Safeway Car Insurance Review 2026

Safeway may be a good fit for high-risk drivers. However, it's more expensive than competitors for safe drivers, and its digital tools are limited.

Get quotes from providers in your area

Questions? Call us: 844-966-4864

Safeway Insurance is a regional auto insurer that serves high-risk drivers. It’s available in 12 states and is a practical option for drivers who like customized service and can’t find coverage elsewhere. According to our industry data, Safeway’s rates are higher than the national average. However, high-risk drivers may be eligible for additional savings, including discounts for having low mileage and taking a defensive driver course.

Safeway Insurance Pros and Cons

Pros

Accessible coverage for high-risk drivers

Local agents available

Simple coverage options

Cons

Limited availability (12 states)

Lower customer satisfaction scores

Higher-than-average rates for safe drivers

Who Is Safeway Car Insurance Best For?

In general, Safeway is best for high-risk drivers who are looking for the most basic coverage options.

Safeway Insurance is best for those who:

- High-risk drivers

- Want to manage their policy over the phone

- Prefer to work with a local agent

- Drive fewer than 5,000 miles per year

Safeway Insurance is not best for those who:

- People with a clean driving record

- Want to manage their policies through an app

- Live outside these states:

-

- Alabama

- Arizona

- Arkansas

- California

- Colorado

- Georgia

- Illinois

- Louisiana

- Mississippi

- New Mexico

- Tennessee

- Texas

How Much Does Safeway Car Insurance Cost?

For full coverage policies, Safeway’s average annual rate is $2,601, or about 8 percent above the national average. For minimum coverage, Safeway’s average annual rate of $1,278 is about double the national average.

Here’s a closer look at how Safeway’s average premiums compare with those of other auto insurers:

| Company | Average annual premium for full coverage | Average annual premium for minimum coverage |

|---|---|---|

| Safeway | $2,601 | $1,278 |

| AAA | $3,014 | $1,056 |

| Allstate | $2,605 | $840 |

| American Family | $1,936 | $604 |

| Erie | $1,647 | $581 |

| Farmers | $2,979 | $1,002 |

| GEICO | $1,731 | $517 |

| Nationwide | $1,808 | $718 |

| Progressive | $1,960 | $638 |

| State Farm | $2,167 | $674 |

| U.S. average | $2,399 | $635 |

How You Can Save on Your Policy With Safeway Insurance

Safeway doesn’t openly advertise its car insurance discounts on its website, so I asked an agent while getting a quote. I was eligible for these discounts:

- Safe driver

- Low mileage

- Pay in full

Additionally, Safeway offers the following discounts that I didn’t qualify for:

- Multivehicle

- Good student

- Homeowner

- Defensive driving course

- Married driver

I found the low-mileage and defensive-driving discounts particularly notable. These are great savings opportunities for high-risk drivers because they don’t require a clean record.

Low Mileage

Safeway considers you a low-mileage driver if you drive fewer than 5,000 miles per year. If you work from home (as I do) and don’t travel much outside your neighborhood, I recommend asking about this discount. I received over $300 (13 percent) off my quote with the low-mileage discount. Note that you’ll need proof of your yearly mileage. The agent recommended providing formal records from getting my car serviced at a dealership, since they usually give receipts with your current mileage.

I actually prefer this method of earning a low-mileage discount. Some providers have discount programs that require you to track your miles through an app (like USAA SafePilot Miles). Although you may earn greater discounts through a telematics app, you might deal with battery drain and data usage. Plus, many drivers have concerns about data privacy.

To me, this discount is an advantage as a California driver. Due to a law passed in the 1980s, telematics programs are not available in the state, so the low mileage discount is a nice opportunity to save.

Defensive Driving Course

You can get an additional discount on your premium if you take a state-approved defensive driving course. I haven’t taken one, so I didn’t qualify. However, you can ask an agent how much you could save. Many insurers offer savings of between 5 and 10 percent. If you have a spotty driving history, a defensive driving course can help you review safe habits on the road while netting you a discount on your policy.

