $50,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person/$100,000 per accident

- Comprehensive and collision: $500 deductible

Frequently Asked Questions

Rhode Island requires minimum liability coverage plus minimum uninsured motorist coverage. The requirements are:

- $25,000 per person in bodily injury

- $50,000 per accident in bodily injury

- $25,000 per accident in property damage

Full coverage in Rhode Island means meeting the state minimum liability requirements, plus optional coverages like uninsured motorist, medical payments, collision, and comprehensive.

Rhode Island is slightly higher than the national average for car insurance rates, while the Massachusetts average premium is slightly lower. Massachusetts’ average is less than Rhode Island’s.

A monthly premium of $500 is a lot for car insurance, especially since it’s much higher than the Rhode Island average. However, how much you pay depends on your age, driving record, and credit score. Get a few quotes from companies to see how much you can expect to pay for auto insurance.

Sources

Vehicle Registration Counts by State. Alternative Fuels Data Center, U.S. Department of Energy. (2024).

https://afdc.energy.gov/vehicle-registrationAutomobile Insurance Rating (230-RICR-20-05-3). Rhode Island Department of State. (2025).

https://rules.sos.ri.gov/regulations/Part/230-20-05-3