National General Car Insurance Review 2026

National General specializes in car insurance for high-risk drivers but has a poor customer service record.

Get quotes from providers in your area

Questions? Call us: 844-966-4864

National General was technically founded in 1920, though it has gone through several acquisitions over the years, and the name National General only came about in 2013. Most recently, the company was acquired by Allstate in January 2021. The company’s name is often shortened to simply NatGen.

National General is headquartered in North Carolina and operates nationwide. It specializes in providing coverage to high-risk drivers, including those with DUIs. It sells insurance policies directly to consumers and through a network of 55,000 independent agents across the country.

In addition to personal auto insurance, National General sells commercial auto, RV, motorcycle, homeowners, condo, renters, flood, umbrella, and private collection policies. It offers affordable average rates for full coverage, but it doesn’t have the best customer service record.

I used my industry knowledge and experience as a senior editor and analyst at AutoInsurance.com to put together this comprehensive review of National General. I’ll go over average rates, coverage offerings, discount opportunities, and more to help you decide if it’s right for you.

Quick Look: National General Pros & Cons

Pros

Provides coverage for high-risk drivers

Online quotes and purchasing

Nationwide availability

Cons

Below-average customer service ratings

No gap coverage

Who Is National General Auto Insurance Best For?

National General provides an easy quote and purchase process, and caters to drivers with violations.

National General Is Best for Those Who:

- Have violations on their record, including DUIs

- Prefer to purchase their policy online or through an agent, as National General offers both options

- Those who drive less than average

National General Is Not Best for Those Who:

- Prioritize customer service

- Lease or finance their car and need gap coverage

How Much Does National General Car Insurance Cost?

National General’s full coverage rates are a bit below the national average at $2,210 per year (compared to the national average of $2,356 annually). Its average minimum coverage rate of $791 per year is slightly above the national average of $722.

The table below displays average annual premiums for full and minimum coverage for major national insurers so you can see how National General compares:

| Company | Average annual premium for full coverage | Average annual premium for minimum coverage |

|---|---|---|

| Allstate | $2,915 | $823 |

| American Family | $2,181 | $686 |

| Farmers | $3,023 | $1,090 |

| GEICO | $1,867 | $686 |

| National General | $2,210 | $791 |

| Nationwide | $1,987 | $722 |

| Progressive | $2,060 | $702 |

| State Farm | $2,030 | $650 |

| Travelers | $1,837 | $684 |

| USAA | $1,533 | $436 |

| National average | $2,356 | $722 |

How You Can Save on Your Policy With National General

National General offers various auto insurance discounts that can be applied to your policy.