DID YOU KNOW?

According to the National Safety Council, the peak time of day for crashes is 4 p.m. to 7:59 p.m. The rate of nonfatal crashes is the highest on Fridays, and fatal crashes peak on Saturdays.1

Getting a Quote With Safeway Insurance

You must go through a local independent agency to get a quote from Safeway Insurance, so I called one of the agencies listed on the company’s site. The agent quoted me $1,600 per year for a liability policy for my profile (driver with a clean record in California). We had to keep the call short because she had other clients to assist.

Because I wasn’t able to get a quote for full coverage auto insurance, I called another local agent. He got me a quote for a policy with California’s minimum liability limits and added comprehensive coverage, collision insurance, uninsured/underinsured motorist coverage, and rental reimbursement. The total came out to $2,400 annually. That’s considerably more than I pay for my GEICO policy right now. However, high-risk drivers may have better luck with Safeway Insurance than they would with GEICO.

As for additional savings, my full coverage quote included a good-driver discount. The agent mentioned that if I could prove that my mileage was around 5,000 miles per year, my annual premium would decrease to about $2,076.

TIP:

If you’re shopping for a new policy, we recommend that you compare car insurance quotes from at least three companies. Auto insurers can offer different rates for the same coverage, depending on your ZIP code, driving history, eligible discounts, and other factors that affect car insurance rates.

What Types of Auto Insurance Coverage Does Safeway Insurance Offer?

Safeway provides standard types of auto insurance coverage, like liability insurance, collision and comprehensive coverage, and uninsured and underinsured motorist coverage. It also offers roadside assistance and rental reimbursement — two add-ons that are important if your car breaks down.

| Coverage type | What it covers | Cost per month |

|---|---|---|

| Roadside assistance | Towing and roadside service for your vehicle | About $5 |

| Rental reimbursement | $30 per day for a rental car if your car needs repairs due to a covered accident | N/A |

Safeway Insurance Customer Satisfaction

Safeway Insurance has below-average ratings for customer satisfaction. According to the National Association of Insurance Commissioners (NAIC), Safeway Insurance has an NAIC Complaint Index score of 3.72, indicating that the company receives nearly four times more complaints than expected for an insurer of its size. However, when limited to private passenger auto insurance, its score improves to 1.42. That’s a good sign for potential customers, since lower numbers are better on this metric. However, the average is 1.

Safeway ranked 83rd out of 97 providers on the CRASH Network Insurer Report Card, which surveys body shops across the country on how well companies claims handling ensures quality repairs and customer service for motorists. That’s below GEICO (80th) and State Farm (81st) but higher than USAA (85th) and Allstate (93rd).

Although Safeway Insurance has an A rating from the Better Business Bureau (BBB), which reflects the auto insurer’s commitment to addressing customer concerns.

| Category | Safeway score |

|---|---|

| NAIC Complaint Index | 3.72 (more complaints than average)2 |

| CRASH Network Insurer Report Card | C- (83rd out of 97 providers)3 |

| BBB | A4 |

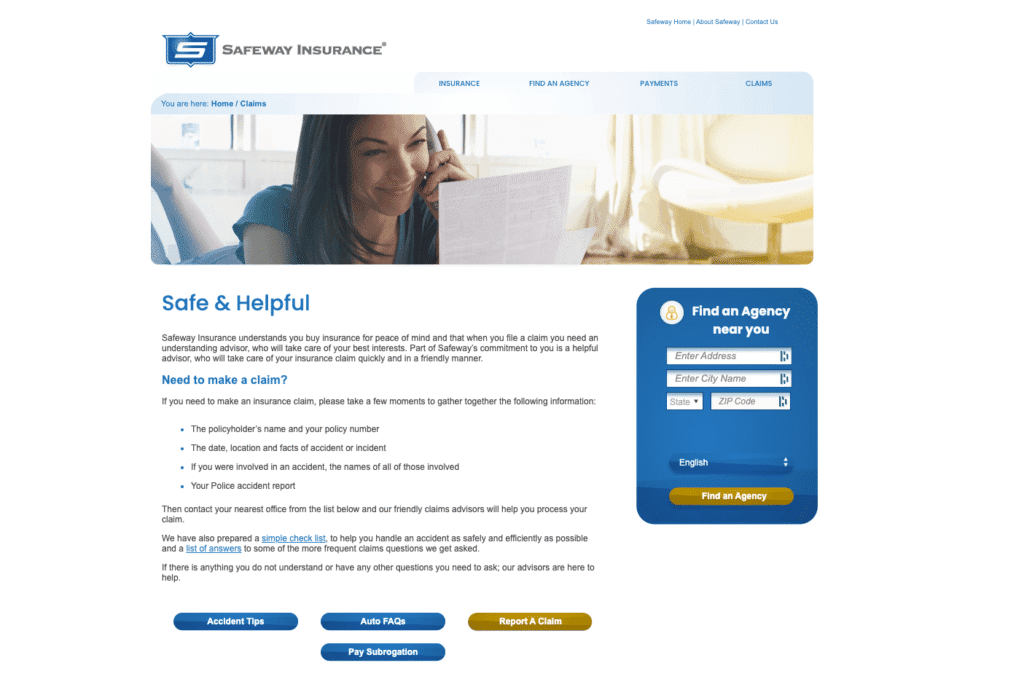

Filing a Claim With Safeway Insurance

To file a claim, go to the Claims page on the Safeway Insurance website and log in to your account. You can also file a claim over the phone by calling (888) 203-5129 to speak with an agent. While it appears you can’t file a claim in the mobile app, you can track the status of claims there.

Safeway Insurance also has physical locations where you can get help from a claims agent in person. Visit https://www.safewayinsurance.com/about/SafewayLocations.aspx, and look for the address and phone number listed under your state.

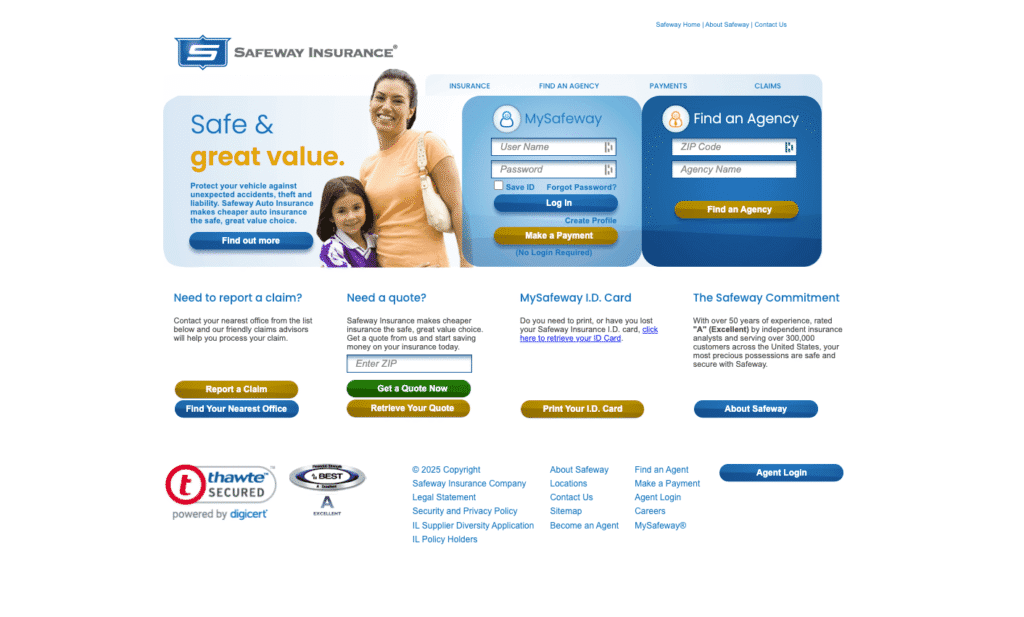

Safeway Insurance Website and Mobile App

I consider myself fairly savvy when it comes to digital tools, so I was surprised to see that Safeway Insurance offers a very basic digital experience. Although the website is optimized for mobile devices, the design looks like it hasn’t changed in a while. There’s also very little information about Safeway’s coverage and discounts. However, you can manage your policy, make payments, and file a claim via the website.