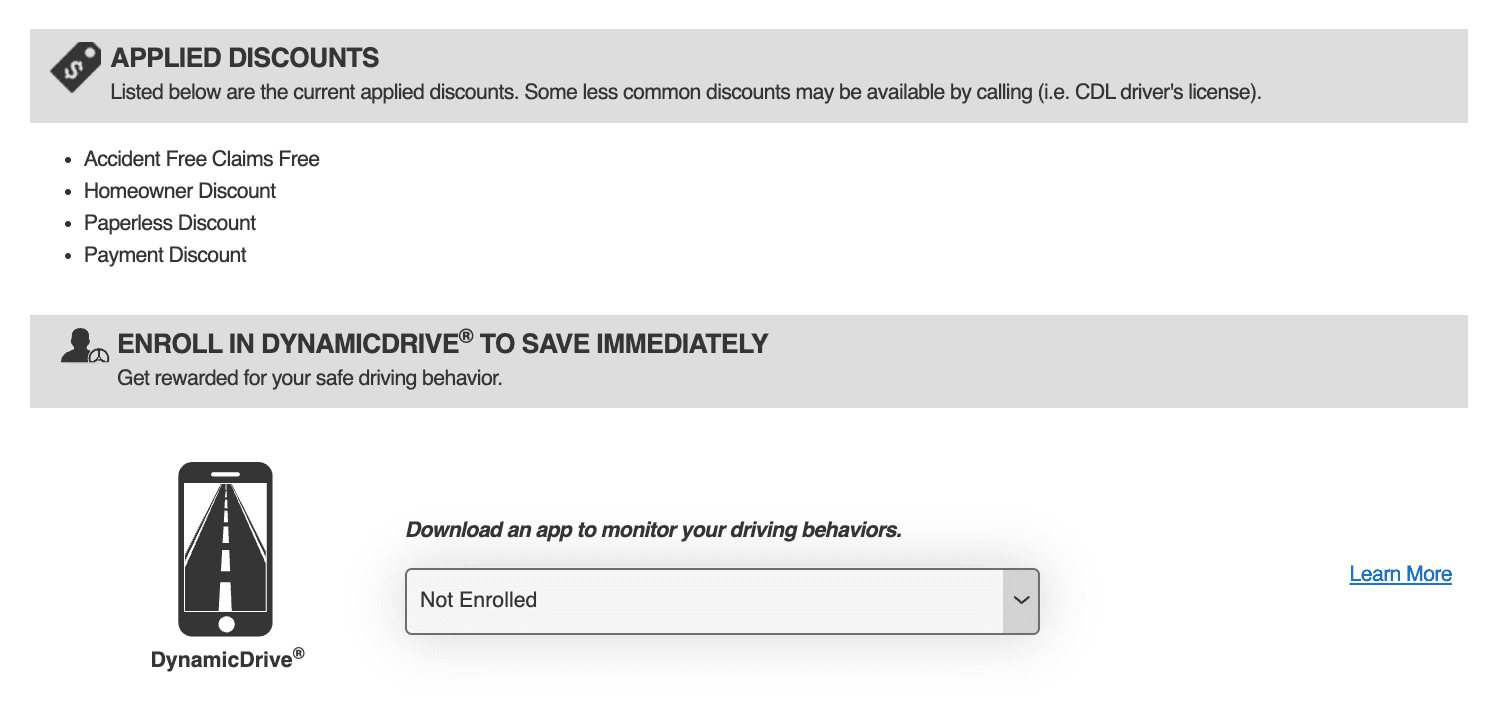

Highlighted Discount: DynamicDrive

If you purchase a National General auto policy, you’ll have access to DynamicDrive, which is the telematics program affiliated with several Allstate subsidiaries, including Direct Auto. You’ll get a 10 percent discount just for signing up, and an additional discount at renewal if you drive safely. National General doesn’t advertise the maximum discount.

I also think it’s important to note that National General doesn’t specify whether DynamicDrive could increase your rates, but Allstate’s Drivewise can, so I recommend confirming with an agent before signing up. If you’re not confident in your safe driving habits, it’s risky to participate if there’s a chance of your rates going up.

Other Discounts

Here are some of the other discounts that you may qualify for with National General:

- Bundling discount: Get a discount for bundling home and auto.

- Multi-vehicle discount: Insuring more than one vehicle with National General will save you money.

- Safe driver discount: You may qualify for a discount if you haven’t had any driving violations in the last three years.

- Low-mileage discount: Save on your premium if you drive under a certain number of miles per year.

- Pay-in-full discount: You’ll pay less if you pay your entire premium up front rather than in monthly installments.

- Paperless discount: Get a discount for signing up for paperless billing.

- Security device discount: If your car has certain anti-theft features, you can qualify for a discount on comprehensive coverage.

FYI:

National General doesn’t list all of its available discounts on its website, so you may see additional discounts added to your quote. Be sure to check with an agent if you want to verify that all applicable discounts are included.

National General Quote and Purchase Process

National General provides quotes through an easy online process, as well as through local independent agents. You can also purchase policies online or through an agent. I tried getting a quote on the company’s website, and it was quick and easy.

The first screen asks a few basic questions, including whether you currently have car insurance and how many cars and drivers you’re looking to insure.

Then, I needed to select my vehicle year, make, and model. It also asked if I currently make payments on the vehicle. Finally, I input my details as the driver on the policy, including my garaging address, and answered a few more questions about my driving history. These included whether I’ve had any violations within the past three years and whether I’m required to file an SR-22. Once I completed everything, I received my quote.

The initial quote was for liability limits of 50/100/50, even though I indicated that I was looking for at least 100/300/100. I was able to modify my coverage, but it wouldn’t let me select more than 50/100/50 online, and I assume I would need to call an agent to request higher limits.

The quote shown above would come out to $421 for a six-month policy. I also checked the pay-in-full price, which includes a slight discount and would come out to $383 for six months, or $38 less.

I was able to add other coverages to my policy, including collision, comprehensive, and rental reimbursement, right from the online platform. If I were satisfied with the options provided, I would be able to easily move forward with purchasing the policy without contacting an agent.

The other discounts applied to my policy were homeowners, accident-free/claims-free, and paperless. I also had the option of adding accident forgiveness and roadside assistance to my policy, as well as enrolling in DynamicDrive for another discount.

What Types of Auto Insurance Coverage Does National General Offer?

National General offers all of the basic coverages that you may need, including bodily injury liability, property damage liability, collision, comprehensive, medical payments, personal injury protection, and uninsured motorist coverage.

It also has additional coverage options, including the following:

| Coverage | What it covers |

|---|---|

| Accidental death and dismemberment | This will pay out a certain amount if the insured person dies or suffers a severe injury. |

| Roadside assistance | This coverage will help pay for roadside services if your car breaks down, including gas delivery, flat tire replacement, and towing. |

| Towing | This is separate from roadside assistance and is a cheaper option if you just want towing coverage specifically. You cannot purchase this coverage if you have roadside assistance, as it’s included in that option. |

| Rental car reimbursement | If your car is being replaced due to a covered incident, you’ll get a daily stipend toward a rental car. |

National General: Customer Satisfaction

Customer satisfaction is one of National General’s main weak points. I looked at several industry metrics, and it scored far below average on all of them.

Starting with J.D. Power’s most recent U.S. Claims Satisfaction Study, National General ranked last among 20 total insurers, scoring almost 100 points below average and over 60 points less than the next-lowest insurer. It was also included in J.D. Power’s Auto Insurance Study for the California, Mid-Atlantic, and Southeast regions, ranking below average in all of them (and last in California).

It didn’t fare much better on the CRASH Network Report Card, which gave National General a D+ rating and ranked it 91st out of 97 insurers. In addition, it has an NAIC Complaint Index of 5.16, indicating that it receives more complaints than average. Even when filtering for private passenger policies, it still has an above-average number of complaints with an index of 3.44.

Based on these customer service ratings, I would not recommend National General unless you’re having trouble finding coverage from other insurers due to violations or low credit.

That said, National General does have an A+ rating from AM Best, indicating that it can reliably pay out claims. However, I don’t think this factor is enough to make up for its very low ratings otherwise.

| Category | National General score |

|---|---|

| NAIC Complaint Index1 | Overall: 5.16 (more complaints than average)

Private Passenger: 3.44 (more complaints than average) |

| J.D. Power 2025 Auto Claims Satisfaction Study2 | 605 out of 1,000 — below average |

| J.D. Power 2025 Auto Claims Satisfaction Study – California, Mid-Atlantic, and Southeast Regions3 | Below average |

| CRASH Network 2025 Insurer Report Card4 | D+ — 91st out of 97 |

| AM Best Financial Strength Rating5 | A+ (Superior) |

Filing a Claim With National General

National General provides several ways to file a claim and is available 24/7, which I do appreciate about the company, as that is not always the case. To file a claim, you can call the number on your policy card or 1-800-468-3466 at any time. You can also file one online through the website portal or by chatting with a loss taking specialist.

Eligible policyholders can use the company’s virtual estimating tool, called MyClaimsPics, which allows you to take photos of the damage to your car and submit them for a quick estimate. National General states that simple claims may be processed in as little as 24 hours, but more complex cases, especially involving disputes, can take longer.

GOOD TO KNOW:

National General provides a lifetime guarantee on any collision repairs made due to a covered incident as long as you take your car to an approved repair shop.

National General's Website and Mobile App

National General’s website is clear and user-friendly, though I found that it did not provide as much information on coverages and discounts as I would have liked. However, it clearly directs visitors to find an agent or get a quote online, and also has links to log in to your account and file a claim from the homepage.