Safeway also offers an app that allows you to make payments, access ID cards, locate an agent, and see your claims status. It looks like Android users have a better experience than iPhone users. Many reviewers mentioned frozen screens, glitches, and trouble making payments.

| App | Rating (out of 5) |

|---|---|

| MySafeway | iPhone — 3.4 stars

Android — 4.1 stars |

I’d say Safeway’s digital experience reflects the company. You can expect a no-frills experience, but you’ll still get what you need.

Bottom Line: Should You Get Safeway Insurance?

Safeway Insurance is worth considering if you’re having trouble finding high-risk auto insurance. It has notable discounts that don’t require a clean driving record, like ones for having low mileage and taking a defensive driving course. It’s also great if you prefer working with a local agent and don’t mind managing your policy through an agent or the website.

However, if you have a clean record and have other options, I’d recommend looking elsewhere. Safeway’s digital experience is simple, so you could get better digital tools and coverage while paying less for your policy.

Frequently Asked Questions

Safeway Insurance has been in business for more than 65 years, making it one of the oldest privately owned regional auto insurers in the U.S.

Yes. Safeway Insurance specializes in nonstandard auto insurance, which is geared toward drivers who may have trouble getting coverage due to past accidents, violations or coverage lapses. Safeway’s policies typically provide the state’s minimum required liability coverage, with optional add-ons, such as comprehensive, collision, and medical payments coverage.

To cancel your Safeway policy, contact your local agent directly. They can guide you through the process and confirm any final payments or refund eligibility.

Methodology: How We Review Insurance Companies

At AutoInsurance.com, we evaluate auto insurance providers based on four key factors:

- Price (40%): We analyzed average premiums for full and minimum coverage for good drivers with good credit. Full coverage averages use the following limits:

- Bodily injury liability: $100,000 per person/$300,000 per accident

- Property damage liability: $50,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person/$100,000 per accident

- Comprehensive and collision: $500 deductible

- Claims handling (25%): A good claims handling process from an auto insurer is prompt, transparent, and efficient, with clear communication throughout, fair evaluation of damages, and timely payment or resolution. We assess claims practices through sources like the CRASH Network Insurer Report Card and J.D. Power’s Auto Claims Satisfaction Study, and financial strength from sources like AM Best and S&P. Real-life customer experiences are included when available.

- Customer experience (25%): We evaluate the ease of the customer journey, from getting a quote and purchasing a policy to making changes or accessing documents. We consider the availability and quality of both online and agent interactions, as well as the functionality of the company’s website and mobile app. Our sources include J.D. Power studies, the NAIC Complaint Index, BBB ratings, and app store reviews.

- Coverage options (10%): We review each company’s coverage offerings and value providers with options beyond the state required minimums, like accident forgiveness, gap coverage, rideshare coverage and more.

Read more about our ratings and methodology.

Citations

Crashes by Time of Day and Day of Week. NSC. (2023).

https://injuryfacts.nsc.org/motor-vehicle/overview/crashes-by-time-of-day-and-day-of-week/Results by Complaint Index. NAIC. (2024).

https://content.naic.org/cis_refined_results.htm?TABLEAU=CIS_COMPLAINTS&COCODE=12521&:refreshTop Rated U.S. Car Insurance Companies for 2025. Crash Network. (2025).

https://www.crashnetwork.com/irc/Safeway Insurance Co.. Better Business Bureau. (2025).

https://www.bbb.org/us/il/westmont/profile/insurance-companies/safeway-insurance-co-0654-9000263