You can use your online account to access your ID cards, make a payment, enroll in paperless billing, renew your policy, and more. I also downloaded the app, but I wasn’t able to access anything without registering my account or logging in.

The National General has improved its reviews since 2025, when they fell in the 2-star range. Now, the app holds above a 4.5 star in both the Google Play Store and App Store. A number of negative reviews concern the insurer itself, rather than the app experience, though some users do complain about being unable to log in and pay their bills.

National General’s telematics program, DynamicDrive, requires a separate app, which also holds decent ratings. In negative reviews, many users complain that the app is overly sensitive and penalizes them unfairly for their driving.

| App Version | Rating (out of 5) |

|---|---|

| iPhone (App Store) – National General Mobile | 4.6 stars |

| iPhone (App Store) – DynamicDrive | 4.8 stars |

| Android (Google Play) – National General Mobile | 4.8 stars |

| Android (Google Play) – DynamicDrive | 4.0 stars |

Frequently Asked Questions

Generally, Progressive can be considered a better insurance company than National General, but that is relatively subjective, and your personal experience may vary. When using various customer satisfaction studies as a metric for which is better, Progressive comes out on top. For example, it receives fewer complaints than National General according to the NAIC, and it ranks higher in J.D. Power’s auto insurance studies.

National General is not exclusively for high-risk drivers, but it does specialize in policies for this demographic. It offers below-average rates for drivers with a DUI on their record, making it a good choice for those who are facing high rates from other companies following a violation.

While it would be difficult to objectively say that one company gets the most overall complaints, Fred Loya probably comes close. It ranks last on the CRASH Network Report Card and has an NAIC Complaint Index above 20, which means it receives over 20 times more complaints than average.

Dairyland has some of the worst, or most expensive, car insurance rates, with an average annual premium of $4,851 for full coverage. That’s about twice the national average. Dairyland sells policies mainly to high-risk drivers, which accounts for its high rates. However, your rate depends on many factors, so it’s possible that a different company would quote you higher rates than Dairyland.

Methodology – How We Review Insurance Companies

At AutoInsurance.com, we review auto insurance providers based on four key factors:

- Price (40%): We analyze average full and minimum coverage rates for safe drivers with good credit. Since National General specializes in high-risk insurance, we also looked at rates for drivers with DUIs. We take into account available discounts as well. Full coverage averages use the following limits:

- Bodily injury liability: $100,000 per person/$300,000 per accident

- Property damage liability: $100,000 per accident

- Comprehensive and collision: $500 deductible

- Claims Handling (25%): Claims processing is the most important role of an insurance company, and we assess how satisfied customers are with insurers’ claims practices through sources like the J.D. Power U.S. Auto Claims Satisfaction Study and the CRASH Network Insurer Report Card. We also factor in financial strength ratings from sources like AM Best.

- Customer Experience (25%): We evaluate auto insurance companies based on their customer experience, which includes the ease of getting a quote and buying a policy. We also consider how much customers can do online versus through an agent. Our sources include the NAIC complaint index, J.D. Power’s Auto Insurance Study, and app store reviews.

- Coverage Options (10%): We look at the range of coverages available from each insurer, including whether they have selections beyond the state-required minimums, such as accident forgiveness, gap coverage, and more.

Read more about our ratings and methodology.

Citations

Results by Complaint Index. NAIC. (2024).

https://content.naic.org/cis_refined_results.htm?TABLEAU=CIS_COMPLAINTS&COCODE=23728&:refreshSatisfaction with Auto Insurance Claims Strained by Higher Deductibles, More Total Losses, J.D. Power Finds. J.D. Power. (2025, Oct 28).

https://www.jdpower.com/business/press-releases/2025-us-auto-claims-satisfaction-studyIt’s Now a Buyer’s Market for Auto Insurance, J.D. Power Finds. J.D. Power. (2025, June 10).

https://www.jdpower.com/business/press-releases/2025-us-auto-insurance-studyTop Rated U.S. Car Insurance Companies for 2025. Crash Network. (2025).

https://www.crashnetwork.com/irc/Search for a Rating. AM Best. (2025).

https://ratings.ambest.com/